NGI All News Access | LNG | Markets

Australia Preparing for Possible Domestic Natural Gas Shortage

With more of its bountiful natural gas destined for Asia-Pacific markets, leaving less for domestic use, Australia Pacific LNG (APLNG) last week agreed to provide 16.2 petajoules (PJ) of natural gas to the country’s manufacturing market.

Explosives manufacturer Orica Ltd. agreed to take 10.2 PJ over four years starting in 2021, while packaging manufacturer Orora would take up to 6 PJ of gas over three years at an option beginning in 2023).

“We’re delighted to be getting more gas to domestic customers and as a result, supporting manufacturing jobs in Australia,” CEO Warwick King said.

The Queensland Resources Council called the announcement another sign of the benefits that flow from a successful gas industry that has regulatory stability.

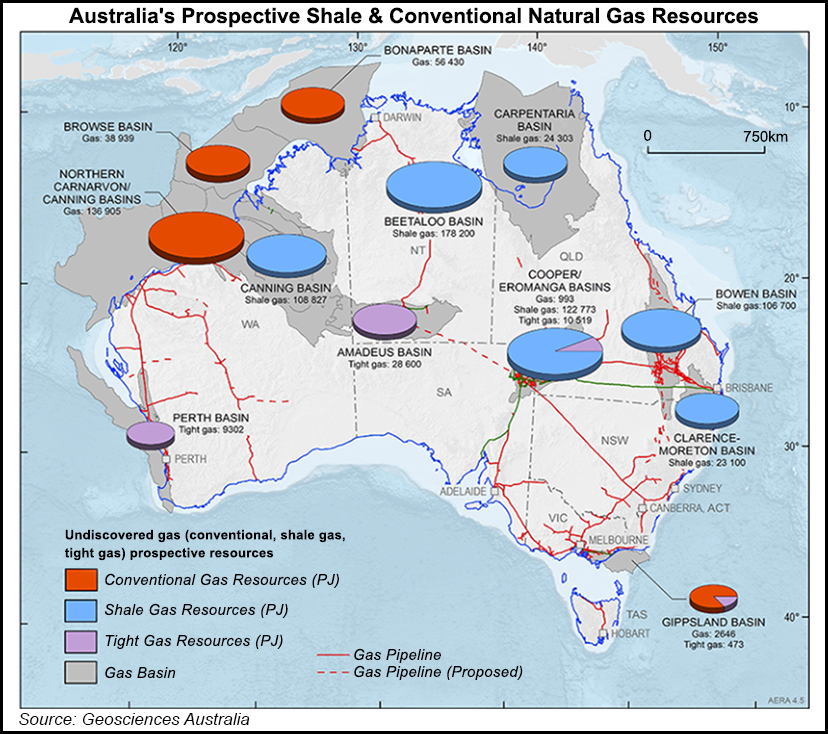

“The Queensland gas industry is leading the nation with a proactive approach to easing the east coast gas squeeze,” it said. “Queensland’s neighbors must take a leaf out of our book, instead of relying on our state to meet the gap caused by their failure to develop their own gas industries. Gas exploration has stalled in New South Wales and Victoria, despite the fact all jurisdictions have their own reserves in the ground.”

Last month, APLNG and joint venture (JV) partner Armour Energy were awarded a tender by the Queensland government to develop gas supplies for the domestic industry. The project partners said at the time that developing the tender block would help it sign gas supply agreements to deliver more than 50 PJ of gas to a number of Australian manufacturers, including Incitec Pivot.

“The proximity of the block to our existing infrastructure will allow us to bring the gas to the east coast market efficiently and on competitive terms,” APLNG said.

The Australian state of Queensland covers the country’s northeast, with a coastline stretching nearly 4,350 miles (7,000 kilometers). It is also home to three large-scale LNG projects: APLNG, the Santos-led Gladstone LNG project and Queensland Curtis LNG operated by Royal Dutch Shell plc.

APLNG is the largest gas producer in eastern Australia and a major LNG exporter, mainly to customers in the Asia-Pacific region, which accounts for around two-thirds of global LNG demand. The 9 million metric ton/year (mmty) project is on Curtis Island near Gladstone, along Australia’s eastern coast.

Project partners include Sydney-based Origin Energy (37.5%), the project’s operator, as well as Houston-based ConocoPhillips (37.5%) and Chinese state-owned oil and gas major Sinopec (25%). The project began production from its first train in December 2015, while its second train started production in October 2016. The project is also Australia’s largest producer of coal seam gas.

Last year APLNG provided around 30% of gas supply to the east coast market and has been a net contributor to the domestic market every year since it was formed.

Australia’s is still grappling with a possible gas shortage because of its LNG export success. In April the Energy Users Association of Australia (EUAA) said rising commodity prices could force many manufacturers out of business, as gas costs for domestic users had risen by as much as 300% since Australia began exporting LNG from east coast terminals.

EUAA called on the government to take action, noting that the Australian Energy Market Operator (AEMO) already had warned that the east coast faced a gas supply shortfall as soon as 2024.

Two years ago, the Turnbull administration pulled back from threats to curb LNG exports after three major producers agreed to put more supply into the domestic market to ease potential shortages. Overseas customers at the time were basically getting first dibs on Australia gas and charged less than domestic customers.

Australia, with a liquefaction capacity of 80 mmty, recently bypassed Qatar (77 mmty of liquefaction capacity) to become the global LNG leader.

The AEMO said in its annual gas outlook in March the country’s gas outlook was more dire than in June 2018, when it forecasted no shortage before 2030. Since then companies have cut reserve and production estimates.

Meanwhile, Canberra is already trying to address the problem. Last year, the government put in place the Australian Domestic Gas Security Mechanism to help ensure there is a sufficient domestic supply.

If LNG projects’ use of domestic gas results in a supply shortfall in a domestic market, those projects may be required to limit their exports or find new gas sources.

As many as five LNG import projects in New South Wales, Victoria and South Australia are reportedly on the drawing board. Sydney-based AGL Energy said in late June it expected to start delivering gas from its proposed import jetty in Victoria in 2022, around a year later than previously scheduled, because of a prolonged environmental review.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |