Australian Industrial Sector Secures More Natural Gas Supply

Another Australian energy company has signed a natural gas supply agreement to help support the country’s manufacturing and industrial sector.

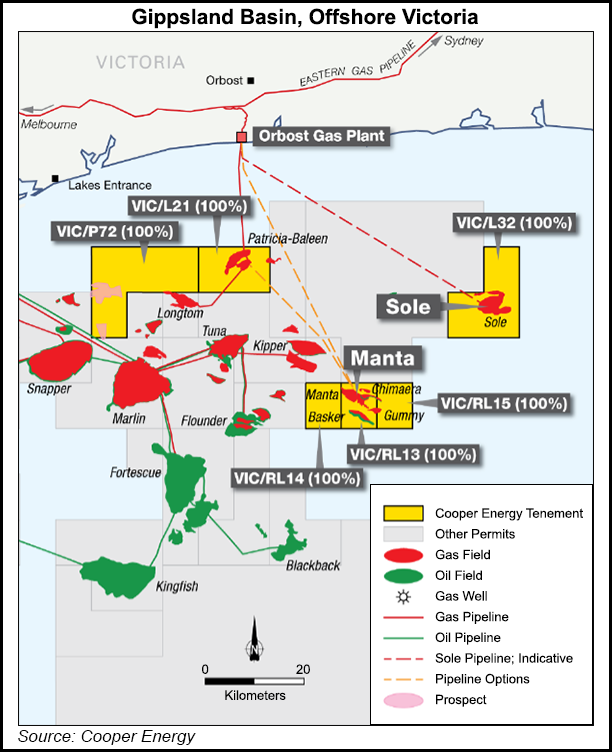

Adelaide-based Cooper Energy said last week it would provide 7.6 petajoules (PJ) from the Sole gas field, 30 miles offshore Victoria in the Gippsland Basin, to packaging and resource recovery firm Visy for three years starting in 2020. Visy has more than 120 sites across Australia, New Zealand and Thailand, with trading offices in Asia, Europe and the United States.

Gas from the Sole field would be supplied at market prices, indexed annually, the company said. Cooper Energy managing director David Maxwell said the agreement with industrial gas user Visy demonstrates his company’s support for all domestic demand segments.

“Visy joins O-I Australia as the second large industrial manufacturer supplied by Cooper,” Maxwell said. “We are delighted to add another industrial user of gas to our customer portfolio under a multi-year supply agreement.”

The Sole field would become Southeast Australia’s newest source of gas supply when it begins production after the completion of the Orbost Gas Plant upgrade underway by APA Group, Australia’s largest gas infrastructure company.

The field is the first new gas source developed off the southeastern coast in more than seven years and is estimated to contain proved and probable reserves of 249 PJ of commercial gas. Commissioning and delivery of gas sales are scheduled to begin sometime between now and September.

The Sole field also would deliver an additional 68 terajoules (TJ) per day of gas supply for southeastern Australia. Cooper became the field’s sole owner when it bought a 50% share from Australian independent Santos Ltd. in October 2016.

Australian Petroleum Production and Exploration Association CEO Andrew McConville said the Cooper deal showed further evidence of the strong investment that industry is making to increase gas flow into the east coast market.

“The industry takes its obligations to the domestic market seriously,” he said. “This deal highlights the importance of developing new gas resources and the response industry is taking to accelerate delivery of more supply.

“This new agreement brings the total to 79 new publicly announced gas agreements signed since 2012 in Australia, showing the strong commitment the sector has for the domestic market. Together, these contracts total more than 4,500 PJ of gas.”

In the past two-and-a-half years, Arrow Energy, Shell Australia, Cooper Energy, Senex, Strike Energy, Gladstone LNG, Origin Energy and Santos have announced that they would provide new supply to various parts of eastern Australia.

Two weeks ago, the Australia Pacific liquefied natural gas (LNG) export project agreed to provide 16.2 PJ to Australia’s manufacturing market. Explosives manufacturer Orica Ltd. agreed to take 10.2 PJ over four years starting in 2021, while packaging manufacturer Orora would take up to 6 PJ of gas over three years at an option beginning in 2023.

In December, the Northern Gas Pipeline between Tennant Creek in the country’s Northern Territory and Mount Isa in Queensland opened to allow northern Australia’s gas resources to reach gas markets in eastern Australia. The pipeline would initially deliver around 90 TJ/d of natural gas, around 6% of eastern Australia’s average daily gas use, with a possible pipeline extension coming in the future.

Despite these developments, eastern Australia is projected to have a possible gas shortfall because of the country’s LNG export success. Australia, with a liquefaction capacity of 80 million metric tons/ year (mmty), recently bypassed Qatar (77 mmty of liquefaction capacity) to become the global LNG leader.

The Energy Users Association of Australia (EUAA) said in April rising commodity prices could force many manufacturers out of business, as gas costs for domestic users had risen by as much as 300% since Australia began exporting LNG from east coast terminals. EUAA called on the government to act, noting that the Australian Energy Market Operator already had warned that the east coast faced a gas supply shortfall as soon as 2024.

Two years ago, former Prime Minister Malcolm Turnbull’s administration pulled back from threats to curb LNG exports after three major producers agreed to provide supply for the domestic market to ease potential shortages. Overseas customers at the time were getting first dibs on Australian gas supply and charged less than domestic customers.

Australia exports most of its gas to customers in the Asia-Pacific region, which accounts for around two-thirds of global LNG demand, with that amount projected to increase amid more LNG usage in China and south Asia.

As many as five LNG import projects in the states of New South Wales, Victoria and South Australia are reportedly on the drawing board to help alleviate the possible gas shortage. Sydney-based AGL Energy said in late June that it expects to start delivering gas from its proposed import jetty in Victoria in 2022, around a year later than previously scheduled, because of a prolonged environmental review.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |