NGI The Weekly Gas Market Report

NGI The Weekly Gas Market Report | Forward Look | Markets | NGI All News Access

Surprise Shift to Record July Heat Sends Natural Gas Forwards Surging; Market Eyeing Barry

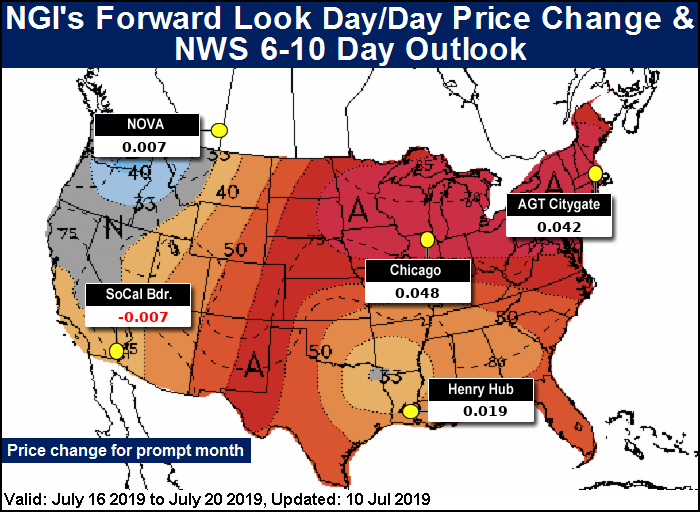

While fireworks lit up the night sky on the July Fourth holiday, natural gas forward prices put on a show of their own as an abrupt change in weather forecasts led to a huge rally during the July 3-10 week. August prices jumped an average 16 cents, with equally stout increases seen through the remainder of the year, according to NGI’s Forward Look.

The surprise shift in long-range weather outlooks was just what market bulls had hoped for after mostly mild weather so far this summer has resulted in a rapid refill in storage inventories at the same time that production growth has accelerated. The latest weather outlooks were a little mixed as Tropical Storm Barry headed toward the Gulf Coast, bringing an expected drop in demand as heavy rains drench the region.

In a 1 p.m. CT update, the National Hurricane Center (NHC) said Barry was moving toward the west near 5 mph, and this motion was expected to continue Thursday. A turn toward the west-northwest was expected Thursday night, followed by a turn toward the northwest on Friday. On the forecast track, the center of Barry was expected to be near the central or southeastern coast of Louisiana Friday night or Saturday.

Maximum sustained winds were near 40 mph with higher gusts, according to the NHC. Strengthening was expected during the next day or two, and Barry could become a hurricane late Friday or early Saturday, it said.

The slow movement of this system is expected to result in a long duration heavy rainfall threat along the central Gulf Coast and inland through the lower Mississippi Valley through the weekend and potentially into early next week, according to the NHC.

Longer term, however, weather models showed hotter weather returning. As of early Thursday, the European models remained several gas-weighted degree days (GWDD) hotter than the American data, according to Bespoke Weather Services. The European models were also hotter than Bespoke’s forecast as it does not show much drop-off at all around the storm.

“This seems rather unrealistic, though once the storm is out of the picture, the hotter solutions can verify,” Bespoke chief meteorologist Brian Lovern said.

The firm also sees less heat at the end of the runs in both models, though for now remain hotter than normal. “We do believe there is potential for less heat in that final week of July, but we are still on pace for the third hottest July on record, per GWDDs, as of right now.”

After a massive rally on Friday that sent the August Nymex gas futures contract up nearly 13 cents and other contracts through the winter strip (November-March) up at least a dime, prices bounced along throughout the rest of the July 3-10 period, shifting only a few cents in either direction. August ultimately rose about 15 cents to $2.444, while the balance of summer (August-October) climbed about 17 cents to $2.45 and the winter strip moved up 16 cents to $2.725.

The potential for more heat following Barry was enough to keep futures well supported early Thursday as well. Traders were also attempting to assess the impact of lost production ahead of Barry and the expected drop in demand once the storm reaches land.

The latest Energy Information Administration (EIA) storage data appeared to take a back seat — at least initially — to the storm hype, despite it throwing a counter-punch to bulls. The EIA reported an 81 Bcf injection into storage inventories for the week ending July 5. The build was on the higher side of estimates and well above last year’s 55 Bcf injection and the 71 Bcf five-year average.

In the lead-up to the report, the August Nymex futures contract had been trading around $2.464-2.472. As the 81 Bcf print hit the screen at 10:30 a.m. ET, the front month went as low as $2.447 before rallying to as high as $2.487 over the next few minutes. By 11 a.m., August was trading at $2.470, up 2.6 cents from Wednesday’s settle and roughly in line with the pre-report trade.

ION Energy analyst Kyle Cooper pointed to the impact of the July Fourth holiday to help explain the bearish miss in this week’s print.

“Holidays have been big demand killers recently,” Cooper said on energy chat room Enelyst, which is hosted by The Desk.

In a note to clients, Bespoke said the 81 Bcf build is looser balance wise compared to last week’s but noted that it was “difficult to read too much into this given notable holiday impact.” It expects next week’s number to be tighter, with supply lower week/week and burns stronger.

“Looking ahead, issues around the coming tropical storm will throw more uncertainty into each of the next two numbers,” Bespoke’s Lovern said.

By region, the Midwest posted the largest week/week injection at 29 Bcf, followed by the East at 18 Bcf. The Pacific recorded an 8 Bcf build, while 6 Bcf was added in the Mountain region. In the South Central, a 21 Bcf injection into nonsalt stocks was partially offset by a 2 Bcf pull from salt for the week, according to EIA.

Some market observers on Enelyst noted that without the large build in nonsalt facilities, the EIA storage report could have been viewed as bullish. Meanwhile, with the holiday report out of the way, further price upside could be expected as summer kicks into high gear.

Total working gas in underground storage as of July 5 stood at 2,471 Bcf, 275 Bcf (12.5%) above year-ago levels but 142 Bcf (minus 5.4%) below the five-year average, according to EIA.

However, with the most recent American weather data trending cooler over the northern and eastern United States after July 24-25, August Nymex futures went on to settle Thursday 2.8 cents lower at $2.416. September dropped 3.2 cents to $2.401.

Heat Boosts Appalachia

Hefty, double-digit increases were seen across the country, but forward prices in Appalachia posted some of the largest gains as much of the expected heat in the next couple of weeks is concentrated in the Northeast.

Steamy conditions were already in place earlier this week, but a line of thunderstorms was forecast to sweep across the region beginning Thursday and continuing through Friday, according to forecasts. The main threats from the storms from eastern Tennessee and western North Carolina to northern New York state, Vermont and neighboring Canada will be strong wind gusts and flash flooding, according to AccuWeather.

This batch of thunderstorms and others were forecast to continue strengthening, with risk shifting a bit farther east. Major cities in Virginia, New York, Pennsylvania as well as Washington, D.C. were expected to be heavily impacted by the storms. Washington, D.C. was already hit by flash flooding Monday after receiving 3.30 inches of rain in an hour, according to AccuWeather.

Dry air was forecast to filter southeastward across the Great Lakes region and into the central Appalachians on Friday, the forecaster said. However, it may take until Saturday before it turns a bit less humid in coastal areas of the mid-Atlantic and New England.

Much of next week will feel like the middle of the summer. “We expect a heat wave to build in much of the Northeast during next week,” AccuWeather meteorologist Paul Pastelok said.

Indeed, national demand is expected to reach the strongest levels yet this year late next week, according to NatGasWeather. The firm said a hot upper ridge would dominate much of the country going into the last week of July, “although there could be cooler exceptions on the northern, southern and eastern periphery as weak weather systems trigger showers and thunderstorms.”

The steamy outlook sent Dominion South August prices up 19 cents from July 3-10 to reach $2.103, while the balance of summer was up 20 cents to $2.01. The winter strip gained 17 cents to reach $2.39, according to Forward Look.

Transco Leidy August was up 21 cents during that time to $2.019, the balance of summer picked up 22 cents to hit $1.94 and the winter tacked on 17 cents to reach $2.38.

On the West Coast, southern California forward prices were the only ones to decline during the July 3-10 week, even as extreme heat has returned to the region. That’s likely due to hefty storage inventories in the region, with Southern California Gas recently indicating that stocks were near historical levels.

SoCal Citygate August prices fell a nickel to $3.882, as did the balance of summer, which hit $3.26, Forward Look data show. The winter strip was flat at $3.80.

Conversely, PG&E Citygate August rose a dime to $2.901, the balance of summer climbed 12 cents to $2.85 and the winter jumped 16 cents to $3.16.

The surprise shift in long-range weather outlooks was just what market bulls had hoped for after mostly mild weather so far this summer has resulted in a rapid refill in storage inventories at the same time that production growth has accelerated. The latest weather outlooks were a little mixed as Tropical Storm Barry headed toward the Gulf Coast, bringing an expected drop in demand as heavy rains drench the region.

In a 1 p.m. CT update, the National Hurricane Center (NHC) said Barry was moving toward the west near 5 mph, and this motion was expected to continue Thursday. A turn toward the west-northwest was expected Thursday night, followed by a turn toward the northwest on Friday. On the forecast track, the center of Barry was expected to be near the central or southeastern coast of Louisiana Friday night or Saturday.

Maximum sustained winds were near 40 mph with higher gusts, according to the NHC. Strengthening was expected during the next day or two, and Barry could become a hurricane late Friday or early Saturday, it said.

The slow movement of this system is expected to result in a long duration heavy rainfall threat along the central Gulf Coast and inland through the lower Mississippi Valley through the weekend and potentially into early next week, according to the NHC.

Longer term, however, weather models showed hotter weather returning. As of early Thursday, the European models remained several gas-weighted degree days (GWDD) hotter than the American data, according to Bespoke Weather Services. The European models were also hotter than Bespoke’s forecast as it does not show much drop-off at all around the storm.

“This seems rather unrealistic, though once the storm is out of the picture, the hotter solutions can verify,” Bespoke chief meteorologist Brian Lovern said.

The firm also sees less heat at the end of the runs in both models, though for now remain hotter than normal. “We do believe there is potential for less heat in that final week of July, but we are still on pace for the third hottest July on record, per GWDDs, as of right now.”

After a massive rally on Friday that sent the August Nymex gas futures contract up nearly 13 cents and other contracts through the winter strip (November-March) up at least a dime, prices bounced along throughout the rest of the July 3-10 period, shifting only a few cents in either direction. August ultimately rose about 15 cents to $2.444, while the balance of summer (August-October) climbed about 17 cents to $2.45 and the winter strip moved up 16 cents to $2.725.

The potential for more heat following Barry was enough to keep futures well supported early Thursday as well. Traders were also attempting to assess the impact of lost production ahead of Barry and the expected drop in demand once the storm reaches land.

The latest Energy Information Administration (EIA) storage data appeared to take a back seat — at least initially — to the storm hype, despite it throwing a counter-punch to bulls. The EIA reported an 81 Bcf injection into storage inventories for the week ending July 5. The build was on the higher side of estimates and well above last year’s 55 Bcf injection and the 71 Bcf five-year average.

In the lead-up to the report, the August Nymex futures contract had been trading around $2.464-2.472. As the 81 Bcf print hit the screen at 10:30 a.m. ET, the front month went as low as $2.447 before rallying to as high as $2.487 over the next few minutes. By 11 a.m., August was trading at $2.470, up 2.6 cents from Wednesday’s settle and roughly in line with the pre-report trade.

ION Energy analyst Kyle Cooper pointed to the impact of the July Fourth holiday to help explain the bearish miss in this week’s print.

“Holidays have been big demand killers recently,” Cooper said on energy chat room Enelyst, which is hosted by The Desk.

In a note to clients, Bespoke said the 81 Bcf build is looser balance wise compared to last week’s but noted that it was “difficult to read too much into this given notable holiday impact.” It expects next week’s number to be tighter, with supply lower week/week and burns stronger.

“Looking ahead, issues around the coming tropical storm will throw more uncertainty into each of the next two numbers,” Bespoke’s Lovern said.

By region, the Midwest posted the largest week/week injection at 29 Bcf, followed by the East at 18 Bcf. The Pacific recorded an 8 Bcf build, while 6 Bcf was added in the Mountain region. In the South Central, a 21 Bcf injection into nonsalt stocks was partially offset by a 2 Bcf pull from salt for the week, according to EIA.

Some market observers on Enelyst noted that without the large build in nonsalt facilities, the EIA storage report could have been viewed as bullish. Meanwhile, with the holiday report out of the way, further price upside could be expected as summer kicks into high gear.

Total working gas in underground storage as of July 5 stood at 2,471 Bcf, 275 Bcf (12.5%) above year-ago levels but 142 Bcf (minus 5.4%) below the five-year average, according to EIA.

However, with the most recent American weather data trending cooler over the northern and eastern United States after July 24-25, August Nymex futures went on to settle Thursday 2.8 cents lower at $2.416. September dropped 3.2 cents to $2.401.

Heat Boosts Appalachia

Hefty, double-digit increases were seen across the country, but forward prices in Appalachia posted some of the largest gains as much of the expected heat in the next couple of weeks is concentrated in the Northeast.

Steamy conditions were already in place earlier this week, but a line of thunderstorms was forecast to sweep across the region beginning Thursday and continuing through Friday, according to forecasts. The main threats from the storms from eastern Tennessee and western North Carolina to northern New York state, Vermont and neighboring Canada will be strong wind gusts and flash flooding, according to AccuWeather.

This batch of thunderstorms and others were forecast to continue strengthening, with risk shifting a bit farther east. Major cities in Virginia, New York, Pennsylvania as well as Washington, D.C. were expected to be heavily impacted by the storms. Washington, D.C. was already hit by flash flooding Monday after receiving 3.30 inches of rain in an hour, according to AccuWeather.

Dry air was forecast to filter southeastward across the Great Lakes region and into the central Appalachians on Friday, the forecaster said. However, it may take until Saturday before it turns a bit less humid in coastal areas of the mid-Atlantic and New England.

Much of next week will feel like the middle of the summer. “We expect a heat wave to build in much of the Northeast during next week,” AccuWeather meteorologist Paul Pastelok said.

Indeed, national demand is expected to reach the strongest levels yet this year late next week, according to NatGasWeather. The firm said a hot upper ridge would dominate much of the country going into the last week of July, “although there could be cooler exceptions on the northern, southern and eastern periphery as weak weather systems trigger showers and thunderstorms.”

The steamy outlook sent Dominion South August prices up 19 cents from July 3-10 to reach $2.103, while the balance of summer was up 20 cents to $2.01. The winter strip gained 17 cents to reach $2.39, according to Forward Look.

Transco Leidy August was up 21 cents during that time to $2.019, the balance of summer picked up 22 cents to hit $1.94 and the winter tacked on 17 cents to reach $2.38.

On the West Coast, southern California forward prices were the only ones to decline during the July 3-10 week, even as extreme heat has returned to the region. That’s likely due to hefty storage inventories in the region, with Southern California Gas recently indicating that stocks were near historical levels.

SoCal Citygate August prices fell a nickel to $3.882, as did the balance of summer, which hit $3.26, Forward Look data show. The winter strip was flat at $3.80.

Conversely, PG&E Citygate August rose a dime to $2.901, the balance of summer climbed 12 cents to $2.85 and the winter jumped 16 cents to $3.16.

In a 1 p.m. CT update, the National Hurricane Center (NHC) said Barry was moving toward the west near 5 mph, and this motion was expected to continue Thursday. A turn toward the west-northwest was expected Thursday night, followed by a turn toward the northwest on Friday. On the forecast track, the center of Barry was expected to be near the central or southeastern coast of Louisiana Friday night or Saturday.

Maximum sustained winds were near 40 mph with higher gusts, according to the NHC. Strengthening was expected during the next day or two, and Barry could become a hurricane late Friday or early Saturday, it said.

The slow movement of this system is expected to result in a long duration heavy rainfall threat along the central Gulf Coast and inland through the lower Mississippi Valley through the weekend and potentially into early next week, according to the NHC.

Longer term, however, weather models showed hotter weather returning. As of early Thursday, the European models remained several gas-weighted degree days (GWDD) hotter than the American data, according to Bespoke Weather Services. The European models were also hotter than Bespoke’s forecast as it does not show much drop-off at all around the storm.

“This seems rather unrealistic, though once the storm is out of the picture, the hotter solutions can verify,” Bespoke chief meteorologist Brian Lovern said.

The firm also sees less heat at the end of the runs in both models, though for now remain hotter than normal. “We do believe there is potential for less heat in that final week of July, but we are still on pace for the third hottest July on record, per GWDDs, as of right now.”

After a massive rally on Friday that sent the August Nymex gas futures contract up nearly 13 cents and other contracts through the winter strip (November-March) up at least a dime, prices bounced along throughout the rest of the July 3-10 period, shifting only a few cents in either direction. August ultimately rose about 15 cents to $2.444, while the balance of summer (August-October) climbed about 17 cents to $2.45 and the winter strip moved up 16 cents to $2.725.

The potential for more heat following Barry was enough to keep futures well supported early Thursday as well. Traders were also attempting to assess the impact of lost production ahead of Barry and the expected drop in demand once the storm reaches land.

The latest Energy Information Administration (EIA) storage data appeared to take a back seat — at least initially — to the storm hype, despite it throwing a counter-punch to bulls. The EIA reported an 81 Bcf injection into storage inventories for the week ending July 5. The build was on the higher side of estimates and well above last year’s 55 Bcf injection and the 71 Bcf five-year average.

In the lead-up to the report, the August Nymex futures contract had been trading around $2.464-2.472. As the 81 Bcf print hit the screen at 10:30 a.m. ET, the front month went as low as $2.447 before rallying to as high as $2.487 over the next few minutes. By 11 a.m., August was trading at $2.470, up 2.6 cents from Wednesday’s settle and roughly in line with the pre-report trade.

ION Energy analyst Kyle Cooper pointed to the impact of the July Fourth holiday to help explain the bearish miss in this week’s print.

“Holidays have been big demand killers recently,” Cooper said on energy chat room Enelyst, which is hosted by The Desk.

In a note to clients, Bespoke said the 81 Bcf build is looser balance wise compared to last week’s but noted that it was “difficult to read too much into this given notable holiday impact.” It expects next week’s number to be tighter, with supply lower week/week and burns stronger.

“Looking ahead, issues around the coming tropical storm will throw more uncertainty into each of the next two numbers,” Bespoke’s Lovern said.

By region, the Midwest posted the largest week/week injection at 29 Bcf, followed by the East at 18 Bcf. The Pacific recorded an 8 Bcf build, while 6 Bcf was added in the Mountain region. In the South Central, a 21 Bcf injection into nonsalt stocks was partially offset by a 2 Bcf pull from salt for the week, according to EIA.

Some market observers on Enelyst noted that without the large build in nonsalt facilities, the EIA storage report could have been viewed as bullish. Meanwhile, with the holiday report out of the way, further price upside could be expected as summer kicks into high gear.

Total working gas in underground storage as of July 5 stood at 2,471 Bcf, 275 Bcf (12.5%) above year-ago levels but 142 Bcf (minus 5.4%) below the five-year average, according to EIA.

However, with the most recent American weather data trending cooler over the northern and eastern United States after July 24-25, August Nymex futures went on to settle Thursday 2.8 cents lower at $2.416. September dropped 3.2 cents to $2.401.

Heat Boosts Appalachia

Hefty, double-digit increases were seen across the country, but forward prices in Appalachia posted some of the largest gains as much of the expected heat in the next couple of weeks is concentrated in the Northeast.

Steamy conditions were already in place earlier this week, but a line of thunderstorms was forecast to sweep across the region beginning Thursday and continuing through Friday, according to forecasts. The main threats from the storms from eastern Tennessee and western North Carolina to northern New York state, Vermont and neighboring Canada will be strong wind gusts and flash flooding, according to AccuWeather.

This batch of thunderstorms and others were forecast to continue strengthening, with risk shifting a bit farther east. Major cities in Virginia, New York, Pennsylvania as well as Washington, D.C. were expected to be heavily impacted by the storms. Washington, D.C. was already hit by flash flooding Monday after receiving 3.30 inches of rain in an hour, according to AccuWeather.

Dry air was forecast to filter southeastward across the Great Lakes region and into the central Appalachians on Friday, the forecaster said. However, it may take until Saturday before it turns a bit less humid in coastal areas of the mid-Atlantic and New England.

Much of next week will feel like the middle of the summer. “We expect a heat wave to build in much of the Northeast during next week,” AccuWeather meteorologist Paul Pastelok said.

Indeed, national demand is expected to reach the strongest levels yet this year late next week, according to NatGasWeather. The firm said a hot upper ridge would dominate much of the country going into the last week of July, “although there could be cooler exceptions on the northern, southern and eastern periphery as weak weather systems trigger showers and thunderstorms.”

The steamy outlook sent Dominion South August prices up 19 cents from July 3-10 to reach $2.103, while the balance of summer was up 20 cents to $2.01. The winter strip gained 17 cents to reach $2.39, according to Forward Look.

Transco Leidy August was up 21 cents during that time to $2.019, the balance of summer picked up 22 cents to hit $1.94 and the winter tacked on 17 cents to reach $2.38.

On the West Coast, southern California forward prices were the only ones to decline during the July 3-10 week, even as extreme heat has returned to the region. That’s likely due to hefty storage inventories in the region, with Southern California Gas recently indicating that stocks were near historical levels.

SoCal Citygate August prices fell a nickel to $3.882, as did the balance of summer, which hit $3.26, Forward Look data show. The winter strip was flat at $3.80.

Conversely, PG&E Citygate August rose a dime to $2.901, the balance of summer climbed 12 cents to $2.85 and the winter jumped 16 cents to $3.16.

Maximum sustained winds were near 40 mph with higher gusts, according to the NHC. Strengthening was expected during the next day or two, and Barry could become a hurricane late Friday or early Saturday, it said.

The slow movement of this system is expected to result in a long duration heavy rainfall threat along the central Gulf Coast and inland through the lower Mississippi Valley through the weekend and potentially into early next week, according to the NHC.

Longer term, however, weather models showed hotter weather returning. As of early Thursday, the European models remained several gas-weighted degree days (GWDD) hotter than the American data, according to Bespoke Weather Services. The European models were also hotter than Bespoke’s forecast as it does not show much drop-off at all around the storm.

“This seems rather unrealistic, though once the storm is out of the picture, the hotter solutions can verify,” Bespoke chief meteorologist Brian Lovern said.

The firm also sees less heat at the end of the runs in both models, though for now remain hotter than normal. “We do believe there is potential for less heat in that final week of July, but we are still on pace for the third hottest July on record, per GWDDs, as of right now.”

After a massive rally on Friday that sent the August Nymex gas futures contract up nearly 13 cents and other contracts through the winter strip (November-March) up at least a dime, prices bounced along throughout the rest of the July 3-10 period, shifting only a few cents in either direction. August ultimately rose about 15 cents to $2.444, while the balance of summer (August-October) climbed about 17 cents to $2.45 and the winter strip moved up 16 cents to $2.725.

The potential for more heat following Barry was enough to keep futures well supported early Thursday as well. Traders were also attempting to assess the impact of lost production ahead of Barry and the expected drop in demand once the storm reaches land.

The latest Energy Information Administration (EIA) storage data appeared to take a back seat — at least initially — to the storm hype, despite it throwing a counter-punch to bulls. The EIA reported an 81 Bcf injection into storage inventories for the week ending July 5. The build was on the higher side of estimates and well above last year’s 55 Bcf injection and the 71 Bcf five-year average.

In the lead-up to the report, the August Nymex futures contract had been trading around $2.464-2.472. As the 81 Bcf print hit the screen at 10:30 a.m. ET, the front month went as low as $2.447 before rallying to as high as $2.487 over the next few minutes. By 11 a.m., August was trading at $2.470, up 2.6 cents from Wednesday’s settle and roughly in line with the pre-report trade.

ION Energy analyst Kyle Cooper pointed to the impact of the July Fourth holiday to help explain the bearish miss in this week’s print.

“Holidays have been big demand killers recently,” Cooper said on energy chat room Enelyst, which is hosted by The Desk.

In a note to clients, Bespoke said the 81 Bcf build is looser balance wise compared to last week’s but noted that it was “difficult to read too much into this given notable holiday impact.” It expects next week’s number to be tighter, with supply lower week/week and burns stronger.

“Looking ahead, issues around the coming tropical storm will throw more uncertainty into each of the next two numbers,” Bespoke’s Lovern said.

By region, the Midwest posted the largest week/week injection at 29 Bcf, followed by the East at 18 Bcf. The Pacific recorded an 8 Bcf build, while 6 Bcf was added in the Mountain region. In the South Central, a 21 Bcf injection into nonsalt stocks was partially offset by a 2 Bcf pull from salt for the week, according to EIA.

Some market observers on Enelyst noted that without the large build in nonsalt facilities, the EIA storage report could have been viewed as bullish. Meanwhile, with the holiday report out of the way, further price upside could be expected as summer kicks into high gear.

Total working gas in underground storage as of July 5 stood at 2,471 Bcf, 275 Bcf (12.5%) above year-ago levels but 142 Bcf (minus 5.4%) below the five-year average, according to EIA.

However, with the most recent American weather data trending cooler over the northern and eastern United States after July 24-25, August Nymex futures went on to settle Thursday 2.8 cents lower at $2.416. September dropped 3.2 cents to $2.401.

Heat Boosts Appalachia

Hefty, double-digit increases were seen across the country, but forward prices in Appalachia posted some of the largest gains as much of the expected heat in the next couple of weeks is concentrated in the Northeast.

Steamy conditions were already in place earlier this week, but a line of thunderstorms was forecast to sweep across the region beginning Thursday and continuing through Friday, according to forecasts. The main threats from the storms from eastern Tennessee and western North Carolina to northern New York state, Vermont and neighboring Canada will be strong wind gusts and flash flooding, according to AccuWeather.

This batch of thunderstorms and others were forecast to continue strengthening, with risk shifting a bit farther east. Major cities in Virginia, New York, Pennsylvania as well as Washington, D.C. were expected to be heavily impacted by the storms. Washington, D.C. was already hit by flash flooding Monday after receiving 3.30 inches of rain in an hour, according to AccuWeather.

Dry air was forecast to filter southeastward across the Great Lakes region and into the central Appalachians on Friday, the forecaster said. However, it may take until Saturday before it turns a bit less humid in coastal areas of the mid-Atlantic and New England.

Much of next week will feel like the middle of the summer. “We expect a heat wave to build in much of the Northeast during next week,” AccuWeather meteorologist Paul Pastelok said.

Indeed, national demand is expected to reach the strongest levels yet this year late next week, according to NatGasWeather. The firm said a hot upper ridge would dominate much of the country going into the last week of July, “although there could be cooler exceptions on the northern, southern and eastern periphery as weak weather systems trigger showers and thunderstorms.”

The steamy outlook sent Dominion South August prices up 19 cents from July 3-10 to reach $2.103, while the balance of summer was up 20 cents to $2.01. The winter strip gained 17 cents to reach $2.39, according to Forward Look.

Transco Leidy August was up 21 cents during that time to $2.019, the balance of summer picked up 22 cents to hit $1.94 and the winter tacked on 17 cents to reach $2.38.

On the West Coast, southern California forward prices were the only ones to decline during the July 3-10 week, even as extreme heat has returned to the region. That’s likely due to hefty storage inventories in the region, with Southern California Gas recently indicating that stocks were near historical levels.

SoCal Citygate August prices fell a nickel to $3.882, as did the balance of summer, which hit $3.26, Forward Look data show. The winter strip was flat at $3.80.

Conversely, PG&E Citygate August rose a dime to $2.901, the balance of summer climbed 12 cents to $2.85 and the winter jumped 16 cents to $3.16.

The slow movement of this system is expected to result in a long duration heavy rainfall threat along the central Gulf Coast and inland through the lower Mississippi Valley through the weekend and potentially into early next week, according to the NHC.

Longer term, however, weather models showed hotter weather returning. As of early Thursday, the European models remained several gas-weighted degree days (GWDD) hotter than the American data, according to Bespoke Weather Services. The European models were also hotter than Bespoke’s forecast as it does not show much drop-off at all around the storm.

“This seems rather unrealistic, though once the storm is out of the picture, the hotter solutions can verify,” Bespoke chief meteorologist Brian Lovern said.

The firm also sees less heat at the end of the runs in both models, though for now remain hotter than normal. “We do believe there is potential for less heat in that final week of July, but we are still on pace for the third hottest July on record, per GWDDs, as of right now.”

After a massive rally on Friday that sent the August Nymex gas futures contract up nearly 13 cents and other contracts through the winter strip (November-March) up at least a dime, prices bounced along throughout the rest of the July 3-10 period, shifting only a few cents in either direction. August ultimately rose about 15 cents to $2.444, while the balance of summer (August-October) climbed about 17 cents to $2.45 and the winter strip moved up 16 cents to $2.725.

The potential for more heat following Barry was enough to keep futures well supported early Thursday as well. Traders were also attempting to assess the impact of lost production ahead of Barry and the expected drop in demand once the storm reaches land.

The latest Energy Information Administration (EIA) storage data appeared to take a back seat — at least initially — to the storm hype, despite it throwing a counter-punch to bulls. The EIA reported an 81 Bcf injection into storage inventories for the week ending July 5. The build was on the higher side of estimates and well above last year’s 55 Bcf injection and the 71 Bcf five-year average.

In the lead-up to the report, the August Nymex futures contract had been trading around $2.464-2.472. As the 81 Bcf print hit the screen at 10:30 a.m. ET, the front month went as low as $2.447 before rallying to as high as $2.487 over the next few minutes. By 11 a.m., August was trading at $2.470, up 2.6 cents from Wednesday’s settle and roughly in line with the pre-report trade.

ION Energy analyst Kyle Cooper pointed to the impact of the July Fourth holiday to help explain the bearish miss in this week’s print.

“Holidays have been big demand killers recently,” Cooper said on energy chat room Enelyst, which is hosted by The Desk.

In a note to clients, Bespoke said the 81 Bcf build is looser balance wise compared to last week’s but noted that it was “difficult to read too much into this given notable holiday impact.” It expects next week’s number to be tighter, with supply lower week/week and burns stronger.

“Looking ahead, issues around the coming tropical storm will throw more uncertainty into each of the next two numbers,” Bespoke’s Lovern said.

By region, the Midwest posted the largest week/week injection at 29 Bcf, followed by the East at 18 Bcf. The Pacific recorded an 8 Bcf build, while 6 Bcf was added in the Mountain region. In the South Central, a 21 Bcf injection into nonsalt stocks was partially offset by a 2 Bcf pull from salt for the week, according to EIA.

Some market observers on Enelyst noted that without the large build in nonsalt facilities, the EIA storage report could have been viewed as bullish. Meanwhile, with the holiday report out of the way, further price upside could be expected as summer kicks into high gear.

Total working gas in underground storage as of July 5 stood at 2,471 Bcf, 275 Bcf (12.5%) above year-ago levels but 142 Bcf (minus 5.4%) below the five-year average, according to EIA.

However, with the most recent American weather data trending cooler over the northern and eastern United States after July 24-25, August Nymex futures went on to settle Thursday 2.8 cents lower at $2.416. September dropped 3.2 cents to $2.401.

Heat Boosts Appalachia

Hefty, double-digit increases were seen across the country, but forward prices in Appalachia posted some of the largest gains as much of the expected heat in the next couple of weeks is concentrated in the Northeast.

Steamy conditions were already in place earlier this week, but a line of thunderstorms was forecast to sweep across the region beginning Thursday and continuing through Friday, according to forecasts. The main threats from the storms from eastern Tennessee and western North Carolina to northern New York state, Vermont and neighboring Canada will be strong wind gusts and flash flooding, according to AccuWeather.

This batch of thunderstorms and others were forecast to continue strengthening, with risk shifting a bit farther east. Major cities in Virginia, New York, Pennsylvania as well as Washington, D.C. were expected to be heavily impacted by the storms. Washington, D.C. was already hit by flash flooding Monday after receiving 3.30 inches of rain in an hour, according to AccuWeather.

Dry air was forecast to filter southeastward across the Great Lakes region and into the central Appalachians on Friday, the forecaster said. However, it may take until Saturday before it turns a bit less humid in coastal areas of the mid-Atlantic and New England.

Much of next week will feel like the middle of the summer. “We expect a heat wave to build in much of the Northeast during next week,” AccuWeather meteorologist Paul Pastelok said.

Indeed, national demand is expected to reach the strongest levels yet this year late next week, according to NatGasWeather. The firm said a hot upper ridge would dominate much of the country going into the last week of July, “although there could be cooler exceptions on the northern, southern and eastern periphery as weak weather systems trigger showers and thunderstorms.”

The steamy outlook sent Dominion South August prices up 19 cents from July 3-10 to reach $2.103, while the balance of summer was up 20 cents to $2.01. The winter strip gained 17 cents to reach $2.39, according to Forward Look.

Transco Leidy August was up 21 cents during that time to $2.019, the balance of summer picked up 22 cents to hit $1.94 and the winter tacked on 17 cents to reach $2.38.

On the West Coast, southern California forward prices were the only ones to decline during the July 3-10 week, even as extreme heat has returned to the region. That’s likely due to hefty storage inventories in the region, with Southern California Gas recently indicating that stocks were near historical levels.

SoCal Citygate August prices fell a nickel to $3.882, as did the balance of summer, which hit $3.26, Forward Look data show. The winter strip was flat at $3.80.

Conversely, PG&E Citygate August rose a dime to $2.901, the balance of summer climbed 12 cents to $2.85 and the winter jumped 16 cents to $3.16.

Longer term, however, weather models showed hotter weather returning. As of early Thursday, the European models remained several gas-weighted degree days (GWDD) hotter than the American data, according to Bespoke Weather Services. The European models were also hotter than Bespoke’s forecast as it does not show much drop-off at all around the storm.

“This seems rather unrealistic, though once the storm is out of the picture, the hotter solutions can verify,” Bespoke chief meteorologist Brian Lovern said.

The firm also sees less heat at the end of the runs in both models, though for now remain hotter than normal. “We do believe there is potential for less heat in that final week of July, but we are still on pace for the third hottest July on record, per GWDDs, as of right now.”

After a massive rally on Friday that sent the August Nymex gas futures contract up nearly 13 cents and other contracts through the winter strip (November-March) up at least a dime, prices bounced along throughout the rest of the July 3-10 period, shifting only a few cents in either direction. August ultimately rose about 15 cents to $2.444, while the balance of summer (August-October) climbed about 17 cents to $2.45 and the winter strip moved up 16 cents to $2.725.

The potential for more heat following Barry was enough to keep futures well supported early Thursday as well. Traders were also attempting to assess the impact of lost production ahead of Barry and the expected drop in demand once the storm reaches land.

The latest Energy Information Administration (EIA) storage data appeared to take a back seat — at least initially — to the storm hype, despite it throwing a counter-punch to bulls. The EIA reported an 81 Bcf injection into storage inventories for the week ending July 5. The build was on the higher side of estimates and well above last year’s 55 Bcf injection and the 71 Bcf five-year average.

In the lead-up to the report, the August Nymex futures contract had been trading around $2.464-2.472. As the 81 Bcf print hit the screen at 10:30 a.m. ET, the front month went as low as $2.447 before rallying to as high as $2.487 over the next few minutes. By 11 a.m., August was trading at $2.470, up 2.6 cents from Wednesday’s settle and roughly in line with the pre-report trade.

ION Energy analyst Kyle Cooper pointed to the impact of the July Fourth holiday to help explain the bearish miss in this week’s print.

“Holidays have been big demand killers recently,” Cooper said on energy chat room Enelyst, which is hosted by The Desk.

In a note to clients, Bespoke said the 81 Bcf build is looser balance wise compared to last week’s but noted that it was “difficult to read too much into this given notable holiday impact.” It expects next week’s number to be tighter, with supply lower week/week and burns stronger.

“Looking ahead, issues around the coming tropical storm will throw more uncertainty into each of the next two numbers,” Bespoke’s Lovern said.

By region, the Midwest posted the largest week/week injection at 29 Bcf, followed by the East at 18 Bcf. The Pacific recorded an 8 Bcf build, while 6 Bcf was added in the Mountain region. In the South Central, a 21 Bcf injection into nonsalt stocks was partially offset by a 2 Bcf pull from salt for the week, according to EIA.

Some market observers on Enelyst noted that without the large build in nonsalt facilities, the EIA storage report could have been viewed as bullish. Meanwhile, with the holiday report out of the way, further price upside could be expected as summer kicks into high gear.

Total working gas in underground storage as of July 5 stood at 2,471 Bcf, 275 Bcf (12.5%) above year-ago levels but 142 Bcf (minus 5.4%) below the five-year average, according to EIA.

However, with the most recent American weather data trending cooler over the northern and eastern United States after July 24-25, August Nymex futures went on to settle Thursday 2.8 cents lower at $2.416. September dropped 3.2 cents to $2.401.

Heat Boosts Appalachia

Hefty, double-digit increases were seen across the country, but forward prices in Appalachia posted some of the largest gains as much of the expected heat in the next couple of weeks is concentrated in the Northeast.

Steamy conditions were already in place earlier this week, but a line of thunderstorms was forecast to sweep across the region beginning Thursday and continuing through Friday, according to forecasts. The main threats from the storms from eastern Tennessee and western North Carolina to northern New York state, Vermont and neighboring Canada will be strong wind gusts and flash flooding, according to AccuWeather.

This batch of thunderstorms and others were forecast to continue strengthening, with risk shifting a bit farther east. Major cities in Virginia, New York, Pennsylvania as well as Washington, D.C. were expected to be heavily impacted by the storms. Washington, D.C. was already hit by flash flooding Monday after receiving 3.30 inches of rain in an hour, according to AccuWeather.

Dry air was forecast to filter southeastward across the Great Lakes region and into the central Appalachians on Friday, the forecaster said. However, it may take until Saturday before it turns a bit less humid in coastal areas of the mid-Atlantic and New England.

Much of next week will feel like the middle of the summer. “We expect a heat wave to build in much of the Northeast during next week,” AccuWeather meteorologist Paul Pastelok said.

Indeed, national demand is expected to reach the strongest levels yet this year late next week, according to NatGasWeather. The firm said a hot upper ridge would dominate much of the country going into the last week of July, “although there could be cooler exceptions on the northern, southern and eastern periphery as weak weather systems trigger showers and thunderstorms.”

The steamy outlook sent Dominion South August prices up 19 cents from July 3-10 to reach $2.103, while the balance of summer was up 20 cents to $2.01. The winter strip gained 17 cents to reach $2.39, according to Forward Look.

Transco Leidy August was up 21 cents during that time to $2.019, the balance of summer picked up 22 cents to hit $1.94 and the winter tacked on 17 cents to reach $2.38.

On the West Coast, southern California forward prices were the only ones to decline during the July 3-10 week, even as extreme heat has returned to the region. That’s likely due to hefty storage inventories in the region, with Southern California Gas recently indicating that stocks were near historical levels.

SoCal Citygate August prices fell a nickel to $3.882, as did the balance of summer, which hit $3.26, Forward Look data show. The winter strip was flat at $3.80.

Conversely, PG&E Citygate August rose a dime to $2.901, the balance of summer climbed 12 cents to $2.85 and the winter jumped 16 cents to $3.16.

“This seems rather unrealistic, though once the storm is out of the picture, the hotter solutions can verify,” Bespoke chief meteorologist Brian Lovern said.

The firm also sees less heat at the end of the runs in both models, though for now remain hotter than normal. “We do believe there is potential for less heat in that final week of July, but we are still on pace for the third hottest July on record, per GWDDs, as of right now.”

After a massive rally on Friday that sent the August Nymex gas futures contract up nearly 13 cents and other contracts through the winter strip (November-March) up at least a dime, prices bounced along throughout the rest of the July 3-10 period, shifting only a few cents in either direction. August ultimately rose about 15 cents to $2.444, while the balance of summer (August-October) climbed about 17 cents to $2.45 and the winter strip moved up 16 cents to $2.725.

The potential for more heat following Barry was enough to keep futures well supported early Thursday as well. Traders were also attempting to assess the impact of lost production ahead of Barry and the expected drop in demand once the storm reaches land.

The latest Energy Information Administration (EIA) storage data appeared to take a back seat — at least initially — to the storm hype, despite it throwing a counter-punch to bulls. The EIA reported an 81 Bcf injection into storage inventories for the week ending July 5. The build was on the higher side of estimates and well above last year’s 55 Bcf injection and the 71 Bcf five-year average.

In the lead-up to the report, the August Nymex futures contract had been trading around $2.464-2.472. As the 81 Bcf print hit the screen at 10:30 a.m. ET, the front month went as low as $2.447 before rallying to as high as $2.487 over the next few minutes. By 11 a.m., August was trading at $2.470, up 2.6 cents from Wednesday’s settle and roughly in line with the pre-report trade.

ION Energy analyst Kyle Cooper pointed to the impact of the July Fourth holiday to help explain the bearish miss in this week’s print.

“Holidays have been big demand killers recently,” Cooper said on energy chat room Enelyst, which is hosted by The Desk.

In a note to clients, Bespoke said the 81 Bcf build is looser balance wise compared to last week’s but noted that it was “difficult to read too much into this given notable holiday impact.” It expects next week’s number to be tighter, with supply lower week/week and burns stronger.

“Looking ahead, issues around the coming tropical storm will throw more uncertainty into each of the next two numbers,” Bespoke’s Lovern said.

By region, the Midwest posted the largest week/week injection at 29 Bcf, followed by the East at 18 Bcf. The Pacific recorded an 8 Bcf build, while 6 Bcf was added in the Mountain region. In the South Central, a 21 Bcf injection into nonsalt stocks was partially offset by a 2 Bcf pull from salt for the week, according to EIA.

Some market observers on Enelyst noted that without the large build in nonsalt facilities, the EIA storage report could have been viewed as bullish. Meanwhile, with the holiday report out of the way, further price upside could be expected as summer kicks into high gear.

Total working gas in underground storage as of July 5 stood at 2,471 Bcf, 275 Bcf (12.5%) above year-ago levels but 142 Bcf (minus 5.4%) below the five-year average, according to EIA.

However, with the most recent American weather data trending cooler over the northern and eastern United States after July 24-25, August Nymex futures went on to settle Thursday 2.8 cents lower at $2.416. September dropped 3.2 cents to $2.401.

Heat Boosts Appalachia

Hefty, double-digit increases were seen across the country, but forward prices in Appalachia posted some of the largest gains as much of the expected heat in the next couple of weeks is concentrated in the Northeast.

Steamy conditions were already in place earlier this week, but a line of thunderstorms was forecast to sweep across the region beginning Thursday and continuing through Friday, according to forecasts. The main threats from the storms from eastern Tennessee and western North Carolina to northern New York state, Vermont and neighboring Canada will be strong wind gusts and flash flooding, according to AccuWeather.

This batch of thunderstorms and others were forecast to continue strengthening, with risk shifting a bit farther east. Major cities in Virginia, New York, Pennsylvania as well as Washington, D.C. were expected to be heavily impacted by the storms. Washington, D.C. was already hit by flash flooding Monday after receiving 3.30 inches of rain in an hour, according to AccuWeather.

Dry air was forecast to filter southeastward across the Great Lakes region and into the central Appalachians on Friday, the forecaster said. However, it may take until Saturday before it turns a bit less humid in coastal areas of the mid-Atlantic and New England.

Much of next week will feel like the middle of the summer. “We expect a heat wave to build in much of the Northeast during next week,” AccuWeather meteorologist Paul Pastelok said.

Indeed, national demand is expected to reach the strongest levels yet this year late next week, according to NatGasWeather. The firm said a hot upper ridge would dominate much of the country going into the last week of July, “although there could be cooler exceptions on the northern, southern and eastern periphery as weak weather systems trigger showers and thunderstorms.”

The steamy outlook sent Dominion South August prices up 19 cents from July 3-10 to reach $2.103, while the balance of summer was up 20 cents to $2.01. The winter strip gained 17 cents to reach $2.39, according to Forward Look.

Transco Leidy August was up 21 cents during that time to $2.019, the balance of summer picked up 22 cents to hit $1.94 and the winter tacked on 17 cents to reach $2.38.

On the West Coast, southern California forward prices were the only ones to decline during the July 3-10 week, even as extreme heat has returned to the region. That’s likely due to hefty storage inventories in the region, with Southern California Gas recently indicating that stocks were near historical levels.

SoCal Citygate August prices fell a nickel to $3.882, as did the balance of summer, which hit $3.26, Forward Look data show. The winter strip was flat at $3.80.

Conversely, PG&E Citygate August rose a dime to $2.901, the balance of summer climbed 12 cents to $2.85 and the winter jumped 16 cents to $3.16.

The firm also sees less heat at the end of the runs in both models, though for now remain hotter than normal. “We do believe there is potential for less heat in that final week of July, but we are still on pace for the third hottest July on record, per GWDDs, as of right now.”

After a massive rally on Friday that sent the August Nymex gas futures contract up nearly 13 cents and other contracts through the winter strip (November-March) up at least a dime, prices bounced along throughout the rest of the July 3-10 period, shifting only a few cents in either direction. August ultimately rose about 15 cents to $2.444, while the balance of summer (August-October) climbed about 17 cents to $2.45 and the winter strip moved up 16 cents to $2.725.

The potential for more heat following Barry was enough to keep futures well supported early Thursday as well. Traders were also attempting to assess the impact of lost production ahead of Barry and the expected drop in demand once the storm reaches land.

The latest Energy Information Administration (EIA) storage data appeared to take a back seat — at least initially — to the storm hype, despite it throwing a counter-punch to bulls. The EIA reported an 81 Bcf injection into storage inventories for the week ending July 5. The build was on the higher side of estimates and well above last year’s 55 Bcf injection and the 71 Bcf five-year average.

In the lead-up to the report, the August Nymex futures contract had been trading around $2.464-2.472. As the 81 Bcf print hit the screen at 10:30 a.m. ET, the front month went as low as $2.447 before rallying to as high as $2.487 over the next few minutes. By 11 a.m., August was trading at $2.470, up 2.6 cents from Wednesday’s settle and roughly in line with the pre-report trade.

ION Energy analyst Kyle Cooper pointed to the impact of the July Fourth holiday to help explain the bearish miss in this week’s print.

“Holidays have been big demand killers recently,” Cooper said on energy chat room Enelyst, which is hosted by The Desk.

In a note to clients, Bespoke said the 81 Bcf build is looser balance wise compared to last week’s but noted that it was “difficult to read too much into this given notable holiday impact.” It expects next week’s number to be tighter, with supply lower week/week and burns stronger.

“Looking ahead, issues around the coming tropical storm will throw more uncertainty into each of the next two numbers,” Bespoke’s Lovern said.

By region, the Midwest posted the largest week/week injection at 29 Bcf, followed by the East at 18 Bcf. The Pacific recorded an 8 Bcf build, while 6 Bcf was added in the Mountain region. In the South Central, a 21 Bcf injection into nonsalt stocks was partially offset by a 2 Bcf pull from salt for the week, according to EIA.

Some market observers on Enelyst noted that without the large build in nonsalt facilities, the EIA storage report could have been viewed as bullish. Meanwhile, with the holiday report out of the way, further price upside could be expected as summer kicks into high gear.

Total working gas in underground storage as of July 5 stood at 2,471 Bcf, 275 Bcf (12.5%) above year-ago levels but 142 Bcf (minus 5.4%) below the five-year average, according to EIA.

However, with the most recent American weather data trending cooler over the northern and eastern United States after July 24-25, August Nymex futures went on to settle Thursday 2.8 cents lower at $2.416. September dropped 3.2 cents to $2.401.

Heat Boosts Appalachia

Hefty, double-digit increases were seen across the country, but forward prices in Appalachia posted some of the largest gains as much of the expected heat in the next couple of weeks is concentrated in the Northeast.

Steamy conditions were already in place earlier this week, but a line of thunderstorms was forecast to sweep across the region beginning Thursday and continuing through Friday, according to forecasts. The main threats from the storms from eastern Tennessee and western North Carolina to northern New York state, Vermont and neighboring Canada will be strong wind gusts and flash flooding, according to AccuWeather.

This batch of thunderstorms and others were forecast to continue strengthening, with risk shifting a bit farther east. Major cities in Virginia, New York, Pennsylvania as well as Washington, D.C. were expected to be heavily impacted by the storms. Washington, D.C. was already hit by flash flooding Monday after receiving 3.30 inches of rain in an hour, according to AccuWeather.

Dry air was forecast to filter southeastward across the Great Lakes region and into the central Appalachians on Friday, the forecaster said. However, it may take until Saturday before it turns a bit less humid in coastal areas of the mid-Atlantic and New England.

Much of next week will feel like the middle of the summer. “We expect a heat wave to build in much of the Northeast during next week,” AccuWeather meteorologist Paul Pastelok said.

Indeed, national demand is expected to reach the strongest levels yet this year late next week, according to NatGasWeather. The firm said a hot upper ridge would dominate much of the country going into the last week of July, “although there could be cooler exceptions on the northern, southern and eastern periphery as weak weather systems trigger showers and thunderstorms.”

The steamy outlook sent Dominion South August prices up 19 cents from July 3-10 to reach $2.103, while the balance of summer was up 20 cents to $2.01. The winter strip gained 17 cents to reach $2.39, according to Forward Look.

Transco Leidy August was up 21 cents during that time to $2.019, the balance of summer picked up 22 cents to hit $1.94 and the winter tacked on 17 cents to reach $2.38.

On the West Coast, southern California forward prices were the only ones to decline during the July 3-10 week, even as extreme heat has returned to the region. That’s likely due to hefty storage inventories in the region, with Southern California Gas recently indicating that stocks were near historical levels.

SoCal Citygate August prices fell a nickel to $3.882, as did the balance of summer, which hit $3.26, Forward Look data show. The winter strip was flat at $3.80.

Conversely, PG&E Citygate August rose a dime to $2.901, the balance of summer climbed 12 cents to $2.85 and the winter jumped 16 cents to $3.16.

After a massive rally on Friday that sent the August Nymex gas futures contract up nearly 13 cents and other contracts through the winter strip (November-March) up at least a dime, prices bounced along throughout the rest of the July 3-10 period, shifting only a few cents in either direction. August ultimately rose about 15 cents to $2.444, while the balance of summer (August-October) climbed about 17 cents to $2.45 and the winter strip moved up 16 cents to $2.725.

The potential for more heat following Barry was enough to keep futures well supported early Thursday as well. Traders were also attempting to assess the impact of lost production ahead of Barry and the expected drop in demand once the storm reaches land.

The latest Energy Information Administration (EIA) storage data appeared to take a back seat — at least initially — to the storm hype, despite it throwing a counter-punch to bulls. The EIA reported an 81 Bcf injection into storage inventories for the week ending July 5. The build was on the higher side of estimates and well above last year’s 55 Bcf injection and the 71 Bcf five-year average.

In the lead-up to the report, the August Nymex futures contract had been trading around $2.464-2.472. As the 81 Bcf print hit the screen at 10:30 a.m. ET, the front month went as low as $2.447 before rallying to as high as $2.487 over the next few minutes. By 11 a.m., August was trading at $2.470, up 2.6 cents from Wednesday’s settle and roughly in line with the pre-report trade.

ION Energy analyst Kyle Cooper pointed to the impact of the July Fourth holiday to help explain the bearish miss in this week’s print.

“Holidays have been big demand killers recently,” Cooper said on energy chat room Enelyst, which is hosted by The Desk.

In a note to clients, Bespoke said the 81 Bcf build is looser balance wise compared to last week’s but noted that it was “difficult to read too much into this given notable holiday impact.” It expects next week’s number to be tighter, with supply lower week/week and burns stronger.

“Looking ahead, issues around the coming tropical storm will throw more uncertainty into each of the next two numbers,” Bespoke’s Lovern said.

By region, the Midwest posted the largest week/week injection at 29 Bcf, followed by the East at 18 Bcf. The Pacific recorded an 8 Bcf build, while 6 Bcf was added in the Mountain region. In the South Central, a 21 Bcf injection into nonsalt stocks was partially offset by a 2 Bcf pull from salt for the week, according to EIA.

Some market observers on Enelyst noted that without the large build in nonsalt facilities, the EIA storage report could have been viewed as bullish. Meanwhile, with the holiday report out of the way, further price upside could be expected as summer kicks into high gear.

Total working gas in underground storage as of July 5 stood at 2,471 Bcf, 275 Bcf (12.5%) above year-ago levels but 142 Bcf (minus 5.4%) below the five-year average, according to EIA.

However, with the most recent American weather data trending cooler over the northern and eastern United States after July 24-25, August Nymex futures went on to settle Thursday 2.8 cents lower at $2.416. September dropped 3.2 cents to $2.401.

Heat Boosts Appalachia

Hefty, double-digit increases were seen across the country, but forward prices in Appalachia posted some of the largest gains as much of the expected heat in the next couple of weeks is concentrated in the Northeast.

Steamy conditions were already in place earlier this week, but a line of thunderstorms was forecast to sweep across the region beginning Thursday and continuing through Friday, according to forecasts. The main threats from the storms from eastern Tennessee and western North Carolina to northern New York state, Vermont and neighboring Canada will be strong wind gusts and flash flooding, according to AccuWeather.

This batch of thunderstorms and others were forecast to continue strengthening, with risk shifting a bit farther east. Major cities in Virginia, New York, Pennsylvania as well as Washington, D.C. were expected to be heavily impacted by the storms. Washington, D.C. was already hit by flash flooding Monday after receiving 3.30 inches of rain in an hour, according to AccuWeather.

Dry air was forecast to filter southeastward across the Great Lakes region and into the central Appalachians on Friday, the forecaster said. However, it may take until Saturday before it turns a bit less humid in coastal areas of the mid-Atlantic and New England.

Much of next week will feel like the middle of the summer. “We expect a heat wave to build in much of the Northeast during next week,” AccuWeather meteorologist Paul Pastelok said.

Indeed, national demand is expected to reach the strongest levels yet this year late next week, according to NatGasWeather. The firm said a hot upper ridge would dominate much of the country going into the last week of July, “although there could be cooler exceptions on the northern, southern and eastern periphery as weak weather systems trigger showers and thunderstorms.”

The steamy outlook sent Dominion South August prices up 19 cents from July 3-10 to reach $2.103, while the balance of summer was up 20 cents to $2.01. The winter strip gained 17 cents to reach $2.39, according to Forward Look.

Transco Leidy August was up 21 cents during that time to $2.019, the balance of summer picked up 22 cents to hit $1.94 and the winter tacked on 17 cents to reach $2.38.

On the West Coast, southern California forward prices were the only ones to decline during the July 3-10 week, even as extreme heat has returned to the region. That’s likely due to hefty storage inventories in the region, with Southern California Gas recently indicating that stocks were near historical levels.

SoCal Citygate August prices fell a nickel to $3.882, as did the balance of summer, which hit $3.26, Forward Look data show. The winter strip was flat at $3.80.

Conversely, PG&E Citygate August rose a dime to $2.901, the balance of summer climbed 12 cents to $2.85 and the winter jumped 16 cents to $3.16.

The potential for more heat following Barry was enough to keep futures well supported early Thursday as well. Traders were also attempting to assess the impact of lost production ahead of Barry and the expected drop in demand once the storm reaches land.

The latest Energy Information Administration (EIA) storage data appeared to take a back seat — at least initially — to the storm hype, despite it throwing a counter-punch to bulls. The EIA reported an 81 Bcf injection into storage inventories for the week ending July 5. The build was on the higher side of estimates and well above last year’s 55 Bcf injection and the 71 Bcf five-year average.

In the lead-up to the report, the August Nymex futures contract had been trading around $2.464-2.472. As the 81 Bcf print hit the screen at 10:30 a.m. ET, the front month went as low as $2.447 before rallying to as high as $2.487 over the next few minutes. By 11 a.m., August was trading at $2.470, up 2.6 cents from Wednesday’s settle and roughly in line with the pre-report trade.

ION Energy analyst Kyle Cooper pointed to the impact of the July Fourth holiday to help explain the bearish miss in this week’s print.

“Holidays have been big demand killers recently,” Cooper said on energy chat room Enelyst, which is hosted by The Desk.

In a note to clients, Bespoke said the 81 Bcf build is looser balance wise compared to last week’s but noted that it was “difficult to read too much into this given notable holiday impact.” It expects next week’s number to be tighter, with supply lower week/week and burns stronger.

“Looking ahead, issues around the coming tropical storm will throw more uncertainty into each of the next two numbers,” Bespoke’s Lovern said.

By region, the Midwest posted the largest week/week injection at 29 Bcf, followed by the East at 18 Bcf. The Pacific recorded an 8 Bcf build, while 6 Bcf was added in the Mountain region. In the South Central, a 21 Bcf injection into nonsalt stocks was partially offset by a 2 Bcf pull from salt for the week, according to EIA.

Some market observers on Enelyst noted that without the large build in nonsalt facilities, the EIA storage report could have been viewed as bullish. Meanwhile, with the holiday report out of the way, further price upside could be expected as summer kicks into high gear.

Total working gas in underground storage as of July 5 stood at 2,471 Bcf, 275 Bcf (12.5%) above year-ago levels but 142 Bcf (minus 5.4%) below the five-year average, according to EIA.

However, with the most recent American weather data trending cooler over the northern and eastern United States after July 24-25, August Nymex futures went on to settle Thursday 2.8 cents lower at $2.416. September dropped 3.2 cents to $2.401.

Heat Boosts Appalachia

Hefty, double-digit increases were seen across the country, but forward prices in Appalachia posted some of the largest gains as much of the expected heat in the next couple of weeks is concentrated in the Northeast.

Steamy conditions were already in place earlier this week, but a line of thunderstorms was forecast to sweep across the region beginning Thursday and continuing through Friday, according to forecasts. The main threats from the storms from eastern Tennessee and western North Carolina to northern New York state, Vermont and neighboring Canada will be strong wind gusts and flash flooding, according to AccuWeather.

This batch of thunderstorms and others were forecast to continue strengthening, with risk shifting a bit farther east. Major cities in Virginia, New York, Pennsylvania as well as Washington, D.C. were expected to be heavily impacted by the storms. Washington, D.C. was already hit by flash flooding Monday after receiving 3.30 inches of rain in an hour, according to AccuWeather.

Dry air was forecast to filter southeastward across the Great Lakes region and into the central Appalachians on Friday, the forecaster said. However, it may take until Saturday before it turns a bit less humid in coastal areas of the mid-Atlantic and New England.

Much of next week will feel like the middle of the summer. “We expect a heat wave to build in much of the Northeast during next week,” AccuWeather meteorologist Paul Pastelok said.

Indeed, national demand is expected to reach the strongest levels yet this year late next week, according to NatGasWeather. The firm said a hot upper ridge would dominate much of the country going into the last week of July, “although there could be cooler exceptions on the northern, southern and eastern periphery as weak weather systems trigger showers and thunderstorms.”

The steamy outlook sent Dominion South August prices up 19 cents from July 3-10 to reach $2.103, while the balance of summer was up 20 cents to $2.01. The winter strip gained 17 cents to reach $2.39, according to Forward Look.

Transco Leidy August was up 21 cents during that time to $2.019, the balance of summer picked up 22 cents to hit $1.94 and the winter tacked on 17 cents to reach $2.38.

On the West Coast, southern California forward prices were the only ones to decline during the July 3-10 week, even as extreme heat has returned to the region. That’s likely due to hefty storage inventories in the region, with Southern California Gas recently indicating that stocks were near historical levels.

SoCal Citygate August prices fell a nickel to $3.882, as did the balance of summer, which hit $3.26, Forward Look data show. The winter strip was flat at $3.80.

Conversely, PG&E Citygate August rose a dime to $2.901, the balance of summer climbed 12 cents to $2.85 and the winter jumped 16 cents to $3.16.

The latest Energy Information Administration (EIA) storage data appeared to take a back seat — at least initially — to the storm hype, despite it throwing a counter-punch to bulls. The EIA reported an 81 Bcf injection into storage inventories for the week ending July 5. The build was on the higher side of estimates and well above last year’s 55 Bcf injection and the 71 Bcf five-year average.

In the lead-up to the report, the August Nymex futures contract had been trading around $2.464-2.472. As the 81 Bcf print hit the screen at 10:30 a.m. ET, the front month went as low as $2.447 before rallying to as high as $2.487 over the next few minutes. By 11 a.m., August was trading at $2.470, up 2.6 cents from Wednesday’s settle and roughly in line with the pre-report trade.

ION Energy analyst Kyle Cooper pointed to the impact of the July Fourth holiday to help explain the bearish miss in this week’s print.

“Holidays have been big demand killers recently,” Cooper said on energy chat room Enelyst, which is hosted by The Desk.

In a note to clients, Bespoke said the 81 Bcf build is looser balance wise compared to last week’s but noted that it was “difficult to read too much into this given notable holiday impact.” It expects next week’s number to be tighter, with supply lower week/week and burns stronger.

“Looking ahead, issues around the coming tropical storm will throw more uncertainty into each of the next two numbers,” Bespoke’s Lovern said.

By region, the Midwest posted the largest week/week injection at 29 Bcf, followed by the East at 18 Bcf. The Pacific recorded an 8 Bcf build, while 6 Bcf was added in the Mountain region. In the South Central, a 21 Bcf injection into nonsalt stocks was partially offset by a 2 Bcf pull from salt for the week, according to EIA.

Some market observers on Enelyst noted that without the large build in nonsalt facilities, the EIA storage report could have been viewed as bullish. Meanwhile, with the holiday report out of the way, further price upside could be expected as summer kicks into high gear.

Total working gas in underground storage as of July 5 stood at 2,471 Bcf, 275 Bcf (12.5%) above year-ago levels but 142 Bcf (minus 5.4%) below the five-year average, according to EIA.

However, with the most recent American weather data trending cooler over the northern and eastern United States after July 24-25, August Nymex futures went on to settle Thursday 2.8 cents lower at $2.416. September dropped 3.2 cents to $2.401.

Heat Boosts Appalachia

Hefty, double-digit increases were seen across the country, but forward prices in Appalachia posted some of the largest gains as much of the expected heat in the next couple of weeks is concentrated in the Northeast.

Steamy conditions were already in place earlier this week, but a line of thunderstorms was forecast to sweep across the region beginning Thursday and continuing through Friday, according to forecasts. The main threats from the storms from eastern Tennessee and western North Carolina to northern New York state, Vermont and neighboring Canada will be strong wind gusts and flash flooding, according to AccuWeather.

This batch of thunderstorms and others were forecast to continue strengthening, with risk shifting a bit farther east. Major cities in Virginia, New York, Pennsylvania as well as Washington, D.C. were expected to be heavily impacted by the storms. Washington, D.C. was already hit by flash flooding Monday after receiving 3.30 inches of rain in an hour, according to AccuWeather.

Dry air was forecast to filter southeastward across the Great Lakes region and into the central Appalachians on Friday, the forecaster said. However, it may take until Saturday before it turns a bit less humid in coastal areas of the mid-Atlantic and New England.

Much of next week will feel like the middle of the summer. “We expect a heat wave to build in much of the Northeast during next week,” AccuWeather meteorologist Paul Pastelok said.

Indeed, national demand is expected to reach the strongest levels yet this year late next week, according to NatGasWeather. The firm said a hot upper ridge would dominate much of the country going into the last week of July, “although there could be cooler exceptions on the northern, southern and eastern periphery as weak weather systems trigger showers and thunderstorms.”

The steamy outlook sent Dominion South August prices up 19 cents from July 3-10 to reach $2.103, while the balance of summer was up 20 cents to $2.01. The winter strip gained 17 cents to reach $2.39, according to Forward Look.

Transco Leidy August was up 21 cents during that time to $2.019, the balance of summer picked up 22 cents to hit $1.94 and the winter tacked on 17 cents to reach $2.38.

On the West Coast, southern California forward prices were the only ones to decline during the July 3-10 week, even as extreme heat has returned to the region. That’s likely due to hefty storage inventories in the region, with Southern California Gas recently indicating that stocks were near historical levels.

SoCal Citygate August prices fell a nickel to $3.882, as did the balance of summer, which hit $3.26, Forward Look data show. The winter strip was flat at $3.80.

Conversely, PG&E Citygate August rose a dime to $2.901, the balance of summer climbed 12 cents to $2.85 and the winter jumped 16 cents to $3.16.

In the lead-up to the report, the August Nymex futures contract had been trading around $2.464-2.472. As the 81 Bcf print hit the screen at 10:30 a.m. ET, the front month went as low as $2.447 before rallying to as high as $2.487 over the next few minutes. By 11 a.m., August was trading at $2.470, up 2.6 cents from Wednesday’s settle and roughly in line with the pre-report trade.

ION Energy analyst Kyle Cooper pointed to the impact of the July Fourth holiday to help explain the bearish miss in this week’s print.

“Holidays have been big demand killers recently,” Cooper said on energy chat room Enelyst, which is hosted by The Desk.

In a note to clients, Bespoke said the 81 Bcf build is looser balance wise compared to last week’s but noted that it was “difficult to read too much into this given notable holiday impact.” It expects next week’s number to be tighter, with supply lower week/week and burns stronger.

“Looking ahead, issues around the coming tropical storm will throw more uncertainty into each of the next two numbers,” Bespoke’s Lovern said.

By region, the Midwest posted the largest week/week injection at 29 Bcf, followed by the East at 18 Bcf. The Pacific recorded an 8 Bcf build, while 6 Bcf was added in the Mountain region. In the South Central, a 21 Bcf injection into nonsalt stocks was partially offset by a 2 Bcf pull from salt for the week, according to EIA.

Some market observers on Enelyst noted that without the large build in nonsalt facilities, the EIA storage report could have been viewed as bullish. Meanwhile, with the holiday report out of the way, further price upside could be expected as summer kicks into high gear.

Total working gas in underground storage as of July 5 stood at 2,471 Bcf, 275 Bcf (12.5%) above year-ago levels but 142 Bcf (minus 5.4%) below the five-year average, according to EIA.

However, with the most recent American weather data trending cooler over the northern and eastern United States after July 24-25, August Nymex futures went on to settle Thursday 2.8 cents lower at $2.416. September dropped 3.2 cents to $2.401.

Heat Boosts Appalachia

Hefty, double-digit increases were seen across the country, but forward prices in Appalachia posted some of the largest gains as much of the expected heat in the next couple of weeks is concentrated in the Northeast.