NGI The Weekly Gas Market Report | Infrastructure | NGI All News Access

More Appalachian Pipelines Needed to Match Production Growth, RBN Says

Appalachian producers are finally enjoying the benefits of surplus pipeline capacity that matches their prolific natural gas volumes, but more will be needed in the coming years to prevent additional bottlenecks that have long plagued the region and undercut local prices, according to RBN Energy LLC.

A bevy of pipeline reversals, expansions and greenfield projects in recent years have finally come online to balance supply and demand, which has lifted basis and provided a cushion for incremental production growth, RBN analyst Sheetal Nasta said in a recent report. The buildout culminated last year, when a number of major projects, including the Rover Pipeline, Nexus Gas Transmission system and the Atlantic Sunrise expansion — all with more than 1 Bcf/d of capacity — entered service.

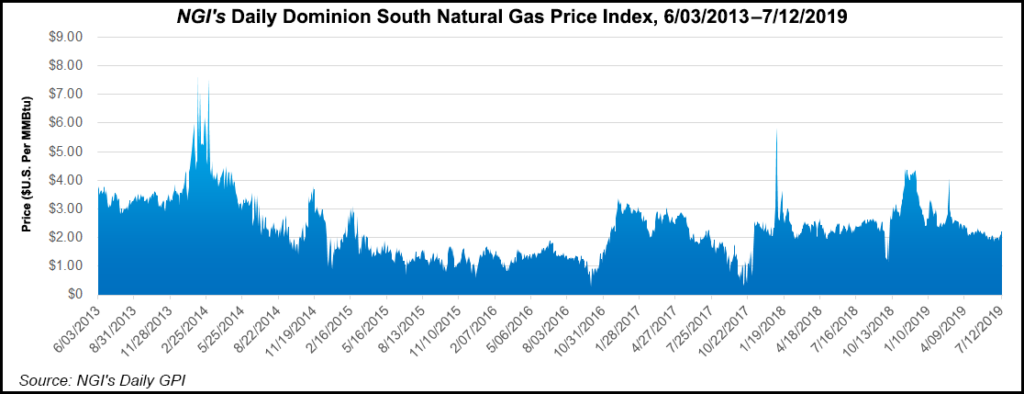

This year marks the first full year of operation for many of the major takeaway expansions that have lifted the fortunes of Appalachia’s leading producers. According to RBN, there’s currently an average of 4 Bcf/d of unused exit capacity in the basin. As a result, Nasta noted that June spot prices at the Dominion South Hub were the strongest they’ve been in six years.

But even as natural gas faces broader headwinds that have prompted Northeast producers to curb their outlooks, volumes are still expected to grow at a modest pace in the coming years. RBN found that production growth slowed late last year through the beginning of 2019 as a combination of freeze-offs and infrastructure outages cut into production. A slowing pipeline buildout, spikes in associated gas production in oil-directed basins such as the Permian and restive investors demanding capital discipline have also all combined to stymie the outlook for natural gas.

But Nasta said RBN, like others, still expects growth in the Northeast, with the firm anticipating that volumes will grow by another 8 Bcf/d over the next five years. While the new takeaway provides some room for growth, she said the cushion “will gradually close over the next three years as pipeline capacity stagnates, allowing production to once again surpass it by late 2022/early 2023,” even assuming larger projects like the Mountain Valley Pipeline (MVP) and Atlantic Coast Pipeline (ACP) get built.

Appalachian production has skyrocketed over the last decade, rising 16-fold from about 2 Bcf/d in 2010 to more than 30 Bcf/d this year. Production has bounced back this year, exceeding 31 Bcf/d for the first time in June, according to RBN. The rapid growth had for years created bottlenecks and strangled netbacks as prices saw steep discounts on the oversupply.

Many of the region’s marquee pipeline projects have been completed, but a handful remain in regulatory and legal limbo, such as MVP, ACP, and the Northeast Supply Enhancement Project and PennEast Pipeline. Environmentalists have so far waged successful battles to slow them, while regulators in places like New York have bogged down others.

“Unlike in the past, when the supply growth happened in tandem with pipeline capacity additions, there are now less than a handful of planned takeaway projects remaining, and they face uncertain futures,” Nasta wrote.

RBN analyzed in-basin demand from the power, industrial and residential/commercial sectors, finding that consumption in the region will grow, but not at a pace that matches production.

Dominion Energy Inc.’s single-train Cove Point LNG Export terminal in Maryland, Nasta added, is also fully operational, meaning Northeast LNG exports are likely to remain flat at about 700 MMcf/d, failing to provide the sort of lift other producers will see closer to the Gulf Coast as a number of projects are slated to come online there.

It’s likely then that the latest reprieve for Appalachian producers isn’t likely to last as signs point toward another “long supply” market, Nasta said, adding that without additional takeaway capacity, “we can expect prices to again reflect constraints.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |