NGI The Weekly Gas Market Report

NGI The Weekly Gas Market Report | Forward Look | Markets | NGI All News Access

Cooler July Outlooks Leave Natural Gas Forwards Sharply Lower; Bulls Running Out of Hope

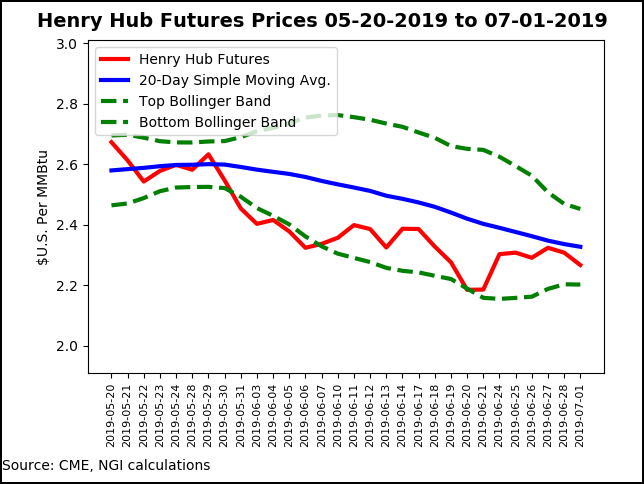

There weren’t enough sparklers and bottle rockets to ignite natural gas forward prices for the June 27-July 2 period as cooler long-range weather forecasts doused any hopes for an extension of last week’s gains.

Prices fell 10 cents or more at the front of the curve, with August shedding an average 11 cents. Only slightly smaller losses were seen in the winter strip (November 2019-March 2020), and even calendar year strips fell at least a nickel, according to NGI’s Forward Look.

While forecasts for early July heat lifted forward prices last week, cooler changes to long-term outlooks hit the market hard this week as demand is expected to ease as early as this coming weekend.

August Nymex gas futures dropped 8.4 cents from June 27-July 2 to reach $2.24, while September fell 8.1 cents to $2.217. The winter strip was down about 7.5 cents to $2.533.

Weather data overnight Tuesday reverted back a little hotter for the 11- to 15-day period, negating the change shown overnight Monday, according to Bespoke Weather Services.

The firm still sees an upper level trough into the eastern half of the nation by the middle of July, with the best heat in the West. “These features were just weaker in last night’s runs,” Bespoke chief meteorologist Brian Lovern said.

The forecaster expected midday runs to lean back a bit cooler given the change overnight with a pattern that’s not all that different. Meanwhile, near-term heat remains on track, although the strongest heat is expected over the July Fourth holiday period, which could mitigate some of the impact the heat would have, market wise, if it occurred on a typical nonholiday period.

Looking ahead to the coming week, while it is not expected to be as hot nationally, temperatures in Texas should actually be higher, with daytime temperatures in the mid to upper 90s forecast in major Texas cities.

NatGasWeather said Wednesday’s midday and afternoon data would be important to watch, as “any further hotter trends would likely give a more obvious bullish bias to weather patterns.”

Alas, the Global Forecast System midday run trended cooler, shedding 4-5 cooling degree days from its 15-day outlook. This makes the afternoon European model all the more important, especially ahead of a long holiday weekend.

Without any warmer changes, however, market bulls are running on empty, especially after the latest storage data delivered yet another blow.

The Energy Information Administration (EIA) reported an 89 Bcf injection for the week ending June 28. The reported build was well within the broader range of estimates, but several Bcf above consensus.

A Bloomberg survey Tuesday showed a median prediction of 83 Bcf based on seven estimates. A Reuters poll pointed to an 85 Bcf injection, with a range of 76 Bcf to 94 Bcf. Intercontinental Exchange EIA Financial Weekly Index futures settled Tuesday at 85 Bcf. NGI’s model just missed the mark with a predicted build of 88 Bcf.

The 89 Bcf injection topped both last year’s 76 Bcf build and the five-year average build of 70 Bcf.

Balance wise, the build was a little looser than the balances from the previous week’s (for the week ending June 21) reported 98 Bcf build, according to Bespoke, which had projected an 86 Bcf build. “We expected to see this slight loosening based on the data…” The latest data was “mixed, with stronger burns plus higher supply. We also have to consider potential holiday impact as well, so confidence will be lower on next week’s number.”

Broken down by region, 30 Bcf was added in the Midwest, and 27 Bcf was injected in the East, according to EIA. The Pacific region reported a 10 Bcf injection, while South Central inventories rose by 14 Bcf, including an 18 Bcf injection into nonsalt facilities. Salts withdrew 4 Bcf.

Working gas in storage rose to 2,390 Bcf, which is 249 Bcf above last year and 152 Bcf below the five-year average, according to EIA.

Since the second week of April, injections have averaged 104 Bcf/week, turning a 228 Bcf year/year storage deficit at the end of March to a 244 Bcf year/year storage surplus, “a tectonic 450 Bcf shift,” according to EBW Analytics.

The firm noted, however, that builds may fall sharply to below 50 Bcf/week during July and August at current pricing, reducing bearish overhang. The slower expansion of the year/year surplus could even begin declining in the back half of August, prompting support for natural gas.

Meanwhile, fast-cycling salt operators are poised to withdraw gas during a heat wave to meet demand, potentially resulting in quite a bullish weekly storage report, according to EBW. This was evident in the latest EIA report, in which scorching temperatures across Texas and much of the South led to the 4 Bcf pull from salt inventories.

“One heat wave can cause a low storage number and a significant demand shock that startles the market to realize the low storage trajectory,” EBW said.

Storage and weather aside, Flux Paradox CEO Gabriel Harris, a former Wood Mackenzie analyst, said a key “factor/hope/risk” for seeing natural gas prices return above $2.50 this summer falls on liquefied natural gas (LNG) exports. LNG exports, which were revised a little lower for Tuesday, remained above 6.0 Bcf on Wednesday but failed to mark a new high.

“I don’t think most people in the market realized how inconsistent the exports would be when this was on the horizon a couple of years ago,” Harris said on Enelyst, an energy chat room hosted by The Desk.

IAF Advisors’ Kyle Cooper agreed that some LNG facilities appeared to be having a rough start to operations. The Freeport project in Texas “just seems to have lots of issues. There’s no telling when stable flows could commence.”

Regardless, LNG exports have only limited near-term upside from 6 Bcf, according to Cooper. With all currently operating trains at Sabine Pass, Corpus Christi and Cameron at maximum capacity, the market could squeeze out “another 0.5 Bcf to 1 Bcf tops.”

Meanwhile, an expected boost to exports to Mexico also remains in limbo amid a dispute between Mexico’s Comision Federal de Electricidad (CFE) and Infraestructura Energética Nova (IEnova), which developed the Sur de Texas-Tuxpan pipeline in partnership with TC Energy.

IEnova indicated in late June that it had received an arbitration request from the CFE over issues related to force majeure clauses in the pipeline’s contract. CFE is seeking to renegotiate the take-or-pay natural gas transport contracts with TC Energy, IEnova and other developers of multiple pipeline projects, saying the contracts are onerous and unfair to the state-controlled company.

Although Sur de Texas-Tuxpan was completed and had begun transporting gas in June, flows abruptly halted following the arbitration request. CFE has to officially file for acceptance of the pipeline in order for flows to resume.

Market observers are keeping a close eye on the developments in the dispute, as Mexico is seen as providing a much-needed outlet for a struggling U.S. gas market.

CFE’s arbitration claim is unlikely to be resolved quickly, according to EBW. “Unless a negotiated settlement is reached, expected demand for natural gas at the U.S.-Mexico border for the rest of 2019 could shrink by more than 100 Bcf compared to previously expected levels, further depressing prices at Waha and other hubs.”

Sur de Texas-Tuxpan is not the only target of CFE’s claims. Mexico President Andrés Manuel López Obrador has asserted that many of the $70 billion-plus of pipeline agreements signed by CFE over the past few years are overpriced, requiring capacity payments that are five to eight times the cost of building the pipelines.

“Arbitration claims relating to these pipelines, many of which have not yet been completed, could seriously affect gas flows into Mexico over the next several years,” EBW said.

The uncertainty over the timing of the expected boost to exports south of the border appears to be already taking a toll on South Texas and Permian Basin prices as declines in the region were far steeper than most other market hubs across the country.

NGPL S. TX prices for August plummeted 24 cents from June 27-July 2 to reach $2.115. In perhaps a sign that the CFE-IENova dispute could be resolved soon, September prices fell only 11 cents to $2.169, while the winter strip fell 9 cents to $2.42, according to Forward Look.

In the West Texas Permian, Waha August tumbled 19 cents to reach an average 51.3 cents, while September fell 17 cents to $1.022. The winter strip was down a dime to $1.75.

However, the stalling in additional exports to Mexico isn’t the only factor weighing down Permian prices. Weak downstream demand in other markets like California also have hit Permian prices in recent weeks. After a sweltering first half of June, temperatures across the state have eased considerably, draining demand.

SoCal Citygate August prices plunged 67 cents from June 27-July 2 to reach $4.092, while September tumbled 56 cents to $3.11, Forward Look data show. The winter strip was down 23 cents to $3.98.

Rockies and Midcontinent market hubs, which often follow in lockstep with markets on the West Coast and in the Permian, instead aligned with Nymex futures for the week. Double-digit declines were seen across the front of the curve, while slightly smaller losses were seen in the winter strip.

On the East Coast, scorching temperatures on tap through the second week of July led to slightly smaller losses in parts of the region. Transco Zone 6 NY August slipped 8 cents from June 27-July 2 to reach $2.068, as did the balance of summer, which landed at $1.95. The winter was down 9 cents to $5.02, Forward Look shows.

Demand in the EIA East region reached a summer-to-date peak of 26.2 Bcf/d on July 2 as the current heatwave engulfed the Northeast, according to Genscape Inc. Temperatures in the East have been steadily rising since the last week of June.

“As expected, most of this bullish demand is driven by gas burns in the Northeast, with demand flatter but still rising in the Southeast and New England,” Genscape senior natural gas analyst Rick Margolin said.

Current forecasts show the steamy conditions sustaining through Saturday (July 6) before tailing off slightly, “but temperatures should still be above 30-year norms next week.” In addition, risks for bullish forecast revisions exist as the United States enters the hottest part of the year.

On the pipeline front, Texas Eastern Transmission (Tetco) on Wednesday began a series of maintenance events that will reduce capacity on some of their most important lines. Per a late notice announced Tuesday, Tetco plans to conduct investigations on Line 10 between its Athens and Berne compressors, reducing operational capacity on its 30-inch diameter line from Berne, OH, to Barton, AL, for Wednesday’s gas day.

From Sunday (July 7) until July 23, Tetco is scheduled to conduct an outage at its Marietta, PA, compressor station, reducing station capacity to 1.38 Bcf/d for the duration of the outage. The pipeline also plans to reduce capacity from Bedford, PA, to Marietta on Monday and Wednesday (July 8 and 10) for cleaner and inline inspection tool runs.

“None of these events will constrain immediate flows, but the Marietta event could provide some upside risk to Tetco M2/M3 spreads due to its duration as temperatures and demand rise in the East,” Genscape analyst Josh Garcia said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9915 | ISSN © 2577-9877 | ISSN © 1532-1266 |