NGI All News Access | Infrastructure | Markets

NatGas Futures Market Shrugs Off Bearish Storage Miss; Analysts Cite Holiday Impacts

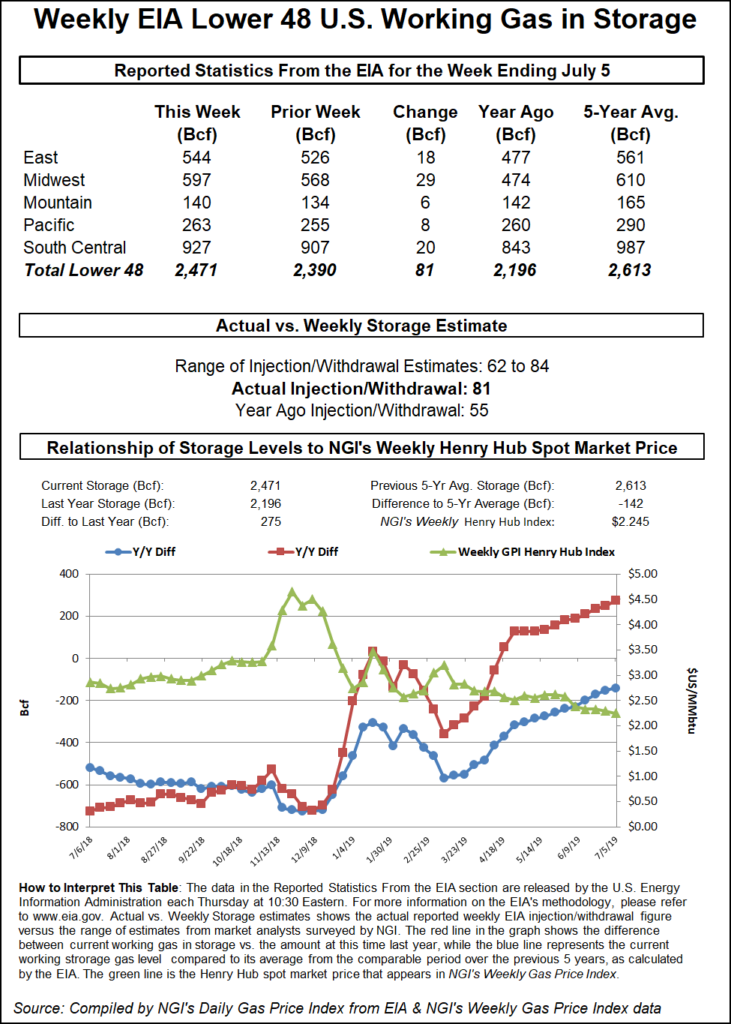

The Energy Information Administration (EIA) on Thursday reported an 81 Bcf weekly injection into U.S. natural gas stocks that was on the higher side of estimates, but the futures market took the news in stride.

The 81 Bcf figure, covering the period ended July 5, came in higher than both the 55 Bcf injection EIA recorded for the year-ago period and the five-year average 71 Bcf.

In the lead-up to the report, the August Nymex futures contract had been trading around $2.464-2.472. As the 81 Bcf print crossed trading screens at 10:30 a.m. ET, the front month went as low as $2.447 before rallying to as high as $2.487 over the next few minutes.

By 11 a.m. ET, August was trading at $2.470, up 2.6 cents from Wednesday’s settle and roughly in line with the pre-report trade.

Prior to Thursday’s report, estimates had been pointing to a near-average build in the mid-70s Bcf. A Bloomberg survey showed a median prediction for a 76 Bcf injection, while a Reuters survey called for a 73 Bcf build. Intercontinental Exchange EIA Financial Weekly Index futures settled Wednesday at 80 Bcf. NGI’s model predicted a 70 Bcf injection.

During a chat on energy-focused social media platform Enelyst, ION Energy analyst Kyle Cooper pointed to the impact of the July Fourth holiday to help explain the bearish miss in this week’s print.

“Holidays have been big demand killers recently,” Cooper said.

In a note to clients, Bespoke Weather Services said the 81 Bcf build is looser balance-wise compared to last week’s.

But “it is difficult to read too much into this given notable holiday impact. We expect next week’s number to be tighter, with supply lower week/week and burns stronger. Looking ahead, issues around the coming tropical storm will throw more uncertainty into each of the next two numbers,” Bespoke said.

Total working gas in underground storage stood at 2,471 Bcf as of July 5, 275 Bcf (12.5%) above year-ago levels but 142 Bcf (minus 5.4%) below the five-year average, according to EIA.

By region, the Midwest posted the largest week/week injection at 29 Bcf, followed by the East at 18 Bcf. The Pacific recorded an 8 Bcf build, while 6 Bcf was refilled in the Mountain region. In the South Central, a 21 Bcf injection into nonsalt stocks was partially offset by a 2 Bcf pull from salt for the week, according to EIA.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |