NGI All News Access | Infrastructure | Markets

NatGas Futures Retreat on Potential Barry Demand Destruction, ‘Unimpressive’ EIA Data

Potential demand destruction from a tropical storm in the Gulf of Mexico (GOM) and a larger-than-expected weekly inventory build helped to pressure natural gas futures lower Thursday.

In the spot market, heat sparked gains in the West, while a rainy pattern accompanied a mix of price moves along the Gulf Coast; the NGI Spot Gas National Avg. picked up 10.0 cents to $2.350/MMBtu.

After gaining a combined 4.1 cents during Tuesday’s and Wednesday’s sessions, the August Nymex futures contract retreated 2.8 cents to settle at $2.416. The front month traded in a range from $2.393 up to $2.487. Further along the strip, September fell 3.2 cents to $2.401, while October slid 3.4 cents to $2.436.

Prices rallied early in the session but were done in by weakness along the curve and an “unimpressive” injection number from the Energy Information Administration’s (EIA) latest storage report, according to Bespoke Weather Services.

Concerns about Tropical Storm Barry’s impact on liquefied natural gas (LNG) exports and the prospect of demand destruction associated with the system also likely contributed to the selling, the forecaster said.

Still, the upcoming weather pattern “remains a hot-dominated one, even with some demand destruction concerns and risk of less heat toward the end of July…Peak heat comes in the upcoming week, and as long as any storm impacts remain short-term, as expected, prices could rebound higher again next week, assuming burns stay strong with the hotter temperatures,” Bespoke said.

Despite the storm and the latest storage data presenting “bearish hurdles” for the market to cross, “the overall backdrop with improved balances is still supportive as long as we hold the hotter pattern.”

The oil and gas industry was on alert as Barry, upgraded to tropical storm status by the National Hurricane Center (NHC) Thursday, remained on an uncertain path, with forecasts indicating the immense rainmaker could come ashore this weekend between an area stretching from the upper Texas coast to Mississippi.

The low pressure area over the northern GOM became better organized and the circulation center also became better defined, leading forecasters to upgrade the system to a tropical storm. Hurricane status is likely before landfall, NHC said.

Hurricane warnings were issued late Thursday by the NHC for the coast of Louisiana from Intracoastal City to Grand Isle. A tropical storm warning was in effect for Lake Pontchartrain and Lake Maurepas including metropolitan New Orleans, as well as for the Louisiana coast west of Intracoastal City to Cameron.

Barry is expected to produce total rain accumulations of 10-20 inches over southeastern Louisiana and southwestern Mississippi, with isolated maximum amounts of 25 inches. Over the remainder of the Lower Mississippi Valley, total rain accumulations of 4-8 inches are expected, with isolated maximum amounts of 12 inches.

The initial motion was “rather uncertain” as Barry was being steered by a weak low- to mid-level ridge to the north, with a weakness in the ridge likely to develop within 24-48 hours. NHC’s forecast track put the center of Barry near the central/southeastern coast of Louisiana Friday night or Saturday.

Based on operator reports, the Bureau of Safety and Environmental Enforcement estimated at midday Thursday that about 44.5% of natural gas production, or 1.24 Bcf/d of output, had been shut in, along with more than 53% of oil production, or 1 million b/d.

Genscape Inc. estimates earlier Thursday showed GOM output dropping to 879 MMcf/d, down nearly 1.6 Bcf/d compared to the 30-day average prior to the storm. That’s also the lowest observed GOM output since Hurricane Nate in October 2017, according to the firm.

In addition to production impacts, the storm also puts LNG operations at risk, according to Genscape.

“Aggregate Evening cycle delivery nominations to Sabine Pass LNG have dipped day/day by around 313 MMcf/d and are currently posted at 2.8 Bcf/d for Thursday (July 11),” Genscape analysts Dominic Eggerman and Allison Hurley said in a note to clients early Thursday.

“Conversely, scheduled nominations to Cameron LNG have jumped to 624 MMcf/d” for Thursday’s gas day, up from 390 MMcf/d Wednesday. “Nominations headed toward Corpus Christi LNG — located further south and east of the storm’s projected path — remain flat at 1.2 Bcf/d for Thursday.”

Analysts with Jefferies were expecting Barry to impact demand more than supply.

“Power burn will be impacted through cooler temps and power outages, with potential for longer lasting effects if power infrastructure is damaged,” the analysts said. “LNG demand will also be impacted, and Sabine Pass flows have already dropped to around 3.0 Bcf/d over the last two days versus around 3.7 Bcf/d for July 1-9.”

This comes as power burns and LNG exports have been strong through the early part of July, according to the Jefferies team.

“Lower prices continue to incentivize additional power burn, which at 39.7 Bcf/d is up about 1.1 Bcf/d year/year” despite cooling degree day totals coming in 6% lower year/year and stronger hydroelectric generation in California, the analysts said. “LNG feed gas has averaged about 6.0 Bcf/d month-to-date, up 8% versus May’s record (5.6 Bcf/d).”

On the supply side, production so far in July has averaged 87.8 Bcf/d, 800 MMcf/d above June’s average, according to Jefferies, though volumes have been down in recent days amid impacts from Barry.

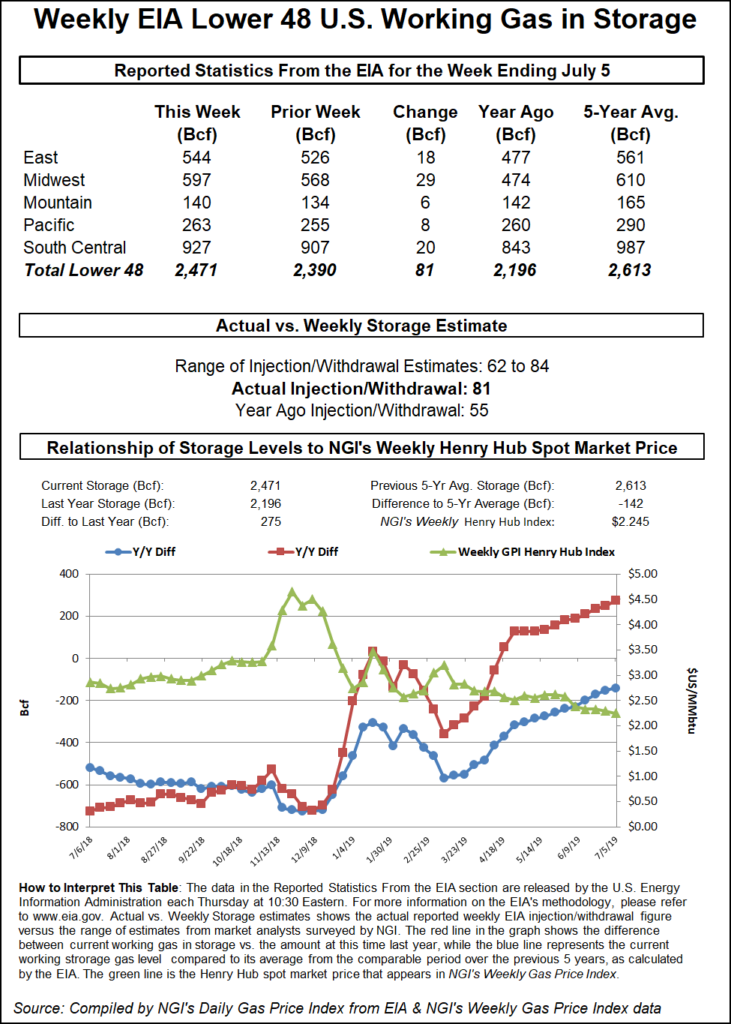

Meanwhile, the Energy Information Administration (EIA) on Thursday reported an 81 Bcf weekly injection into U.S. natural gas stocks that was on the higher side of estimates. The 81 Bcf figure, covering the period ended July 5, came in higher than both the 55 Bcf injection EIA recorded for the year-ago period and the five-year average 71 Bcf.

Prior to Thursday’s report, estimates had been pointing to a near-average build in the mid-70s Bcf. During a chat on energy-focused social media platform Enelyst, ION Energy analyst Kyle Cooper pointed to the impact of the July Fourth holiday to help explain the bearish miss in this week’s print.

“Holidays have been big demand killers recently,” Cooper said.

Total working gas in underground storage stood at 2,471 Bcf as of July 5, 275 Bcf (12.5%) above year-ago levels but 142 Bcf (minus 5.4%) below the five-year average, according to EIA.

By region, the Midwest posted the largest week/week injection at 29 Bcf, followed by the East at 18 Bcf. The Pacific recorded an 8 Bcf build, while 6 Bcf was refilled in the Mountain region. In the South Central, a 21 Bcf injection into nonsalt stocks was partially offset by a 2 Bcf pull from salt for the week, according to EIA.

Some of the largest spot price moves occurred in Southern California Thursday, where hot temperatures were expected to continue into the weekend. Radiant Solutions was forecasting the high in Burbank, CA, to reach 94 degrees Friday, with temperatures averaging about 6.5 degrees hotter than normal.

SoCal Citygate surged 42.5 cents to $2.950 Thursday, while SoCal Border Avg. added 29.0 cents to $2.730. In Arizona/Nevada, Kern Delivery added 28.5 cents to $2.745.

The National Weather Service (NWS) called for “increasingly hot temperatures” over the western United States through the end of the week and into the weekend associated with high pressure strengthening over the Four Corners region.

For Thursday and Friday, “high temperatures in the 90s will be commonplace, with temperatures locally exceeding 110 degrees across the Desert Southwest,” the forecaster said. “Over the weekend, there will also be just a hint of some monsoonal moisture lifting north from the Gulf of California and adjacent areas of mainland Mexico,” resulting in “scattered afternoon and evening showers and thunderstorms over the Four Corners region.”

Further upstream in West Texas, locations throughout the region also rallied Thursday. Waha jumped 57.5 cents to average $1.250.

Elsewhere, prices mostly held steady across the eastern two thirds of the Lower 48, including over the Gulf Coast, which was expected to see heavy rains associated with Barry. In Louisiana, Henry Hub added 2.0 cents to $2.475, while ANR SE slid 1.5 cents to $2.420.

Unplanned maintenance at an ANR Pipeline compressor in Louisiana was expected to restrict up to 165 MMcf/d flowing through the Eunice Total location starting Friday and continuing until next Wednesday (July 17), Genscape analyst Anthony Ferrara said.

“Located in the Southeast Area Segment, deliveries to Eunice Total will be limited by 175 MMcf/d (leaving 1,000 MMcf/d available) throughout the maintenance,” Ferrara said. “Over the past 14 days, deliveries have averaged 1,108 MMcf/d and maxed at 1,165 MMcf/d.”

Meanwhile, in the Midwest, Dawn added 2.0 cents to $2.340.

Inventories at the Dawn Area Storage Hub are recovering to near five-year average levels, according to Ferrara. Stocks there ended June at 120 Bcf, nearly 20 Bcf higher year/year but 9 Bcf below the five-year average.

“As of July 10, the amount of working gas in storage has risen to 132 Bcf, a level that was not reached in 2018 until July 25,” the analyst said. “Dawn has had a notably strong injection season so far this year, and levels could reach back up to the five-year average if this trend continues.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |