Infrastructure | NGI All News Access | NGI The Weekly Gas Market Report

Patterson-UTI Cuts Capex, Predicts Sharp Reduction in North American Rig Count

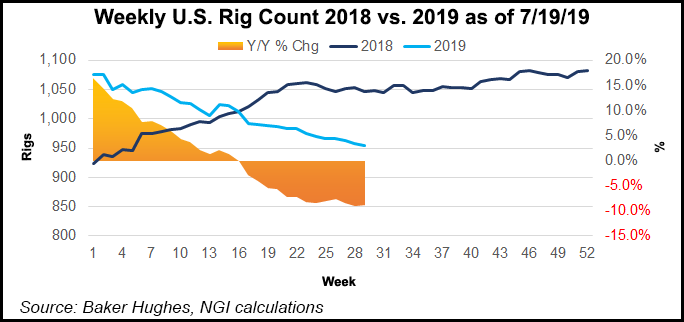

North American contract driller Patterson-UTI Energy Inc. has joined its oilfield services peers in eschewing an increase in Lower 48 activity to the end of the year as customers drop rigs and cut spending.

The management team of the Houston-based oilfield services giant, which provides contract drilling, pressure pumping and directional drilling services to the exploration and production (E&P) sector, mirrored many of its peers in forecasting a downturn in U.S. onshore activity to the end of the year, including Halliburton Co. and Schlumberger Ltd.

“E&P companies are being extra vigilant this year in monitoring their spend due to commodity price volatility and the increased focus on spending within their budgets,” CEO Andy Hendricks said during a conference call early Thursday. “ We believe E&P companies are slowing drilling and completion activity to smooth their spending run rate and reduce the risk of budget exhaustion later in the year.”

Because of the market uncertainty, the company has reduced its capital expenditures for 2019 to $400 million from $465 million.

The company’s rig count, which averaged 158 rigs during the second quarter, “is expected to average 142 rigs during the third quarter.”

Average rig revenue/day between April and June increased to $24,200, while rig margin/day improved on average to $10,170. The results included $280/day from the $4 million received from early contract terminations. Average direct rig costs/day climbed to $14,030 from $13,880 in the first quarter.

At the end of June, term contracts for drilling rigs providing $720 million of future dayrate drilling revenue, compared to $650 million at the end of March.

“Based on contracts currently in place, we expect an average of 92 rigs operating under term contracts during the third quarter, and an average of 58 rigs operating under term contracts during the 12 months ending June 30, 2020,” Hendricks said.

In the pressure pumping business, quarterly results were about the same as in the first three months, “as improving operational efficiencies offset a decline in the number of active spreads. We ended the second quarter with 15 active spreads.” Pressure pumping gross margin in 2Q2019 was $44.9 million on revenue of $251 million, versus 1Q2019 gross margin of $44.9 million on revenue of $248 million.

“Across the pressure pumping industry, we expect completion activity will follow drilling activity lower in the third quarter,” Hendricks told analysts. “We expect to maintain 15 active spreads during the third quarter, but we expect lower utilization of the active spreads will negatively impact pressure pumping revenues and margin.”

In the directional drilling arm, second quarter gross margin improved to $8.1 million from $7.4 million in the first quarter. Directional drilling direct operating costs decreased by $3.5 million to $42.1 million, offsetting a $2.7 million reduction in revenue to $50.2 million.

Net losses totaled $49.4 million (minus 24 cents/share) in 2Q2019, versus a year-ago net loss of $10.7 million (minus 5 cents). Excluding one-time charges, losses would have been $35.9 million (minus 17 cents/share). Revenue fell to $676 million from $854 million.

Impairments for 2Q2019 included $3.6 million of bad debt expense, as well as a $12.7 million charge to reduce the carrying value of a deposit placed in 2017 on future sand purchases. The deposit was part of a capacity reservation contract that increased access to finer grades of sand, which at the time were in tight supply, the company noted. As prices for sand have declined, the company since has purchased lower-cost sand outside of the reservation contract and revalued the deposit.

The company repurchased $150 million shares during the first half of 2019, representing 5.5% of the outstanding shares at the beginning of the year.

“Given our current public market equity valuation, our cash balance and expected future cash flow generation, we will likely allocate additional capital to both share repurchases and debt repayment in the back half of 2019,” Chairman Mark S. Siegel said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |