Infrastructure | LNG | NGI All News Access | NGI The Weekly Gas Market Report

Novatek Finalizes Arctic LNG 2 Project

Russia’s largest independent natural gas producer Novatek has completed the sale of its remaining stakes in the Arctic 2 liquefied natural gas (LNG) project to two Chinese companies and a Japanese consortium.

Novatek signed a $3 billion agreement last month to sell its remaining 10% stake in the project to a consortium of Tokyo-based Mitsui & Co and Japan Oil, Gas and Metals National Corp. The Japanese consortium has been named Japan Arctic LNG.

In April, Novatek also signed binding deals with a subsidiary of China National Petroleum Corp., aka CNPC, and a subsidiary of China’s largest offshore oil and gas producer China National Offshore Oil Corp., aka CNOOC, both with a 10% stake.

Novatek Chairman Leonid Mikhelson said the final deal allows the company to make the final investment decision (FID) and optimally use cash flow to finance new Novatek projects. When fully built, the Arctic LNG 2 project will include three trains with 6.6 million metric tons/year (mmty) each, using gravity-based structure platforms.

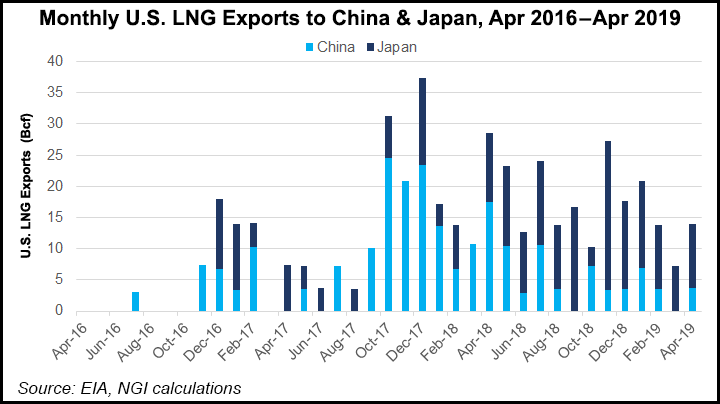

Russia is increasingly interested in locking in more market share for its LNG in the Asia-Pacific region, particularly to both Japan and China, the world’s top two gas importers respectively. The region now accounts for two-thirds of global LNG demand, and demand growth is projected to increase, particularly by China, India, Pakistan and Bangladesh.

Japan, the current top global LNG importer, is forecast to lose its top slot to China as early as 2022, according to Wood Mackenzie. Japan’s year/year LNG imports are expected to decline in 2019 by 12% to 72.8 mmty, while China’s import volume would rise by 37.5% to 74.1 mmty by the 2022 forecast date.

“While LNG demand is declining, Japanese imports will remain above 70 mmty through much of the 2020s,” said Wood Mackenzie’s Lucy Cullen, senior analyst. “It will remain the second largest LNG consumer in the world until at least 2040, with demand still exceeding 60 mmty. As such Japan still provides ample opportunities for LNG sellers, particularly as existing contracts expire.”

Senior natural gas analyst Jean-Baptiste Dubreuil of the International Energy Agency (IEA) said earlier this month that China would bypass Japan as the world’s top LNG importer by 2024. China’s imports are forecast to surge to 100 billion cubic meters (bcm) per year by 2024, he said.

Asia remains the dominant market for LNG imports, although the pattern of imports within Asia shifts. China, India and other Asian countries are overtaking the more established markets of Japan and Korea, and accounting for around half of all LNG imports by 2040, BP plc said earlier this year in its annual Energy Outlook.

In its Gas 2019 report issued in June, the IEA forecasted that global demand in the coming five years is set to be driven by the Asia Pacific region, which is projected to account for almost 60% of total consumption increases by 2024. China will be the main driver for gas demand growth, though slower than in the recent past as economic growth slows, but still accounting for about 40% of total gas demand increase by 2024.

China had 19 LNG import terminals in 2018, while Japan had more than 30 terminals, including expansions and satellite terminals. China’s Ministry of Transport recently proposed 34 coastal LNG terminals with a combined annual import capacity of 247 million tons (mt) by 2035, more than triple the 67.5 mt import capacity at the end of 2018. The extra terminals would help the country meet its gas-to-power plan which calls for natural gas to make up at least 10% of the country’s energy mix by 2020, and 15% by 2030.

Hong Kong is also following mainland China’s lead by reaching an LNG supply deal with a unit of top gas buyer and seller Royal Dutch Shell plc. In June, a joint venture (JV) between Hong Kong Electric Co. (HK Electric) and Castle Peak Power Co. Ltd. (Capco) signed a long-term deal with Shell Eastern Trading to procure LNG for the Hong Kong Offshore LNG Terminal.

Separately, the HK Electric-Capco consortium also has entered into an agreement with Tokyo-based Mitsui OSK Lines (MOL) to hire a floating storage and regasification unit (FSRU) vessel on a time charter basis for the LNG project.

Japanese oil and gas exploration and production major Inpex Corp. signed a heads of agreement in June with the Indonesian government to build the $20 billion Abadi LNG project. If approved, the company would move ahead with the front-end engineering and design work and aims to make an FID within three years, with a completion date in the late 2020s.

Japan is also developing its LNG footprint in other parts of Southeast Asia. In April, President Satoshi Onoda of Jera, a JV between two of Japan’s largest LNG importers, Tokyo Electric Power Co. and Chubu Electric, said it wanted to undertake LNG receiving terminals in Vietnam and Thailand.

Vietnam could see its first LNG import project operational within the next few years with several more proposals under consideration, while Thailand in 2011 became the first country in Southeast Asia to have an operational LNG import terminal. The IEA earlier this year said Southeast Asia is on track to become the heart of future LNG demand growth by 2024.

Jera is the world’s largest private LNG buyer, importing around 35 mmty, pivoting Japan from being not only the largest global LNG importer, but one of the most active secondary LNG traders in the Asia-Pacific region.

Individual Japanese utilities are also planning to invest in LNG infrastructure. Tokyo Gas, Japan’s largest utility, and First General Corp., a major Philippine power producer, in March obtained approval from the Philippine government to construct an LNG receiving terminal in Batangas province north of Manila, the Philippine capital.

In October, Osaka Gas, also a large LNG importer, said it was considering expanding its operations in southeast Asia, where natural gas demand is projected to grow in lockstep with economic expansion.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |