Shale Daily | Bakken Shale | E&P | NGI All News Access | NGI The Weekly Gas Market Report

North Dakota’s Bakken Production Flattens, Rig Count Declines

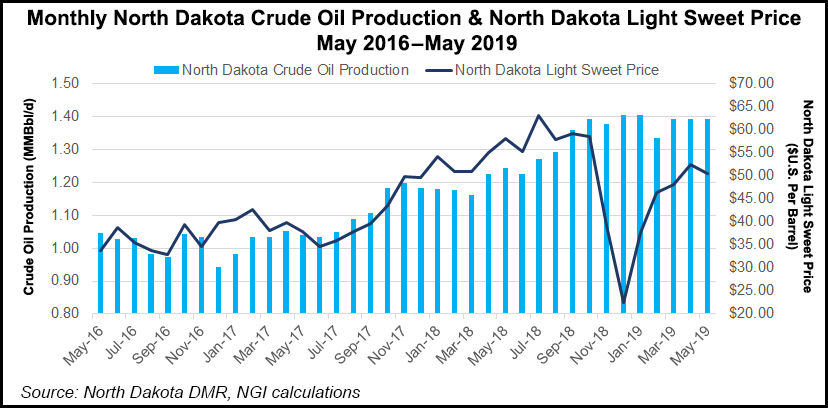

Squeezed by commodity prices and natural gas capture goals, Bakken Shale production results flattened in North Dakota during May, according to the latest statistics from the Department of Mineral Resources (DMR).

DMR chief Lynn Helms on Tuesday during his monthly webinar said producers are planning to idle more rigs through the rest of the year as exploration and production (E&P) players are “struggling to attract capital,” on concerns about “very soft oil prices.”

The concerns by the E&Ps operating in the state have “tended to hold activity pretty flat,” Helms said.

The state’s rig count as of Tuesday was down five from June, and two less than in May.

“We had been cruising along in the mid-60s, but we are beginning to hear warning signals from the E&P companies that they would need to be careful about their spending the rest of the year, so we’re anticipating a reduced rig count for the second half of this year,” Helms said.

During May natural gas production fell slightly month/month to 87.4 Bcf (2.82 Bcf/d) from 84.9 Bcf (2.83 Bcf/d). Oil production was slightly higher in April at 43.1 million bbl (1.393 million b/d) from 41.7 million bbl (1.392 million b/d).

North Dakota Sweet Light oil prices on Tuesday were at around $48.75/bbl, but they had dropped in June to average $43.10, below April’s $52.50 and a May price of $50.50.

“Right now, the signals are that we are not going to see any rapid production growth, but we still think the 3Q2019 and early 4Q2019 we’ll still see some production growth, but we’re not going to see any record-setting paces like we have had in the past,” Helms said.

North Dakota operators also continue to struggle with gas capture as the midstream operators scramble to develop adequate processing and pipeline infrastructure. Helms expects more capacity to be available by early next year.

“Stay tuned for that, as we expect to get the announcement in the third and fourth quarter budgets,” he said.

Overall, gas capture came in a 81%, but Fort Berthold Reservation (FBR) operators that account for more than 300,000 b/d of production continued to lag. The capture rate for areas except for FBR were at 85% in May while FBR was 69%. The capture rates would have been worse if the FBR operators hadn’t self-restricted about 25,000 b/d in production, Helms said.

Operators are looking at a better technology to capture and store wellhead gas supplies. One firm has been supplying electric generators and servers to wellsites, and the largest application so far burns up 500 Mcf/d to produce power from the flared gas, using the power for the computer servers, Helms said.

“This is particularly of interest for Fort Berthold because that is where infrastructure for electricity, internet, and gas capture lag significantly behind the rest of the state,” he said.

Regarding oil transportation, state Pipeline Authority director Justin Kringstad reported that the vast majority of Bakken production continues to travel by pipeline (72% in May), but there was a slight uptick in rail shipments (19%), possibly in anticipation of an oil rail tank car unloading law in Washington state that North Dakota is challenging.

North Dakota Attorney General Wayne Stenehjem on Wednesday filed with the U.S. Department of Transportation (DOT) for an exemption for the state from the Washington law, which lowers the vapor pressure requirement on offloading oil tank cars to 9 psi. By law, DOT’s Pipeline and Hazardous Materials Safety Administration (PHMSA) may declare a state law in conflict with a federal standard.

Washington’s regulation is set to go into effect on July 28, and it has reporting requirements for out-of-state shippers. Stenehjem said while he understands the Pacific Northwest state’s concerns for public safety, state officials have to understand that North Dakota and DOT share those concerns.

“That is why the federal government has a detailed, rigorous and comprehensive regulatory scheme that precisely governs this issue,” he said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |