Markets | NGI All News Access | NGI Data

‘Neutral’ EIA Report Sends Natural Gas Futures a Few Pennies Lower

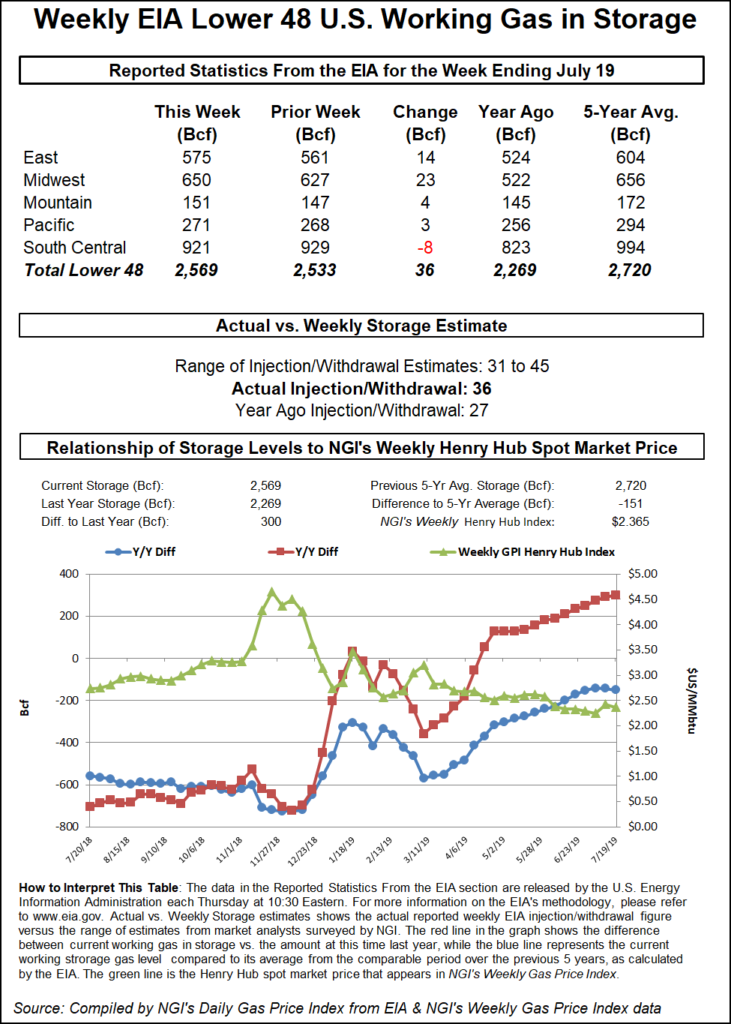

The Energy Information Administration (EIA) on Thursday reported an on-target 36 Bcf weekly injection into U.S. natural gas stocks, and futures prices moved slightly lower in response.

The 36 Bcf build for the week ended July 19 compares to a 27 Bcf injection recorded in the year-ago period and a five-year average 44 Bcf build. After a long string of above-normal builds earlier in the injection season, this week marks the second straight EIA report to come in below the five-year average.

The August Nymex futures contract, which is set to expire early next week, initially sold off on the news. After trading around $2.250-2.260 in the lead-up to the report, once the final number crossed trading screens at 10:30 a.m.ET, the prompt month quickly dropped to around $2.240 before trading as low as $2.229 minutes later.

By 11 a.m. ET, August was trading around $2.231, up 1.1 cents from Wednesday’s settle but off a few pennies from the pre-report trade.

Prior to Thursday’s report, estimates had been pointing to an injection in line with the actual figure. A Bloomberg survey had showed a median 37 Bcf, while Intercontinental Exchange futures had settled at 35 Bcf. NGI’s model predicted a 33 Bcf injection.

Market observers discussing the EIA report on energy-focused social media platform Enelyst saw the number as unlikely to change the market’s perception of balances.

“Prices are still asleep,” The Desk’s John Sodergreen said. The number fell “within a point or two of consensus, and so, crickets.”

In a note to clients, Bespoke Weather Services described the print as “just slightly tighter balance-wise compared to the number in last week’s report, still on the loose side of the trend line for this gas week in previous years. It’s a neutral report overall, doing very little to move the needle in terms of end-of-season projections, especially having been lower than it may have been had there been no Barry-induced shut-ins.”

Total Lower 48 working gas in underground storage stood at 2,569 Bcf as of July 19, 300 Bcf (13.2%) higher than last year but 151 Bcf (minus 5.6%) lower than the five-year average, according to EIA.

By region, the Midwest injected 23 Bcf on the week, while the East saw a net injection of 14 Bcf. Farther west, the Mountain region refilled 4 Bcf, while the Pacific on net grew its inventories by 3 Bcf. In the South Central, a 17 Bcf withdrawal from salt stocks was partially offset by a 9 Bcf injection into nonsalt, EIA data show.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |