Markets | NGI All News Access | NGI Data

Heat in California, Comfortable Temps Elsewhere as Weekly Natural Gas Spot Prices Drop

Comfortable temperatures east of the Rockies countered heat in the Southwest to send natural gas spot prices lower overall for the trading week ended July 26; the NGI Weekly Spot Gas National Avg. fell 11.0 cents to $2.045/MMBtu.

While SoCal Citygate has avoided major price spikes so far this summer, some hotter temperatures in Southern California sent prices there surging to well above benchmark Henry Hub during the week. Weekly SoCal Citygate prices jumped 84.0 cents to $3.455, while SoCal Border Avg. surged 70.5 cents to $3.080.

As for markets further east, with the intense heat wave experienced a week earlier having faded, prices had nowhere to go but down. Transco Zone 6 NY tumbled 31.0 cents to $2.055, while Chicago Citygate shed 19.5 cents to average $2.035.

The start-up of Kinder Morgan Inc.’s Gulf Coast Express pipeline can’t come soon enough for West Texas producers, as prices in the region continued to trade at steep negative basis differentials during the week. Waha fell 2.0 cents to average 69.0 cents.

Weaker forecasts, set against a backdrop of oversupply, kept the pressure on natural gas prices Friday, as futures sold off sharply to close out the work week. The August Nymex futures contract, which expires Monday, sank 7.5 cents to settle at $2.169 Friday. Week/week the front month dropped 8.2 cents after settling at $2.251 the previous Friday.

“We’ve viewed weather patterns as not hot enough to satisfy all week, and that remains the case,” NatGasWeather said. The mid-day Global Forecast System (GFS) data Friday “didn’t back off on weather systems with cooler than normal conditions returning the middle of next week across the Midwest, East and South, while lasting through the first 10 days of August.

“Sure, the European model remains hotter,” up more than 20 cooling degree days (CDD), “but it’s been running too hot this summer and often gives back demand/CDDs as days in the Week 2 forecast roll into Week 1. It’s possible the GFS model is too cool and adds a little demand back, but would it really be hot enough to impress?”

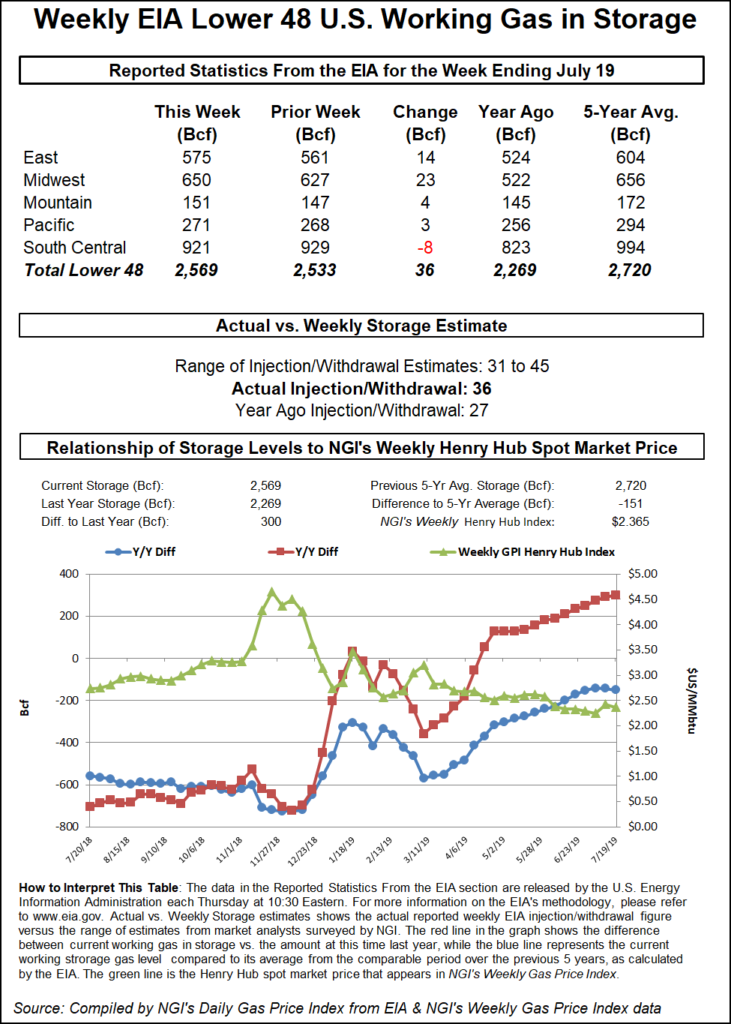

The Energy Information Administration (EIA) on Thursday reported an on-target 36 Bcf weekly injection into U.S. natural gas stocks, and futures prices moved slightly lower in response.

