Heat Boosts NatGas Markets as Storm Brews Over GOM

The natural gas futures market spent Wednesday’s session in a bit of a holding pattern as traders tried to read the tea leaves on the potential impacts of both a developing tropical weather system and this week’s round of inventory data.

In the spot market, a hot forecast helped spur widespread gains from coast to coast despite the potential demand-dampening effects of rain along the Gulf Coast; the NGI Spot Gas National Avg. surged 17.0 cents to $2.250/MMBtu.

After testing both sides of even, going as high as $2.489 and as low as $2.416, the August Nymex futures contract settled at $2.444, up 1.9 cents on the day. September gained 1.7 cents to settle at $2.433, while October settled at $2.470, up 1.6 cents.

Prices peaked around lunchtime on the East Coast Wednesday before pulling back, and cooler trends from the mid-day Global Forecast System (GFS) data likely served as a catalyst for the move lower, according to NatGasWeather.

The cooler trends were focused on “this weekend into the start of next week” due to the “heavy rains and cooling” associated with the tropical system brewing in the Gulf of Mexico (GOM), the forecaster said. The afternoon European data, on the other hand, maintained a “considerably hotter” outlook compared to the GFS. “They both show a rather bullish pattern, just with the European model more impressively so.

“It’s likely the GFS is too cool and the European too hot, making” upcoming data Wednesday night and into Thursday “important to see which one gives in more.” Until the models are better aligned, it’s likely to “add uncertainty as to exactly how strongly bullish weather sentiment should be.”

The GOM storm, expected to potentially reach hurricane status later this week, had offshore operators taking steps to evacuate personnel and shut in facilities Wednesday.

The National Hurricane Center (NHC) in a 2 p.m. ET advisory Wednesday said maximum sustained winds were near 30 mph with higher gusts. Strengthening was forecast over the next 72 hours and “the disturbance is forecast to become a tropical depression Thursday morning, a tropical storm Thursday night, and a hurricane on Friday.” The named storm would be Barry.

The disturbance in the early afternoon Wednesday was centered near latitude 28.3 N, longitude 86.7 W, and it was moving toward the west-southwest near 8 mph.

“A motion toward the west-southwest or southwest is expected through Thursday morning, followed by a turn toward the west late Thursday and a turn toward the west-northwest on Friday,” forecasters said. “By early Saturday, a northwest motion is expected. On the forecast track, the system is expected to approach the central U.S. Gulf Coast this weekend.”

NHC forecasters predicted the system would produce total rain accumulations of six-to-12 inches near and inland of the central Gulf Coast through early next week, with isolated maximum rainfall amounts of 18 inches.

Based on data from offshore operator reports submitted as of 11:30 CT Wednesday, around 17.85% of the natural gas production, or 496.2 MMcf/d, in the GOM had been shut-in, according to the Interior Department’s Bureau of Safety and Environmental Enforcement (BSEE). There also was about 31.89% of the current oil production shut-in, which equates to 602,715 b/d.

“Traders are likely to be cautious during the next few trading sessions, waiting for Thursday’s storage report and trying to assess potential demand destruction” from the storm developing over the GOM, according to EBW Analytics Group CEO Andy Weissman. “Next week, though, the August contract could make a serious run” higher toward the mid $2.50s.

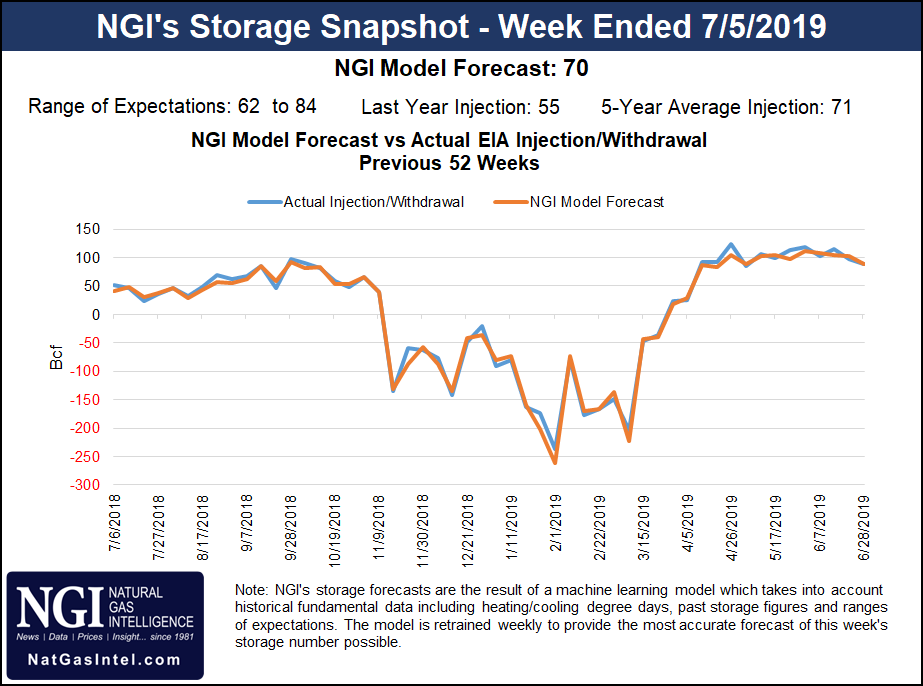

Estimates as of Wednesday pointed to a near-average build from this week’s Energy Information Administration (EIA) storage report, covering the period ended July 5. A Bloomberg survey showed a median prediction of 76 Bcf, with estimates ranging from 62 Bcf to 84 Bcf. A Reuters survey called for a 73 Bcf build, with a range of 62 Bcf to 80 Bcf.

Intercontinental Exchange EIA Financial Weekly Index futures settled Tuesday at 80 Bcf. NGI’s model predicted a 70 Bcf injection.

Last year, EIA recorded a 55 Bcf injection for the period, and the five-year average build is 71 Bcf.

With heat expected to keep national demand strong over the next several days, spot prices rallied throughout the Lower 48 Wednesday, including in the populated Midwest and Northeast markets.

Chicago Citygate surged 16.5 cents to $2.315, while further east, Transco Zone 6 NY added 7.5 cents to $2.380.

“National demand will be elevated the next few days as high pressure dominates much of the U.S. including the Great Lakes and Northeast with highs near 90 degrees,” NatGasWeather said. “Where demand will be strongest is across the southern and central U.S., where highs will reach the 90s, with 100s over the Southwest.

“Of course, the exception will be along the Gulf Coast where heavy rain from a developing tropical storm will cool highs into the upper 80s from the 90s and where cooler trends have occurred” as the storm is expected to “track inland over Texas and Louisiana late this week into early next week.”

Most locations in the Gulf Coast region ratcheted higher by around a dime. In East Texas, Houston Ship Channel gained 13.0 cents to $2.440, while in South Texas, Texas Eastern S. TX gained 12.5 cents to $2.415.

Also factoring into the latest demand picture, a heat wave over Mexico’s northern states has helped drive U.S. exports south of the border to a three-week high, according to Genscape Inc.

The firm’s estimate for cross-border flows Wednesday came in at 5.46 Bcf/d, the highest since mid-June, “when the total export number was goosed by a temporary surge of flow to support testing and packing of the new Sur de Texas pipeline.” Genscape attributes the more recent rise in exports to Mexico to “near-record” demand in the northern Mexican states of Baja California, Coahuila, Nuevo Leon and Tamaulipas.

“South Texas exports are at 4 Bcf/d with daytime highs around the major market center of the city of Monterrey near 110 degrees, about 20 degrees above normal,” Genscape senior natural gas analyst Rick Margolin said. “Enterprise Texas has called a force majeure stating deliveries to NET Mexico could be affected. However, Genscape-monitored flows on NET show no signs of disruption, with deliveries to Mexico’s Ramones system continuing to run more than 2 Bcf/d.

“Exports from California have bounced back to the 0.4 Bcf/d mark for the first time in two weeks. Daytime highs around Mexicali are in the mid-110s, running a few degrees above normal. This is driving power burns in Baja California toward summer-to-date highs.”

U.S. exports to Mexico could pull back over the next few days but should still remain at elevated levels, according to the firm.

“Temperatures in northeastern Mexico may cool slightly from ripple effects” of Barry, “though forecasts for Monterrey show substantially higher-than-normal temperatures expected well into next week,” Margolin said.

Prices also rallied strongly in California and the Rockies Wednesday as the National Weather Service called for “increasingly hot temperatures” over the western United States in the days ahead.

“On Thursday and Friday, high temperatures in the 90s will be commonplace, with temperatures exceeding 110 degrees expected in portions of the Desert Southwest,” the forecaster said.

SoCal Citygate jumped 38.5 cents to $2.520, while Kern River added 39.5 cents to $2.180.

Prices also rallied further upstream in West Texas, where Waha tacked on 28.0 cents to average 67.5 cents.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |