E&P | Infrastructure | NGI All News Access | NGI The Weekly Gas Market Report

U.S. Adds Two Natural Rigs, But Oil Count Slides

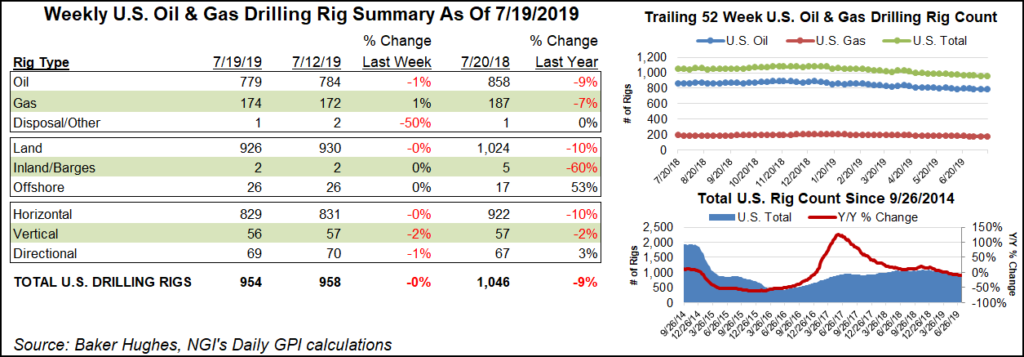

The U.S. natural gas rig count picked up two units to finish at 174 for the week ended July 19, though a slowdown in the oil patch drove the overall domestic count lower, according to data from Baker Hughes, a GE Company.

The combined U.S. rig count fell four units to 954 for the week, including the loss of five oil-directed rigs and one miscellaneous unit. The domestic count is down 92 rigs from 1,046 in the year-ago period.

One rig departed in the Gulf of Mexico, dropping its total to 25, versus 17 a year ago. Two horizontal units exited the patch, along with one directional and one vertical, according to BHGE.

Canada’s rig count increased by one to finish the week at 118, versus 211 in the year-ago period, with the addition of three gas-directed rigs offsetting a decline of two oil-directed. The combined North American rig count ended the week at 1,072, down from 1,257 active rigs at this time last year.

Among major plays, the Permian Basin enjoyed a week of growth, adding three units to reach a total of 440, down from 476 a year ago. The Cana Woodford and Eagle Ford Shale each added one rig on the week.

Also among plays, the Ardmore Woodford saw two rigs exit the patch, while the Haynesville and Marcellus shales each saw one rig depart.

Among states, this week’s Permian gains appeared to be focused in New Mexico, which added five net rigs for the week to end at 107 (103 a year ago). Alaska added two rigs to finish at 10 rigs, doubling its year-ago count.

Louisiana and Oklahoma each saw three rigs pack up shop during the week, while two exited the patch in Texas. One rig each departed in Ohio and West Virginia, according to BHGE.

As the 2Q2019 earnings season for the oil and gas industry kicked off during the week, oilfield services giant Schlumberger Ltd. offered a sobering forecast for North American land activity for the remainder of the year, projecting a 10% decline in upstream spending for the continent in 2019.

This comes as exploration and production operators have slowed their onshore activity in part to appease shareholders and improve cash flow.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |