Infrastructure | E&P | NGI All News Access | NGI The Weekly Gas Market Report

U.S. Producers Drop Another Eight Rigs Total, but Wyoming Adds Four

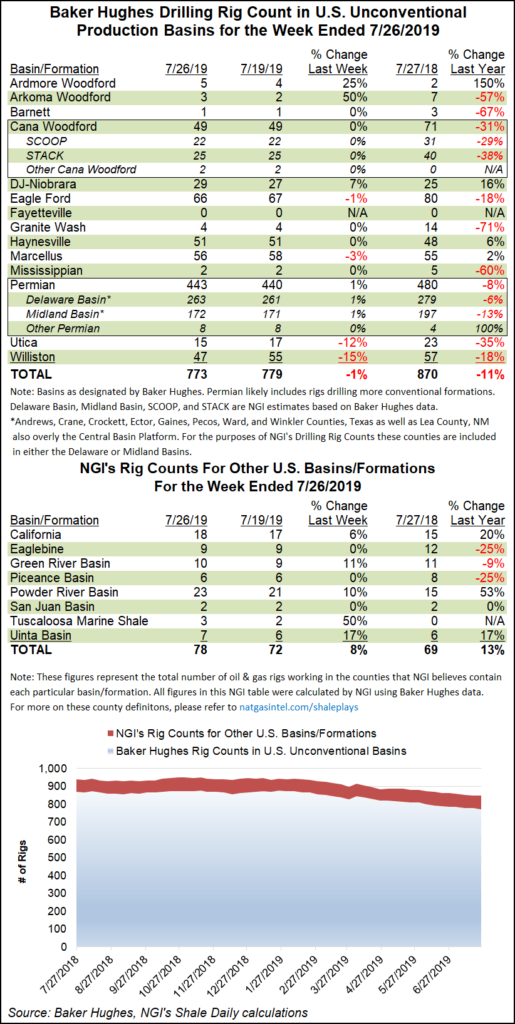

U.S. producers dropped eight rigs — five natural gas and three oil — for the week ending Friday (July 26), bringing the domestic count to 946, off 102 from a year ago, according to Baker Hughes, a GE company.

In the United States, 169 natural gas rigs were working as of Friday, compared with 186 a year ago. There also were 776 oil rigs in operation, versus 861 in the year-ago week. The miscellaneous rig count, at one, was flat from a year ago.

The North American rig count overall gained one week/week to 1,073, but it was running 1,271 a year ago. Canada added nine rigs for the week to end at 127, but it was 96 lower than a year ago.

North America in total lost five land rigs for the week to end at 921. Two inland waters rigs were dropped to finish at zero, while the offshore dropped one rig to end at 25, versus 16 a year earlier. The Gulf of Mexico for the week settled down two rigs to total 23 compared with 15 year/year.

Only a handful of states increased their rig count for the week, with Wyoming eclipsing all others to add four and end at 36, from 28 a year ago. New Mexico added two rigs to hit 109 for the week, up five year/year. California, Colorado, Kansas and Utah each added one rig week/week.

On the losing side of the ledger, North Dakota dropped eight rigs on the week to hit 47; it was running 57 rigs at the same time last year. Louisiana ended down four rigs to finish at 62, still 10 more rigs year/year.

States with a flat rig count from a week earlier were Arkansas, Pennsylvania and Texas.

Ohio and Oklahoma each dropped two rigs week/week, while Alaska and West Virginia each dropped one.

Horizontal rigs continued to be the rig of choice for U.S. operators, with 823 working as of Friday, but the count was six lower week/week and sharply lower than a year ago when 922 were in operation. Sixty-seven directional rigs were in operation as of Friday, down two for the week, along with 56 verticals, flat week/week.

With the second quarter earnings season underway, the news from the oilfield services sector has been less than encouraging for North America.

Halliburton Co. , the largest Lower 48 pressure pumper, stacked equipment during the quarter and has reduced its outlook through the end of the year.

In addition to Schlumberger Ltd., which also predicted a continued downturn, North American contract drillers and manufacturing suppliers that foresee more rigs falling include Helmerich & Payne Inc. (H&P), Patterson-UTI Energy Inc. , RPC Inc. and Superior Energy Services Inc.

H&P, the leading Lower 48 unconventional driller, called the bottom for the rig count too soon, CEO John Lindsay said during a conference call to discuss quarterly results.

“Our expectation of seeing the bottom of the company’s rig count during the quarter turned out to be premature, as the full effect of the industry’s emphasis on disciplined capital spending continues to reverberate through the oilfield services sector,” he said.

H&P exited the quarter with 214 active U.S. rigs, slightly below the low end of its guidance range.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |