Shale Daily | E&P | NGI All News Access

Permit Weakness Seen Persisting Across Lower 48, Particularly for Natural Gas Drilling

A sharp ramp in permit requests for Colorado’s Denver-Julesburg (DJ) Basin/Niobrara formation helped push the June count up to the highest level in three months, but requests for permits in the natural gas-rich Marcellus, Utica and Haynesville shales declined, according to a compilation by Evercore ISI.

Analyst James West and his team cull oil and gas permitting data from state and federal sources every month. The June count climbed 22% from May to 5,363, primarily on the Colorado surge, which reported 1,241 more permits month/month (m/m).

“This was partially offset by lower permits in the Marcellus,” down 102 from May, while the Utica was off 16 m/m and the Haynesville was down by two.

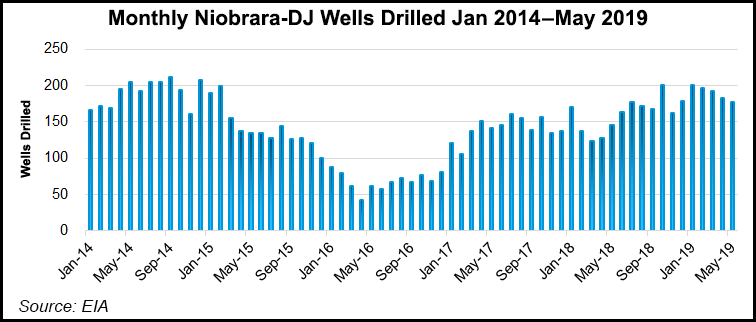

“On a cumulative year-to-date basis, permits are above 2018 levels by 17% which is mainly due to robust activity in the DJ/Niobrara,” which is up 63% year/year, and other unconventional plays that are 57% higher, West noted.

“Permitting activity in oil formations was mixed,” Evercore analysts said. Overall, permitting during June in oil formations increased by 25% from May to 4,643 primarily because of a 27% gain.

However, weaker permitting activity was seen in the Permian Basin, down 17% from May to 981 total. Bakken Shale activity fell 25% from May to 110, while Eagle Ford Shale permitting was off 8% from May to 268.

“On a cumulative year-to-date basis, permits are down 7% for these basins,” analysts said.

Permitting in the gas-heavy formations continued to soften, down by 28% from May to 314, the second lowest count year-to-date, with January also slow.

Marcellus permitting declined by 47% m/m. On a cumulative year-to-date basis, gas permits have fallen by 12%, which appears to be from lower activity in the Haynesville, down 26% year-to-date.

Evercore also offered some insight into early July’s permitting activity, noting onshore permitting had declined 34% week/week to 809. DJ permitting was off 171, while the Permian was down by 31.

Evercore also noted additional softening in the gassy formations early this month. The Marcellus had contracted to 17, down by five week/week, “the lowest weekly permit count year-to-date. Additionally, permits in the Haynesville fell to 19, down 19 week/week. There was a slight uptick in the Utica, where one more permit was requested than a week before.

Meanwhile, offshore permits also continued to fall in June from May. New well permits fell to eight, down by two from May in shallow water. Deepwater and midwater permits remained unchanged at three each.

In the offshore on a cumulative year-to-date basis, new well permits are 20% higher versus 2018 because of stronger levels for deepwater, up three year/year, and for shallow water permits, up by 10. However, total offshore permits filed since the start of the year are 3% below 2018 levels at 103 versus 106.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |