Disintegrating’ Natural Gas Futures Tumble on Lack of Heat

A lack of heat helped sink natural gas futures Wednesday as demand continues to struggle to keep pace with supply growth. In the spot market, hot temperatures supported continued strength in Southern California, while locations farther east generally headed lower; the NGI Spot Gas National Avg. eased 2.0 cents to $2.045/MMBtu.

The August Nymex futures contract plunged 8.0 cents to settle at $2.220 after trading as low as $2.212. September fell 7.3 cents to $2.202, while October was off 7.4 cents to $2.227.

“This thing is just disintegrating,” INTL FCStone Financial Inc. Senior Vice President Tom Saal told NGI. “We just haven’t had enough hot weather to put a dent in the oversupply situation. The market is just moving south.”

The “atypical” number of triple-digit storage injections early in the refill season helped to confirm that supply has been outpacing demand, Saal said. At this point, “we haven’t had enough weather to bring demand in line with the greater supply.”

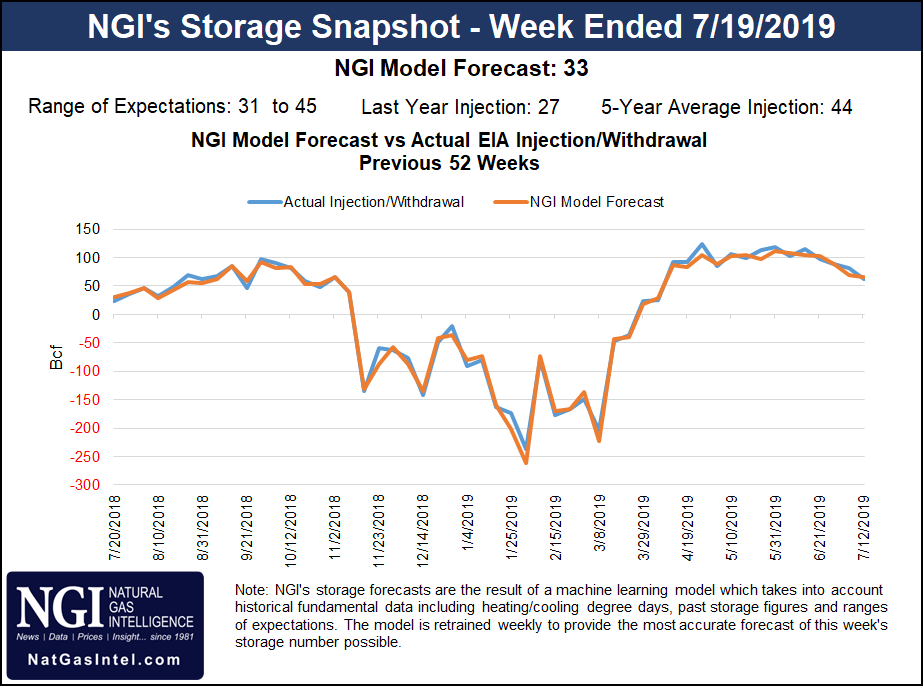

Estimates as of Wednesday were pointing to a below-average build in the 30s Bcf for this week’s Energy Information Administration (EIA) storage report, which covers the period ended July 19. A Bloomberg survey showed a median prediction of 37 Bcf, based on 12 estimates ranging from 31 Bcf to 45 Bcf.

Intercontinental Exchange EIA Financial Weekly Index futures settled Tuesday at 33 Bcf. NGI’s model similarly predicted a 33 Bcf build.

Last year, EIA recorded a 27 Bcf build for the period, and the five-year average is a 44 Bcf injection.

Last week, the EIA reported a 62 Bcf build for the period ended July 12, marking the first below-average weekly build since the start of the injection season back in March.

While this week’s report looks to be on the low side, the question moving forward is whether there will be enough heat to produce multiple smaller builds, according to Saal.

The August contract expiration Monday could also influence price action over the next couple sessions, he said. Speculators have been liquidating length and are now net short “by quite a bit,” meaning “they’ll have to show some buying” as they exit their positions.

As for the latest forecasts, model runs Wednesday lowered weather-driven demand expectations to keep the pressure on prices, noted Bespoke Weather Services.

“Despite the cooler weather change, demand over the next couple of weeks is still seen running above normal, just not at extreme levels, as there will be some variability mixing in at times, with another such cooler window possible at the end of the current 11-15 day,” Bespoke said. While Thursday’s EIA report “carries more than usual amounts of risk due to containing impact from Barry-induced shut-ins, we feel that any balance tightening opens back up some upside risk at these low price levels.”

Spot prices in Southern California remained elevated Wednesday with the region expected to continue experiencing hotter than normal temperatures this week. Radiant Solutions was calling for highs in Burbank, CA, to hover in the mid to upper 90s through the weekend.

SoCal Citygate added 9.0 cents to $3.580, while SoCal Border Avg. climbed 7.0 cents to $3.290.

The frequently supply-constrained Southern California gas market could have a little more slack going forward.

An updated withdrawal protocol for Southern California Gas Co.’s (SoCalGas) Aliso Canyon storage facility loosens restrictions on how the field can be used, “representing a significant change in the region’s supply picture that is likely to put downward pressure on prices there through this winter,” according to Genscape Inc. analyst Joe Bernardi.

On Tuesday, the California Public Utilities Commission (CPUC) issued a revised set of conditions governing how SoCalGas can withdraw volumes from Aliso, the site of a high-profile 2015 leak that has been under close regulatory scrutiny ever since.

Among four potential scenarios where regulators would allow a withdrawal from Aliso, CPUC said SoCalGas can pull molecules from the facility if “there is an imminent and identifiable risk of gas curtailments created by an emergency condition that would impact public health and safety or result in curtailments of electric load that could be mitigated by withdrawals from Aliso Canyon.”

A record of significant volatility and price spikes over the past two years at SoCal Citygate illustrates the thin margins the region’s energy system has operated under with limited availability of Aliso to cushion supply shortages caused by sustained restrictions on pipeline imports in the aftermath of an October 2017 explosion.

“The previous protocol, enacted in November 2017, described Aliso as an ”asset of last resort.’ That language is absent from the new protocol,” observed Bernardi. “…The CPUC expects that more flexibility to withdraw from Aliso will increase inventories at SoCalGas’ other three storage fields and help prevent price volatility. The old system made it considerably more difficult for SoCalGas to withdraw from Aliso, requiring it to first request voluntary curtailments of demand coordinated through” the California Independent System Operator and the Los Angeles Department of Water & Power.

Meanwhile, SoCalGas has again delayed the return to service of its L235 import line in the Desert Southwest, which has been offline since the October 2017 explosion, according to Bernardi, who said this marks the seventh delay in as many months.

“The L235 line was expected to return to service this past weekend but is now not expected to resume flows until late August,” the analyst said. “No change in actual firm import capacity is expected when this line returns, because SoCalGas will take down the adjacent L4000 for additional tests. The earliest date when increased flows might occur is now Oct. 18. This date was also pushed back with the most recent maintenance delay, as actual flows were previously expected to increase at the end of August.”

Further upstream in West Texas, prices strengthened at most locations Wednesday. Waha jumped 29.5 cents to 86.0 cents, while El Paso Permian gained 29.5 cents to average 88.0 cents.

For much of the Lower 48, however, prices generally came under downward pressure amid mild temperatures further east.

According to NatGasWeather, “Light national demand will continue through Friday due to a recent cool front that swept across the eastern half of the country, with highs of only 70s and 80s, including deep into the South and Southeast. Demand will increase this weekend into early next week as high pressure strengthens over much of the country, with highs of 90s returning across the southern U.S. and up the Mid-Atlantic Coast.”

In the Southeast, Transco Zone 5 fell 4.0 cents to $2.255. In Appalachia, Columbia Gas shed 5.0 cents to $1.970.

Starting Thursday (July 25) and continuing through Monday (July 29), maintenance on Line 1804 on the Columbia Gas Transmission system could restrict up to 164 MMcf/d of volumes flowing in southern Pennsylvania and 103 MMcf/d flowing in northern Maryland, according to Genscape analyst Anthony Ferrara.

“Due to the maintenance being performed on the line that travels just north of the Pennsylvania and Maryland border, two throughput meters will be restricted,” Ferrara said. “Artemas MA25, located in southern Pennsylvania, will be limited to 45 MMcf/d of total capacity.”

That location has averaged 167 MMcf/d and maxed at 209 MMcf/d over the past two weeks. Also impacted is Rutledge North MA25 in northern Maryland, expected to be reduced to 30 MMcf/d of total capacity, compared to a two-week average of 102 MMcf/d and a max of 133 MMcf/d, according to Ferrara.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |