NGI Mexico GPI | Markets | NGI All News Access

Slightly Bearish EIA Build No Sweat for Natural Gas Futures Traders Eyeing Summer Heat

After ending the previous few sessions in the red, natural gas futures rebounded Wednesday, with hotter forecaster trends helping the market to shrug off a somewhat bearish inventory report.

Meanwhile, as people throughout the United States were getting ready to light up their sparklers, a hot forecast heading into the Fourth of July holiday failed to spark any noteworthy spot price gains; the NGI Spot Gas National Avg. stumbled 3.5 cents to fall to $1.840/MMBtu.

The August Nymex futures contract rallied 5.0 cents to settle at $2.290 Wednesday, near the top of the day’s range from $2.296 down to $2.237. September settled at $2.263, up 4.6 cents on the day, while October added 4.3 cents to settle at $2.292.

NatGasWeather attributed the buying to hotter trends in the overnight European model heading into Wednesday’s trading. Meanwhile, the midday Global Forecast System (GFS) trended slightly cooler between days eight and 15 of the updated outlook.

“What will be most important going forward is if cooler air over southern Canada will be able to advance far enough into the northern U.S. July 15-20 and where hot high pressure over the southern U.S. will try to block it,” NatGasWeather said. “The winner of this battle will likely determine if weather patterns are viewed as hot enough or not, with the current risk being to the hotter side.”

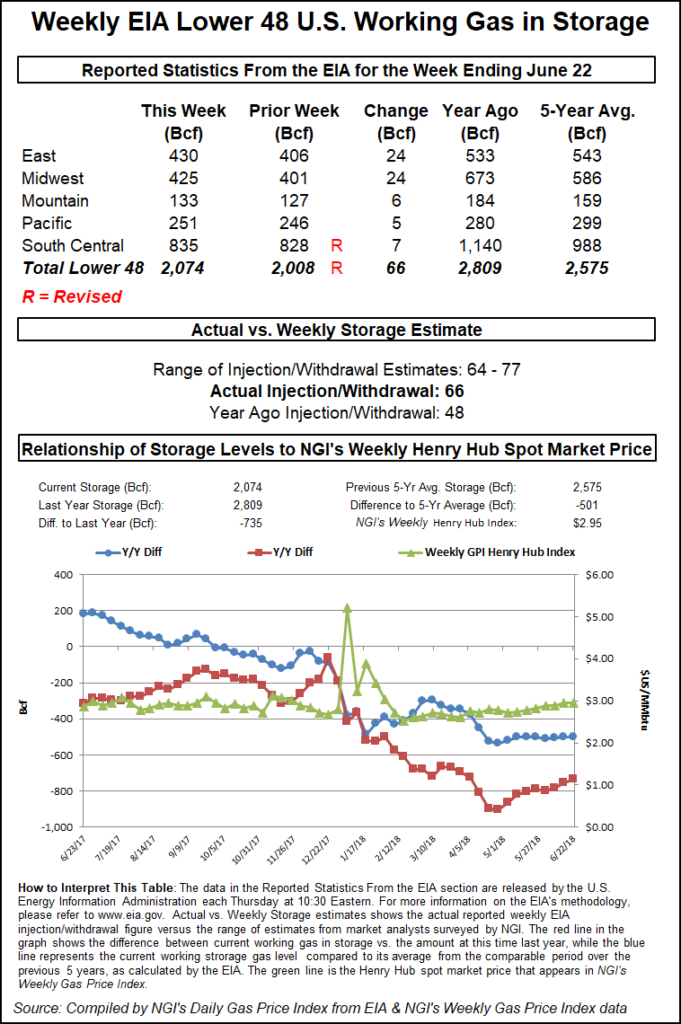

The futures market mostly took the latest Energy Information Administration (EIA) storage report in stride Wednesday, with prices able to absorb the impact of an 89 Bcf weekly injection into U.S. natural gas stocks that came in slightly above consensus.

The 89 Bcf injection, covering the week ended June 28, comes in higher than both the 76 Bcf injection EIA recorded for the year-ago period and the five-year average 70 Bcf.

The August Nymex futures contract had been trading higher Wednesday morning, up to around $2.276/MMBtu in the lead-up to EIA’s report, which was moved up to 12 p.m. ET because of the July Fourth holiday. In the minutes after the 89 Bcf figure crossed trading screens, the front month traded as low as $2.249 before recovering to around $2.255.

By 12:30 p.m. ET, August was back up to $2.274, in line with the pre-report trade and up 3.4 cents from Tuesday’s settlement.

Prior to Wednesday’s report, major surveys had pointed to a build in the mid-80s Bcf, with expectations ranging from 76 Bcf to as high as 103 Bcf. Intercontinental Exchange EIA Financial Weekly Index futures settled Tuesday at 85 Bcf, while NGI’s model predicted a build of 88 Bcf.

Bespoke Weather Services viewed the latest EIA report as “fairly neutral.”

“Balance-wise, it is a little looser than the balances from last week’s reported 98 Bcf build,” Bespoke said. “We expected to see this slight loosening based on the data last week. This week’s data is mixed, with stronger burns plus higher supply. We also have to consider potential holiday impact as well, so confidence will be lower on next week’s number.”

Total Lower 48 working gas in underground storage stood at 2,390 Bcf as of June 28, 249 Bcf (11.6%) higher than year-ago stocks and 152 Bcf (minus 6.0%) below the five-year average, according to EIA.

By region, the Midwest posted the largest weekly build at 30 Bcf, followed by the East, which refilled 27 Bcf. The Mountain region posted a 7 Bcf injection week/week, while the Pacific injected 10 Bcf. In the South Central, 14 Bcf was injected overall for the week, with an 18 Bcf injection into nonsalt offsetting a 4 Bcf pull from salt stocks, according to EIA.

Analysts with Raymond James & Associates Inc. said the 89 Bcf build implied the market was 0.9 Bcf/d looser than last year on a weather-adjusted basis. The market averaged 1.0 Bcf/d looser over the last four weeks, according to the firm.

Both production and demand continue to grow, with July potentially on track to set a monthly record for gas burn as liquefied natural gas (LNG) and Mexico-bound exports increase, Genscape Inc. analyst Eric Fell said during a discussion hosted by energy-focused chat platform Enelyst.

“There is potential for upside” in LNG feed gas demand near-term “as Corpus Christi Train 2 and Cameron Train 1 are still in the commissioning process and not yet up to full volumes,” Fell said. “Also, Genscape’s proprietary monitors have indicated that Freeport has recently started to show signs of life and could begin pulling feed gas soon to begin the final stages of testing/commissioning.”

This comes as European gas prices have reached historical lows, dropping below the cost of U.S. LNG delivered to the continent, according to Rystad Energy. Prices “have plummeted thanks to a rising gas export war between Russia and the U.S., much to the delight of European consumers,” the firm said in a recent research note. “European natural gas prices are at a historical low and below the cost of shipping gas from the U.S. to Europe.

“In May, prices remained just above this floor, fetching around $4.20/MMBtu. But this floor seems to be crumbling, if not collapsing, now that the Dutch front month gas price (TTF) has hit a fresh low of $3.20/MMBtu — the lowest price since the TTF began trading on the Dutch market in 2010,” according to Rystad.

With hot temperatures for key markets in the Midwest and East expected to moderate by the start of the upcoming work week, traders showed little interest in bidding up prices for delivery over the long holiday weekend

Even for the Southeast and Mid-Atlantic, expected to be hot and humid through the long weekend, price points posted discounts Wednesday. Transco Zone 5 dropped 6.5 cents to $2.250.

NatGasWeather was calling for “strong national demand” to continue into Saturday, with highs in the Southeast and Mid-Atlantic expected to climb into the 90s and feel even hotter thanks to high humidity.

“Demand will remain strong across Texas and the South the next several weeks as highs consistently reach the mid-90s,” the forecaster said. Heading into the Fourth of July holiday conditions were “very warm from Chicago to New York City, with highs of upper 80s to near 90 degrees” but with cooling expected by the end of the weekend.

Demand in the EIA’s East region reached 26.2 Bcf/d on Tuesday, the highest level observed so far this summer, driven by temperatures climbing in the region since late June, according to Genscape modeling.

“As expected, most of this bullish demand is driven by gas burns in the Northeast, with demand flatter but still rising in the Southeast and New England,” Genscape analyst Josh Garcia said. “Current forecasts show this heat wave sustaining through Saturday (July 6) before tailing off slightly, but temperatures should still be above 30-year norms” during the week ahead. “Risks for bullish forecast revisions exist as we enter the hottest part of the year.”

Despite the rising temperatures and higher demand, spot prices have remained at relatively low levels throughout the region, and Wednesday’s trading saw notable discounts in the Northeast and Appalachia, dropping a number of points below the $2 mark.

Transco Zone 6 NY tumbled 13.5 cents to $1.975, while further upstream, Texas Eastern M-3, Delivery slid 12.0 cents to $1.945.

Down in Texas, price adjustments were generally small. Katy picked up 5.0 cents to $2.200.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 |