Regulatory | NGI All News Access | NGI The Weekly Gas Market Report

CFE’s Bartlett Says Allowing Marine Pipeline To Operate Would Legitimize ‘Unfair’ Contract

Mexican State Power utility Comisión Federal de Electricidad (CFE) will not allow the start of commercial gas flows on the Sur de Texas-Tuxpan undersea natural gas pipeline until the transport contract that anchored its construction is renegotiated, CFE General Director Manuel Bartlett Díaz indicated Tuesday.

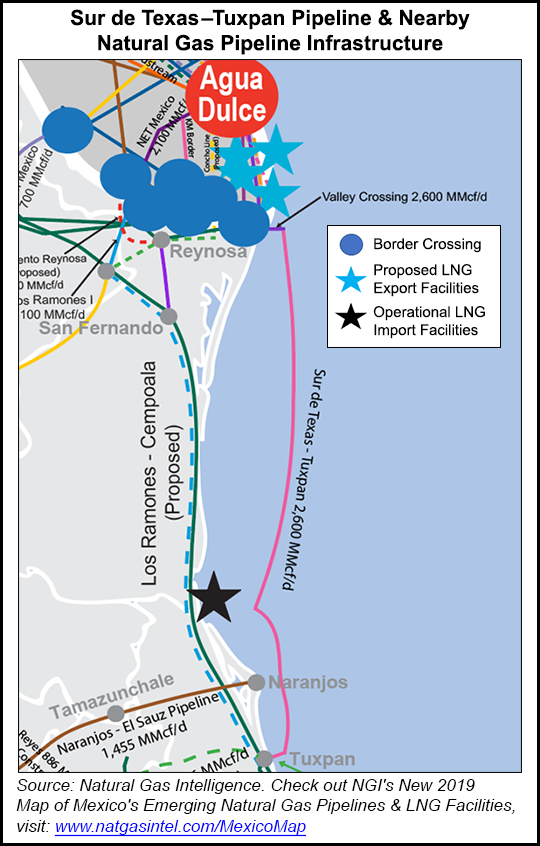

Infraestructura Energética Nova (IEnova), which co-developed the 2.6 Bcf/d pipeline with TC Energy Corp., said last week that although construction of the pipe was complete, CFE, the project’s anchor customer, was refusing to sign off on a start date for gas to begin flowing. IEnova said it had been informed by CFE that the state-owned firm was seeking to nullify certain clauses of the contract, and that it planned to pursue arbitration proceedings to reach a solution.

IEnova contended that the request to begin arbitration would “in no way impede” CFE from allowing gas to flow on the pipe, which stretches 480 miles from Brownsville, Texas, to Tuxpan, Veracruz state, in southeastern Mexico.

Bartlett told reporters during a Tuesday press conference, however, that if CFE gives the go-ahead for a commercial start date, “everything that happened in the pre-operative period would be legitimized.”

CFE is seeking to modify the 25-year contract’s terms, along with those of similar contracts for six other pipelines that CFE says are “unfair.”

The seven pipelines in question comprise Sur de Texas-Tuxpan, Tuxpan-Tula, Tula-Villa de Reyes, La Laguna-Aguascalientes, Villa de Reyes-Aguascalientes-Guadalajara, Guaymas-El Oro, and Samalayuca Sásabe.

The projects have faced repeated delays for reasons including lawsuits, sabotage, unfavorable weather, the discovery of archeological ruins, and a still-pending indigenous consultation by energy ministry Sener.

These events triggered the contracts’ force majeure clauses, forcing CFE to begin making fixed capacity payments to the developers for pipelines that were not in service.

CFE on Monday informed Mexico’s stock market that it had filed seven claims for the pipeline contracts: six in the London Court of International Arbitration, and one with the International Chamber of Commerce (ICC) International Court of Arbitration in Paris.

CFE is seeking damages of $899 million for the marine pipeline alone.

The head of Mexico’s Confederation of National Commerce, Services and Tourism (Concanaco Servytur) on Friday called for a rapid resolution to the conflict so that the marine pipeline can enter service, citing an urgent need for gas on the Yucatán Peninsula, in order to avoid further blackouts and curb the need for the region’s industrial consumers to purchase costlier fuel oil for their operations.

This sentiment was echoed by industrial chamber Concamin.

Bartlett dismissed these concerns on Tuesday, saying that the contract dispute has “nothing to do” with industrial gas consumers, and that the gas that will flow on the marine pipeline “does not belong” to private industry, but rather to CFE.

Miguel Reyes, director of CFE’s fuel marketing arm CFEnergía, said that CFE, national oil company Petróleos Mexicanos (Pemex) and national pipeline grid operator Cenagas are working on a “consolidated purchase” of natural gas, including liquefied natural gas (LNG), to supply the peninsula, whose only source of fuel currently is the Energía Mayakan pipeline.

The Mayakan pipeline, in turn, can only receive the molecule from Pemex fields in southeastern Mexico, where output has been in steady decline since 2009. Although a planned interconnection of the Mayakan pipe with the Sistrangas national pipeline grid was announced last year, the timeline of this project remains unclear.

If Pemex purchased gas at other points in Mexico, it could send more of its output to Mayakan and the Peninsula, as Talanza Energy Consulting’s David Rosales explained recently to NGI.

Bartlett said Tuesday that the CFE had already begun preliminary talks with Fermaca on Monday, and that the remaining developers in question all of the pipeline developers in question — IEnova, TC Energy, and Grupo Carso – had all agreed to begin talks to renegotiate the contracts over the next week.

Bartlett also said Tuesday that IEnova had filed an arbitration claim against CFE first, which IEnova promptly denied the same day.

“Since February 13, 2019, the date on which we held the first meeting with the director general of the CFE, IEnova has been awaiting the call to continue the dialogue,” IEnova said, adding, “The company did not begin any arbitration process against the CFE after the meeting after the meeting…”

Grupo Carso, which is owned by billionaire Carlos Slim, said last week said it too had received a request for arbitration from CFE for the 472 MMcf/d Samalayuca Sásabe pipeline under construction in Chihuahua and Sonora states. Carso said it was “evaluating the legal foundation” of the request.

CFE is seeking to nullify all of the contracts’ force majeure clauses, and to be reimbursed for the capacity payments it had already made to the developers.

IEnova also owns the Sonora pipeline system, the last section of which, Guaymas-El Oro, has been out of operation since August 2017, amid a dispute with a faction of the local Yaqui tribe.

CFE said Monday that Bartlett had met with executives from Mexico-based Fermaca, which is developing the Wahalajara pipeline system, and that the parties agreed to begin renegotiating on July 12 the contracts for the system’s final two sections, which have faced delays. Wahalajara is meant to transport gas from the Waha hub in West Texas to the industrial hub of Guadalajara, Mexico.

The final two sections of the pipeline, La Laguna-Aguascalientes and Villa de Reyes-Aguascalientes-Guadalajara, are scheduled to enter operation in July and November, respectively, according to a June 18 update published by energy ministry Sener.

TC Energy is awaiting the conclusion of the Sener indigenous consultation and the conclusion of an “archeological rescue” in order to continue work on Tuxpan-Tula and Tula-Villa de Reyes, respectively.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 | ISSN © 1532-1266 |