NGI All News Access | E&P | M&A

Rice Brothers Take Control of EQT in Stunning Victory as Shareholders Elect Nominees

With an overwhelming majority of shareholders backing their plans to remake EQT Corp., the next step for Toby and Derek Rice is execution, financial analysts said Wednesday.

In an extraordinary victory seen as a sign of the pressure facing natural gas companies to perform in a low-commodity price environment, the brothers won their nine-month battle to take control of the largest natural gas producer in the country.

Seven of their board candidates and another five incumbents they supported were elected on Wednesday with more than 80% of the vote, according to the certified results. Less than two years after the brothers sold their company, Rice Energy Inc., to EQT for $8 billion, Toby was named CEO.

“To us, it seems like it’s definitely going to be positively received, depending on the execution,” Tudor, Pickering, Holt & Co. analyst Sameer Panjwani told NGI of the market’s reaction. “Now the ball is in Toby and Derek’s court to start executing on all the things that they talked about because that’s what’s going to determine how the market reacts and how the equity reacts.”

The brothers, who own about 3% of the stock, argued late last year that EQT was underperforming and among the highest-cost exploration and production (E&P) companies in the basin. But after management rejected their proposals, the Rices pitched a plan to investors to sap more value from the company. Chief among those plans was a target to cut costs by 25% and generate $500 million of free cash flow (FCF) annually at a time when industry investors are insistent on capital discipline and better returns.

CFRA Equity Research analyst Stewart Glickman said it’s likely that Toby will aim to “slash costs to the bone.” Production growth is likely to be a byproduct, rather than a goal of the new management team’s approach.

“Given how poor natural gas pricing is lately, the way you’re going to get to FCF is not presumably going to be coming from production, it’s going to be coming from cutting costs,” Glickman told NGI. “I think that’s the point of leverage they’re going to work, focusing on their best acreage, maybe experimenting with completion designs that former EQT management wasn’t trying and chopping non-important costs.”

Noncore acreage could be sold, Glickman added, but he said it’s more likely that the new management team will shift the company’s attention strictly to core acreage. Appalachian pure-play EQT has one million net Marcellus Shale acres, including 680,000 that are currently considered core, in addition to sizeable Utica and Upper Devonian shale positions

Analysts said they expect to see updated production and capital expenditures guidance from the new management team in the next six months for 2020 and possibly for the next three- to five-year period.

“If you’re talking about how production and capex is going to change from a near-term standpoint, 2019 is probably too far along to have any material change to that program,” Panjwani said. “But the 2020 program is really what we’re looking for in terms of a meaningfully different outlook that could have higher FCF and potentially lower growth relative to what the previous guidance was because of how the commodity price environment has changed over the course of the year.”

In response to the Rices’ challenge, EQT management under CEO Robert McNally, who will step down when Toby is appointed, had aimed to cut capital costs over the next five years. The old guard expected to shave $25 million off this year’s $1.85-1.95 billion budget. The company had also identified $175 million in annual cost savings to date and was forecasting adjusted FCF of more than $3 billion through 2023.

EQT beat its guidance in 1Q2019 and improved drilling days, increased hydraulic fracture stages and pushed laterals longer. The efficiency gains found it increasing full-year guidance by 10 Bcfe to 1.480-1.520 Tcfe. McNally said earlier this year in an interview with NGI that EQT’s production would likely grow at a single-digit pace in the coming years.

The Rice brothers had pointed to their track record at Rice Energy, which grew exponentially in the years after it went public in 2014, offering a point-by-point rebuttal of EQT’s 2019 operating plan earlier this year.

Toby, Rice Energy’s former CEO and COO, along with Derek, who served as executive vice president of exploration, said if they won the proxy fight, 15 former Rice Energy leaders would be installed as executives at EQT. As part of the transformation, the new board on Wednesday created an “evolution committee,” to be chaired by Toby and include Derek and brother Daniel J. Rice IV, who is already on the board and was serving as CEO of Rice Energy when EQT acquired it. The evolution committee is “dedicated to executing a smooth but expeditious transition to reconstruct the company’s organization, technology and operations,” EQT said.

John McCartney, a former Rice Energy board member, was also elected as chairman. William E. Jordan was named general counsel, replacing Jonathan Lushko, who is no longer with the company.

The “shalennials,” as they’ve dubbed themselves, also said a new vision is needed for the 130 year-old company, arguing that a technological transformation driven by applications developed at their former company would drive part of that change. They’ve also said EQT has to be more effective at planning by improving rig mobilizations, scheduling and drilling performance to help ease the midstream constraints that have dogged the company and cost it cash flow.

Toby said Wednesday that the “magnitude of support we have received is a very strong mandate for our plan to transform EQT into a technology-enabled, sustainable energy producer.”

There remains a level of uncertainty as well for exactly how the latest transition is expected to unfold, said business law professor Jill E. Fisch of the University of Pennsylvania.

“Their proxy contest was based on presenting a plan of proposed changes to the shareholders,” she told NGI. “The shareholders obviously thought there was some reason to believe that things would change or they wouldn’t have voted for them.”

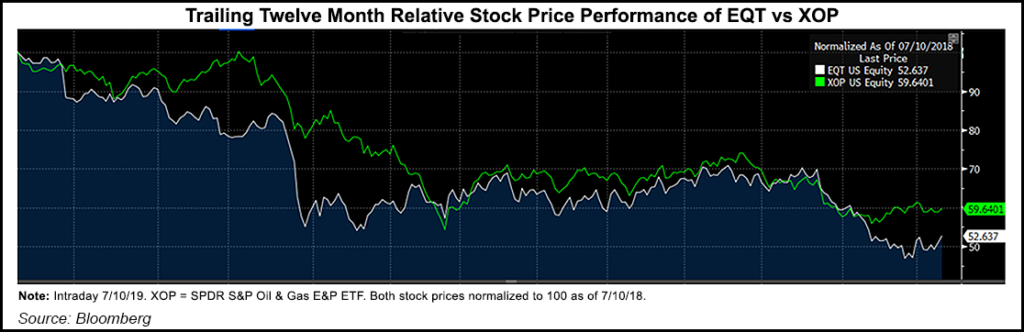

EQT’s stock price plummeted more than 30% last year at a time when it was forced to cut guidance and increase spending after a rough stretch following the Rice merger. A series of management shake-ups has continued to change the face of the company. A number of top executives left the company last year.

Toby becomes EQT’s third CEO in less than two years. Steven Schlotterbeck, who orchestrated the Rice Energy takeover, left the company in March 2018 over a dispute with the board about his compensation.

Between 2016 and the time McNally took over last November, the company had acquired nearly 500,000 acres in deals with Rice Energy, Trans Energy Inc., Stone Energy Corp. and Equinor ASA, among others. McNally argued that EQT had already been remade following previous management changes and said the brothers, both of whom are in their 30s, lack the experience necessary to run such a large company.

One thing is clear, the Rices are likely to take a very different tack with EQT given how much the market has shifted since they sold their company.

“The Rice brothers in many ways stopped running their company before the new focus on capital discipline really took hold on Wall Street,” said NGI’s Patrick Rau, director of strategy and research. “As such, it’s probably a bit of a stretch to assume the Rices will run EQT in the same fast growth manner as they did when they were at the helm of Rice. The investor landscape is very different now.”

Fisch noted that winning a proxy battle certainly isn’t unprecedented in other sectors. But industry analysts said that while the Rices victory was somewhat expected given the momentum they’ve gained in recent weeks, it did come as a surprise.

What’s more, the brothers led a resistive group of investors in taking control of the company. By the time the shareholder meeting came, they had won the support of the company’s largest stockholder, T. Rowe Price Group Inc., as well as the backing of D.E. Shaw & Co., Kensico Capital Management Corp. and Elliott Management Corp. The proxy advisory firms Egan-Jones Ratings Co. and Institutional Shareholder Services also supported their plans.

“It’s pretty rare, I can’t recall the last time I’ve seen a major transition like this at a major U.S. E&P,” Glickman said. “I think it’s partly a reflection of EQT’s underperformance, and probably a reflection of how much pressure gas companies have come under in general.”

EQT shares were up by nearly 2% on Wednesday, closing at $15.94 on the New York Stock Exchange.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |