NGI All News Access | E&P | Infrastructure

Two Rigs Exit U.S. Natural Gas Patch; Oil Count Slides, Too

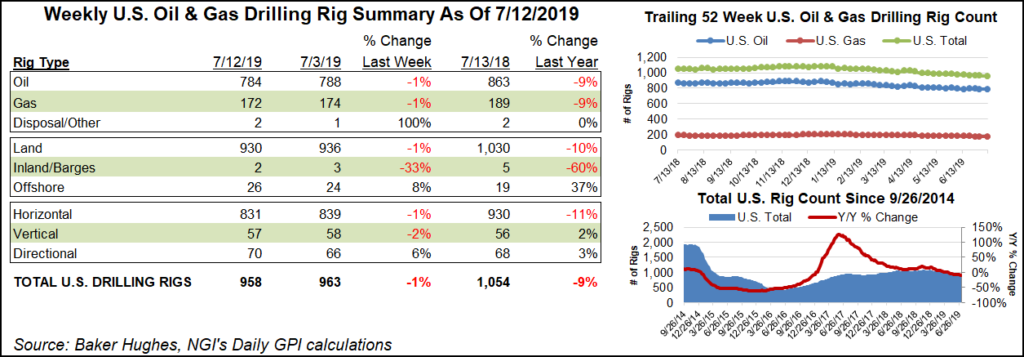

The U.S. natural gas rig count fell two units to 172 for the week ended July 12 as drilling activity in Texas saw a notable slowdown during the period, according to data from Baker Hughes, a GE Company (BHGE).

Four oil-directed rigs also exited in the United States, partially offset by the addition of one “miscellaneous” unit. The overall U.S. rig count finished the week at 958, 96 units behind its year-ago total of 1,054.

BHGE recorded a two-rig increase in the Gulf of Mexico for the week, offset by a six-rig decrease in land drilling. One rig exited from inland waters. The declines included eight horizontal units and one vertical, while four directional rigs joined the patch for the week.

The Canadian rig count fell three units overall to 117, down 80 units year/year. All of the Canadian declines occurred in the gas patch, with the departure of eight gas-directed rigs offsetting the addition of five oil-directed.

The combined North American rig count finished at 1,075, down from 1,251 rigs running in the year-ago period.

Among major plays, the Permian and Eagle Ford recorded heavy losses on the week, dropping six and five rigs, respectively. For the Permian, total rigs now sit at 437, 39 units below year-ago levels, while the Eagle Ford’s tally is down 15 year/year at 66 rigs.

Also among plays, the Cana Woodford, Denver Julesburg-Niobrara and Haynesville Shale each added one rig for the week.

Unsurprisingly given the pullback in the Permian and Eagle Ford, Texas saw the largest weekly move among states, shedding seven net rigs overall to fall to 456, down from 528 a year ago. Colorado added two rigs to reach 31, slightly behind its year-ago tally of 32.

Also among states, Louisiana and Oklahoma added one rig a piece, while Alaska and California each dropped one.

The U.S. natural gas patch underwent a major shake-up during the week after the Rice family secured a remarkable victory to take control of Marcellus and Utica shale powerhouse EQT Corp. In an extraordinary turn seen as a sign of the pressure facing natural gas companies to perform in a low-commodity price environment, Toby and Derek Rice won their nine-month battle to take control of the largest natural gas producer in the country.

Seven of their board candidates and another five incumbents they supported were elected last Wednesday with more than 80% of the vote, according to the certified results. Less than two years after the brothers sold their company, Rice Energy Inc., to EQT for $8 billion, Toby was named CEO.

Speaking of a low-commodity price environment, robust production is likely to help limit Henry Hub natural gas spot prices to an average $2.50/MMBtu in the second half of the year and $2.77/MMBtu next year, according to the Energy Information Administration (EIA).

EIA’s forecast for all of 2019, included in a Short-Term Energy Outlook (STEO) released Tuesday, is $2.62/MMBtu, a 15-cent decline compared with the previous STEO. The 2020 estimate is unchanged from the previous STEO, while the second half of 2019 forecast is a 29-cent decline.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |