Markets | E&P | Mexico | NGI All News Access | NGI Mexico GPI

Contracts Awarded Under Mexico Energy Reform Showing Steady Output Growth — Bonus Coverage

Although Mexican president Andrés Manuel López Obrador has said the country’s 2013 constitutional energy reform failed to bring new investment and production to the local oil and gas industry, figures published last week by upstream hydrocarbons regulator Comisión Nacional de Hidrocarburos (CNH) tell a different story.

CNH has so far approved 133 work plans, requiring investment of $35.9 billion, derived from exploration and production (E&P) contracts awarded to operators between 2015 and 2018. The contracts were awarded under the framework of the reform, which ended the upstream monopoly of state oil company Petróleos Mexicanos (Pemex).

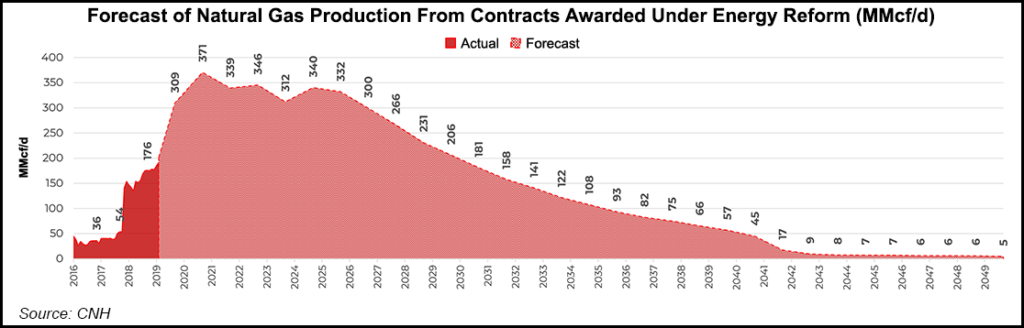

As of May, crude oil and natural gas production from the contracts totaled 74,000 b/d and 176 MMcf/d, respectively. These figures are up from 43,000 b/d and 54 MMcf/d averaged in 2018.

Oil production from these same contracts is expected to peak at 341,000 b/d in 2026, while gas output is seen reaching 371 MMcf/d in 2021.

To read the full article and gain access to more in-depth coverage including natural gas price and flow data surrounding the rapidly evolving Mexico energy markets, check out NGI’s Mexico Gas Price Index.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 2577-9966 |