The 36 Bcf build for the week ended July 19 compares to a 27 Bcf injection recorded in the year-ago period and a five-year average 44 Bcf build. After a long string of above-normal builds earlier in the injection season, this week marks the second straight EIA report to come in below the five-year average.

Prior to Thursday’s report, estimates had been pointing to an injection in line with the actual figure. A Bloomberg survey had showed a median 37 Bcf, while Intercontinental Exchange futures had settled at 35 Bcf. NGI’s model predicted a 33 Bcf injection.

Total Lower 48 working gas in underground storage stood at 2,569 Bcf as of July 19, 300 Bcf (13.2%) higher than last year but 151 Bcf (minus 5.6%) lower than the five-year average, according to EIA.

By region, the Midwest injected 23 Bcf on the week, while the East saw a net injection of 14 Bcf. Farther west, the Mountain region refilled 4 Bcf, while the Pacific on net grew its inventories by 3 Bcf. In the South Central, a 17 Bcf withdrawal from salt stocks was partially offset by a 9 Bcf injection into nonsalt, EIA data show.

Genscape Inc. viewed the 36 Bcf injection as about 1.1 Bcf/d loose versus the five-year average when compared to degree days and normal seasonality.

“The slight tightening compared to the last couple of weeks is largely due to the bullish impact from…Barry, which had a larger impact on Gulf of Mexico production than demand,” according to the firm.

Raymond James & Associates Inc. analysts said the figure implies the market was 0.1 Bcf/d looser than last year on a weather-adjusted basis, with the market averaging 2.0 Bcf/d looser over the past four weeks.

According to Tudor, Pickering, Holt & Co. (TPH) analysts, “Degree days last week were 10% above normal, and we’ve now had three straight weeks with above normal degree days, which has temporarily halted” the convergence of current storage levels with the five-year average.

“But therein lies the problem,” the TPH team said, “as even strong weather demand isn’t undoing any of the convergence to the five-year average, and with weather normalizing (power burn down 2.8 Bcf/d week/week), we’re expecting a return to above-normal injections with next week’s report.”

After enjoying heat-driven premiums during the week, spot prices in California posted double-digit losses heading into the weekend. SoCal Citygate tumbled 58.0 cents to $2.960, while Socal Border Avg. dropped 59.0 cents to $2.560.

Radiant Solutions was calling for above-normal temperatures in Burbank, CA, Friday, including highs in the mid 90s, to ease slightly by early in the upcoming week. The forecaster called for Tuesday’s high there to reach the upper 80s.

Utility Southern California Gas was predicting the typical weekend drop-off in demand on its system, expected to go from slightly under 2.7 million Dth/d Thursday to around 2 million Dth/d Saturday and Sunday.

Elsewhere, in the Northeast, Algonquin Gas Transmission extended its seasonal capacity limitation at its Southeast compressor station along the New York/Connecticut border, according to Genscape analyst Josh Garcia.

“Capacity at Southeast has been limited to 1.58 Bcf/d since May 10 and was originally scheduled to return to a full capacity of 1.78 Bcf/d on Aug. 10,” Garcia said. “This has now been pushed back to Sept. 20. This summer’s seasonal capacity was originally thought of as more bearish than previous years due to a less severe restriction and a shorter duration…incentivizing gas burns.

“Flows have not been restricted so far this season despite recent demand spikes due to heat waves, but more heat in August may compound with the longer restriction to bring volatility to New England prices.”

New England prices weren’t volatile on Friday, though temperatures were expected to warm up over the weekend.

Algonquin Citygate climbed 0.5 cents to average $2.150, while Iroquois, Waddington dropped 5.0 cents to $2.100.

“A hotter U.S. pattern is in store as high pressure strengthens across the southern U.S. and Mid-Atlantic, with 90s returning,” NatGasWeather said. “It will be very warm over the Midwest to Northeast, with upper 80s…A near neutral overall pattern since CDDs will be above normal, but they need to be much above normal to intimidate.”

Throughout much of the Gulf Coast and Southeast, prices sold off around a nickel Friday. Transco Zone 4 dropped 5.0 cents to $2.140, while Henry Hub eased 4.5 cents to $2.175. ANR SE shed 3.5 cents to $2.105.

“Due to ANR’s planned compressor maintenance in Tennessee, flow through Brownsville Southbound will be restricted from gas day Monday (July 29) through Friday (Aug. 2) by up to 196 MMcf/d,” Genscape analyst Anthony Ferrara told clients Friday. “Located in the Southeast Southern Area (Zone 2), total capacity at the Brownsville Southbound throughput meter will be restricted by 230 MMcf/d (leaving 900 MMcf/d available) for the duration of the maintenance event.

“Over the past 14 days, flows through Brownsville Southbound have averaged 1,047 MMcf/d and maxed at 1,096 MMcf/d.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |