Natural Gas Futures Steady as Heat Still Seen Fading Next Week

U.S. natural gas futures paused for a breather Wednesday as the market continued to await any sign of the next bullish weather catalyst. Meanwhile, the spot market displayed indifference to the “dangerous heat” building over the populated Midwest and East regions to close out the week; the NGI Spot Gas National Avg. added 0.5 cents to $2.165/MMBtu.

After testing both sides of even, the August Nymex futures contract settled 0.2 cents lower at $2.304/MMBtu, trading in a roughly 5-cent range from $2.290 up to $2.346. Further along the strip, September eased 0.8 cents to $2.278, while October settled at $2.304, off 1.0 cent.

Weather models Wednesday didn’t offer a “definitive move” in either direction, with the American dataset shifting cooler and the European trending slightly hotter, according to Bespoke Weather Services. In the wake of intense near-term heat, the forecaster said it still favors a pattern delivering below normal temperatures focused over the Midwest starting around day six and continuing through the remainder of the 15-day outlook period.

“We can see some further cool risk yet, but it is trickier since a westward shift in cool anomalies would hit fewer population centers, while an eastward shift would hit more, so it depends on exact location, not just intensity,” Bespoke said. “Fundamentally, we’d still like more strength out of the weather-adjusted burns than what we have seen, especially with production likely to return any time now from the Barry shut-ins.

“…We still see risk for some heat to return down the road into August…so it is possible that next week’s models begin to sniff that out. But before all of that occurs, we wouldn’t be surprised to see a little more downside yet before any turning of the tide can occur.”

Radiant Solutions made a cooler adjustment to its latest six- to 10-day outlook Wednesday, with changes focused in the Midcontinent and Southeast.

“This comes along high pressure pressing southward into the Midwest early and encompassing most in the eastern half during the mid to late period,” the forecaster said. “A round of near normal to below normal temperatures are in association. Prior to the arrival of this cooler and drier air mass are temperatures still in the lower 90s on Day 6 in New York City just ahead of the cold front. Eastern heat wanes quickly after that, as a trough settles over the region.”

The latest 11-15 day forecast underwent a “mix of changes,” leaning cooler in the central Lower 48 and warmer in the East.

“Like the previous outlook, the focus of above normal temperatures is in the West, while most of the Eastern Half falls into the normal category,” Radiant said.

With forecasts showing heat peaking later this week, traders could look to take profits ahead of Thursday’s Energy Information Administration (EIA) storage report, according to EBW Analytics Group.

“The barrier confronting the market at this point is that, with the hottest days of the summer soon to be over, there are few if any positive catalysts in sight to move prices higher — but no shortage of bearish catalysts,” such as the completion of the Gulf Coast Express pipeline in the Permian Basin, demand destruction from potential hurricanes or shortfalls in liquefied natural gas feed gas demand, EBW CEO Andy Weissman said.

“Return of very hot weather in August, if it occurs, could slow the decline. Even a small bounce up, however, is likely to prompt additional shorting. Once August heat fades, significant further declines are likely.”

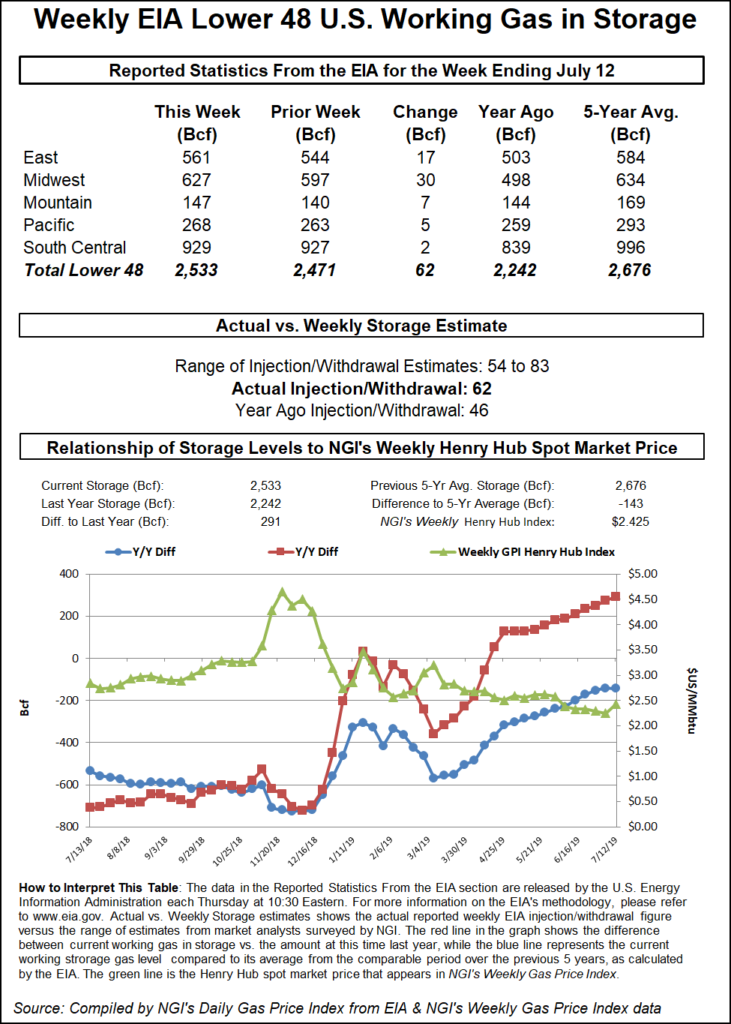

Estimates ahead of this week’s EIA report were pointing to a near-average injection in the 60s Bcf range. A Bloomberg survey showed a median 69 Bcf based on 13 estimates ranging from 64 Bcf to 83 Bcf. A Reuters survey called for a 65 Bcf build based on responses from 54 Bcf to 78 Bcf. Intercontinental Exchange EIA Financial Weekly Index futures settled Tuesday at 60 Bcf, while NGI’s model predicted a 65 Bcf injection.

Last year, EIA recorded a 46 Bcf injection for the period, which covers the week ended July 12. The five-year average is a build of 63 Bcf.

Spot prices in the Midwest and East mostly traded close to even Wednesday as the market appeared to shrug off forecasts showing suffocating heat in those regions. Benchmark Henry Hub added 2.0 cents to average $2.380.

The National Weather Service (NWS) on Wednesday warned of a “dangerous heat wave” moving into the central and eastern United States over the next few days.

“The heat and humidity will combine to create dangerous heat indices,” the forecaster said. “Widespread Excessive Heat Warnings and Watches and Heat Advisories are in effect for much of the Plains, Mississippi Valley and into the Ohio Valley, as well as portions of the Eastern Seaboard.

“The next couple of days are just the beginning, as heat is expected to worsen over the weekend. Meanwhile, the West Coast into the Northern Great Basin and Northern Rockies will be cooler than average over the next couple days behind a cold front.”

The heat wave moving over the East this week could raise U.S. power burn levels to a new record high, according to Genscape Inc. The firm was forecasting power burns to peak on Friday at around 44.5 Bcf/d, which would top the previous modeled record set last July at 44 Bcf/d.

“Demand in the EIA East is set to rise with a heat wave that is currently forecasted to peak this weekend,” Genscape analysts Margaret Jones and Josh Garcia said. “Temperatures and demand have been rising steadily since the end of June, and our pipe data sample for the East showed a summer-to-date peak of 27.0 Bcf/d Tuesday (July 16).”

Genscape’s daily supply and demand forecasts show East region demand averaging 25.9 Bcf/d over the next seven days, up from 24.6 Bcf/d for the prior seven days. On Saturday, temperatures in the region are expected to result in 7.9 average cooling degree days more than 30-year normal levels.

“This will be especially concentrated in the Northeast and New England, where temperatures will be 11.3 and 14.9 average degree days higher than the norm,” the analysts said.

Algonquin Citygate eased 1.5 cents to $2.345, while Transco Zone 6 NY picked up 6.5 cents to $2.410. Further south, Transco Zone 5 slid 1.5 cents to $2.440.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 |