Regulatory | Infrastructure | NGI All News Access

Global Insurance Giant Chubb to Curb Coal Underwriting

Property and casualty Insurance giant Chubb Ltd. has adopted a policy in which it will no longer underwrite new coal-fired construction or operations.

Chubb, headquartered in Switzerland with most of its business in the United States, also plans to stop underwriting for companies that generate more than 30% of their revenues from coal mining or energy production from coal. Current coverage for existing coal plants that exceed the 30% threshold are to be phased out by 2022, and utilities could be phased out beginning in 2022.

“Chubb recognizes the reality of climate change and the substantial impact of human activity on our planet,” CEO Evan G. Greenberg said. “Making the transition to a low carbon economy involves planning and action by policymakers, investors, businesses and citizens alike.”

Chubb’s coal policy comes even as the Trump administration has attempted to encourage more coal production and has issued the Affordable Clean Energy (ACE) rule. The regulations shift oversight to states for regulating carbon dioxide emissions from power plants, which could open a door to more coal-fired generation. The administration’s action rescinded the Obama-era Clean Power Plan.

ACE was first proposed by the Environmental Protection Agency (EPA) last August. EPA said the rule would put in place a “reasonable program focused on potential upgrades to coal plants…[and] leaves the market alone and doesn’t pick winners and losers.”

The new Chubb policy includes that the company plans to not make new debt or equity investments that generate more than 30% of revenues from thermal coal mining or energy production from coal.

Chubb said it would not underwrite new risks for companies — including coal mines, utilities and other companies — that generate more than 30% percent of revenues from thermal coal mining or that generate more than 30% of energy from coal. Chubb plans to phase out coverage of existing risks that exceed this threshold by 2022.

Companies involved in the coal industry may be eligible for exceptions until 2022 if they are in regions that do not have practical near-term alternative energy sources. Chubb said it would have to take into account the insured’s commitments to reduce coal production.

The coal policy is expected to have a minimal impact on Chubb’s premium revenues and no impact on investment performance.

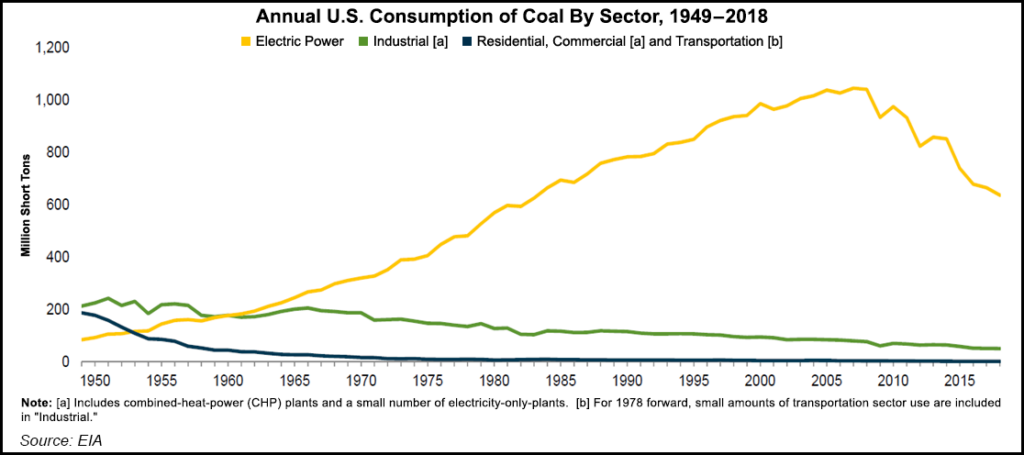

As coal’s role diminishes, environmental groups and an increasingly wary public concerned about the implications of climate change — have trained their sights on oil and gas. NGI’s Clean Energy Series noted that since 2008, coal plant retirements have totaled 81 GW across 696 units at 360 plants in the United States, according to one estimate by BTU Analytics LLC.

According to the Institute for Energy Economics and Financial Analysis, more than 100 globally significant financial institutions have divested from or developed exclusion policies for thermal coal mining and/or coal-fired plants. French insurer Axa in 2015 was the first global insurance company to restrict coal investment and insurance. The number of globally significant insurers that have divested from coal was 20 as of February.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |