‘Fairly Neutral’ EIA Injection Keeps Natural Gas Futures Steady

The Energy Information Administration (EIA) on Wednesday reported an 89 Bcf weekly injection into U.S. natural gas stocks, slightly higher than consensus, and the futures market mostly took the news in stride.

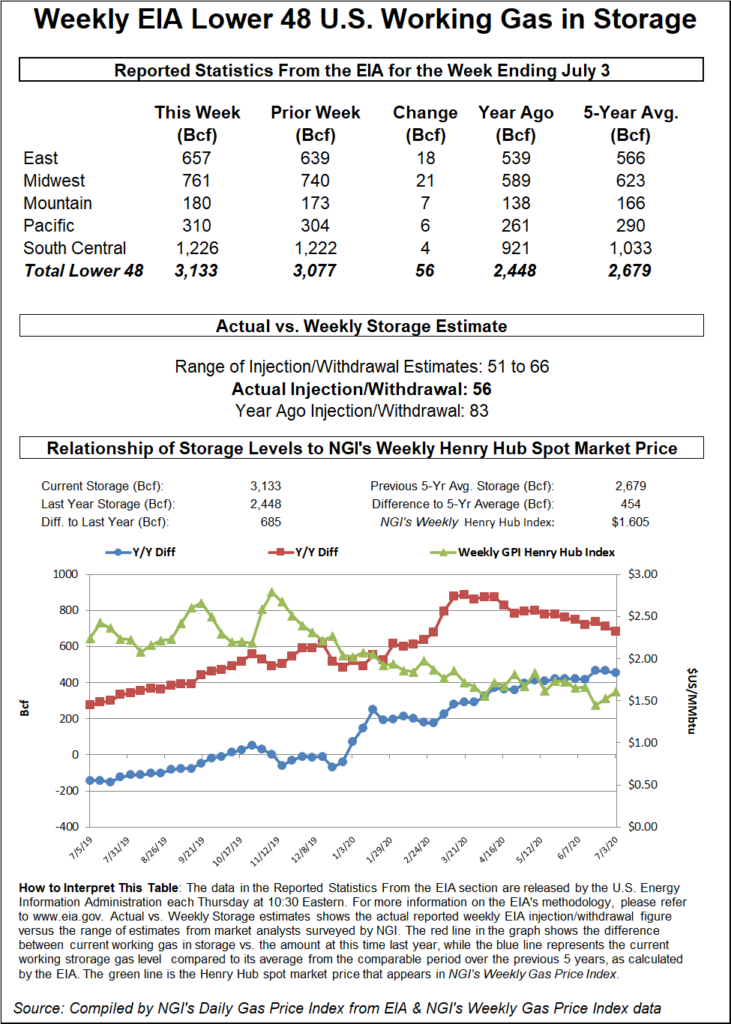

The 89 Bcf injection, covering the week ended June 28, comes in higher than both the 76 Bcf injection EIA recorded for the year-ago period and the five-year average 70 Bcf.

The August Nymex futures contract had been trading higher Wednesday morning, up to around $2.276/MMBtu in the lead-up to EIA’s report, which was moved up to 12 p.m. ET because of the July Fourth holiday. In the minutes after the 89 Bcf figure crossed trading screens, the front month traded as low as $2.249 before recovering to around $2.255.

By 12:30 p.m. ET, August was back up to $2.274, in line with the pre-report trade and up 3.4 cents from Tuesday’s settlement.

Prior to Wednesday’s report, major surveys had pointed to a build in the mid-80s Bcf, with expectations ranging from 76 Bcf to as high as 103 Bcf. Intercontinental Exchange EIA Financial Weekly Index futures settled Tuesday at 85 Bcf, while NGI’s model predicted a build of 88 Bcf.

Bespoke Weather Services viewed this week’s EIA report as “fairly neutral.”

“Balance-wise, it is a little looser than the balances from last week’s reported 98 Bcf build,” Bespoke said. “We expected to see this slight loosening based on the data last week. This week’s data is mixed, with stronger burns plus higher supply. We also have to consider potential holiday impact as well, so confidence will be lower on next week’s number.”

Both production and demand continue to grow, with July potentially on track to set a monthly record for gas burn as liquefied natural gas (LNG) and Mexico-bound exports increase, Genscape Inc. analyst Eric Fell said during a discussion hosted by energy-focused chat platform Enelyst.

“There is potential for upside” in LNG feed gas demand near-term “as Corpus Christi Train 2 and Cameron Train 1 are still in the commissioning process and not yet up to full volumes,” Fell said. “Also, Genscape’s proprietary monitors have indicated that Freeport has recently started to show signs of life and could begin pulling feed gas soon to begin the final stages of testing/commissioning.”

Total Lower 48 working gas in underground storage stood at 2,390 Bcf as of June 28, 249 Bcf (11.6%) higher than year-ago stocks and 152 Bcf (minus 6.0%) below the five-year average, according to EIA.

By region, the Midwest posted the largest weekly build at 30 Bcf, followed by the East, which refilled 27 Bcf. The Mountain region posted a 7 Bcf injection week/week, while the Pacific injected 10 Bcf. In the South Central, 14 Bcf was injected overall for the week, with an 18 Bcf injection into nonsalt offsetting a 4 Bcf pull from salt stocks, according to EIA.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |