E&P | NGI All News Access | NGI The Weekly Gas Market Report

Pemex Cuts Losses in Second Quarter, but Natural Gas Production Continues to Fall

Mexico’s national oil company, Petróleos Mexicanos (Pemex), slashed its losses by more than two thirds to 52.8 billion pesos ($2.8 billion) in the second quarter, although oil and natural gas production continued to decline compared to the year-ago period.

The company said it was able to cut its losses by curtailing costs.

The results were posted Friday on the Mexico Stock Exchange. “Pemex is heading in the right direction,” finance director Alberto Velázquez said during the company’s earnings call.

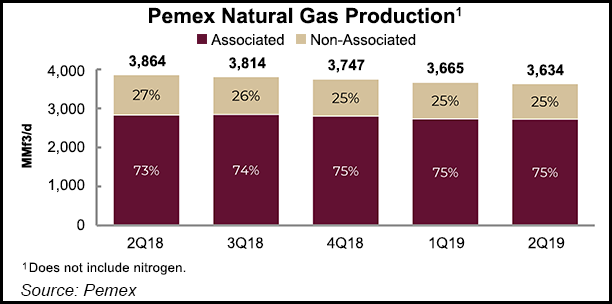

Production of natural gas in the second quarter was 3.634 Bcf/d, down 6% from 3.864 Bcf/d at the same time last year.

The only discovery announced during the quarter was onshore, at Comalcalco, in the state of Tabasco. The Quesqui-1 well produced 4,478 b/d of liquids and 16.67 MMcf/d of gas in the quarter.

Wet gas processing fell to 2,753 MMcf/d, from 2,995 MMcf/d in 2Q2018. Dry gas processing declined to 2,218 MMcf/d, from 2,451 MMcf/d over the same time.

Pemex’s recently released business plan sets a production goal of 4.916 Bcf/d for 2024, from an expected average of 3.561 Bcf/d this year.

The pillar of Pemex’s natural gas plans is the Ixachi field in Veracruz state. In June, Pemex said it would spend $6.4 billion developing the onshore, gas-rich field, with production expected to peak in 2022 at 638.5 MMcf/d.

Year/year crude production in the second quarter dropped to 1.66 million b/d from 1.849 million b/d.

Velázquez noted that crude output was exactly the same in the first two quarters of this year, pointing to “stabilization” of production during what were the first two quarters of the current Mexican administration.

But year-on-year comparisons between the first half of 2018 and the first half of 2019 showed that almost all the operational indices declined under the new regime.

However, President Andrés Manuel López Obrador and his Energy secretary, RocÃo Nahle, stressed on Friday that Pemex had managed to reduce imports of gasoline, although that is probably due, at least in part, to the stern measures that led to shortages in some parts of the country as part of a major drive against fuel theft in the first half of this year.

“The relative stabilization of production and of the consumption of gasoline are the top priorities for this administration, so they will see this as a positive sign,” independent analyst Arturo Carranza told NGI’s Mexico GPI.

Crude exports in the first half of this year dropped by 69,000 b/d compared to the first half of 2018.

In 2Q2019, Pemex reported that the price of the Mexican crude export mix was $1.80/bbl down from the same period of the previous year. That downward differential “is the most relevant variable that has an impact on the company’s sales in this year’s second quarter,” Velázquez said.

The state-owned power utility, Comisión Federal de Electricidad (CFE), reported a profit of 11.13 billion pesos ($584 million) in the second quarter, compared with a loss of 49.3 billion pesos in the same period of last year.

Sales of energy (electricity and natural gas) formed the bulk of income, the company said.

The CFE earlier this month said it is seeking arbitration with developers of seven pipelines in the country, over contracts that it says are “abusive” to the company.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 | ISSN © 1532-1266 |