NGI Mexico GPI | E&P | NGI All News Access

Mexico Upstream Showing Results as Shallow Water Projects Advance

The last week has seen a flurry of developments in Mexico’s upstream oil and gas sector, particularly in the shallow water segment of the Gulf of Mexico.

Items of note include the start of production on Tuesday (July 2) at Eni SpA’s Area 1 offshore project; Talos Energy Inc.’s conclusion of the shallow water appraisal campaign at Zama, Mexico’s largest oil discovery in recent memory; and the approval of a four-well development campaign at the Uchbal project by national oil company Petróleos Mexicanos (Pemex).

Both Area 1 and Zama are the direct result of bid rounds held under the framework of Mexico’s 2013-2014 energy reform. Although President Andrés Manuel López Obrador has banned subsequent rounds for the foreseeable future, the already awarded contracts are on the verge of adding sizable production and reserves to Mexico’s upstream portfolio, as detailed below.

Italy-based Eni SpA has become the first international oil company to begin offshore production in Mexico since the reform. Early phase production is underway at the Miztón shallow water field, part of the major’s 100% operated Area 1, the company said Tuesday.

The early production phase “now is expected to produce up to 15,000 boe/d of oil,” Eni said, adding that Area 1 is expected to reach a hydrocarbon production plateau of 100,000 boe/d after a floating production, storage and offloading facility (FPSO) is installed in 2021.

Officials from upstream hydrocarbons regulator Comisión Nacional de Hidrocarburos (CNH) had said early phase production would be limited to 8,000 b/d oil and 5.7 MMcf/d gas because of limited capacity at the San Ramón treatment plant onshore, which receives output from Eni’s onshore receiving facility in Tabasco state.

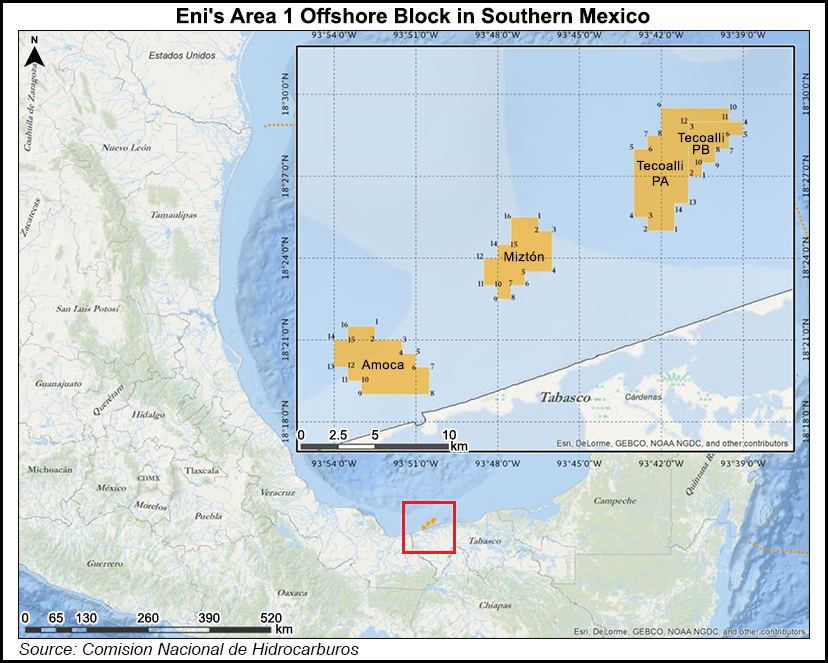

CNH said that full field production was expected to reach 90,000 b/d oil and 75 MMcf/d gas. CNH in late June approved a modified development plan submitted by Eni for the project in the Cuencas del Sureste Basin. Area 1 was awarded to Eni through CNH’s Round 1.2 tender in 2015, and contains the Amoca, Miztón, and Tecoalli fields.

“We have achieved production startup in less than two and a half years after Eni started its first well in Area 1 and in less than one year from the approval of the plan of development,” said CEO Claudio Descalzi. This is in line with the expectations of the Mexican government to increase the country’s overall production.”

Modifications to the original development plan, which CNH approved in 2018, include the onshore installation of two gas compressors with capacity of 7.5 MMcf/d each, because of a lack of sufficient capacity at Pemex’s San Ramón compressor station.

Area 1 is estimated to hold 2.1 billion boe in place, with a 90% oil cut.

Talos Energy said in late June it expects the updated contingent recoverable resources of the Zama shallow water discovery “will fall in the upper half” of the previously provided 400-800 million boe range.

The improved outlook follows the completion of the Zama appraisal program at offshore Block 7 by Talos and joint venture partners Premier Oil plc and Sierra Oil & Gas. Sierra is owned by Wintershall Dea GmbH. The appraisal drilling program comprised the Zama-2, Zama-2 ST1, and Zama-3 penetrations.

“Based on the preliminary results of our appraisal program, we have confirmed the combination of outstanding subsurface properties, significant recoverable volumes and attractive economic potential that have already made Zama a globally-recognized asset,” said Talos CEO Timothy Duncan.

The Block 7 consortium “is simultaneously advancing both its front-end engineering and design (FEED) work streams as well as unitization discussions with Pemex, with the aim of making a final investment decision (FID) on the project in 2020, pending required government approvals,” Talos said.

The consortium of Talos, Premier, and Sierra won exploration and production rights at Block 7 through Mexico’s Round 1.1 tender in 2015, the inaugural bid round conducted under the country’s 2013-2014 constitutional energy reform.

At the June 28 session, CNH approved exploration plans for two shallow water blocks operated by Premier Oil plc in the offshore portion of the Burgos Basin that were awarded through the Round 3.1 tender in 2018.

The plans call for $20.6 million of combined investment, with the majority of the funds going toward geological studies and the reprocessing of seismic data, CNH said. The information obtained would allow Premier to draw up an exploration drilling campaign that would begin in 2021, and require an additional approval from CNH.

Of all the hydrocarbon basins in Mexico, Burgos is the most prolific producer of non-associated natural gas. The plans approved on Friday pertain to contracts CNH-R03-L01-AS-B-57/2018 and CNH-R03-L01-AS-B-60/2018.

Friday’s session also saw the approval of a modified development plan submitted by Pemex Exploración y Producción (PEP) for the Uchbal shallow water field requiring investment of $266.5 million. PEP is the upstream unit of Pemex.

The field in the Cuencas del Sureste basin contains proved and probable reserves totaling 15.8 million bbl and 7.27 Bcf, respectively. The development plan entails the drilling of four horizontal wells.

Of the 20 projects for which Pemex is accelerating development to reverse declining oil production, Uchbal is seventh to obtain approval. The other six are Ixachi, Cahua, Cheek, Esah, Chocol, and Xikin. Total oil production from these seven fields is expected to peak at around 199,000 b/d by 2022, CNH said.

At the same session, CNH also gave the green light to PEP to drill the Pachil-1 onshore exploration well in Tabasco state, which targets super-light, 40-42 degree API crude.

Meanwhile, CNH in late June also approved a $97 million shallow water exploration plan submitted by a subsidiary of BP plc. The plan pertains to the contract CNH-R03-L01-G-CS-03, which was awarded to a BP-led consortium in the Round 3.1 tender conducted in 2018.

The objective of the plan is to continue the evaluation of the area’s oil and gas potential and define the location for the drilling of an exploration well, BP’s partners are Total SA and Hokchi Energy, which is a subsidiary of the BP-controlled venture Pan American Energy Group.

The consortium has not yet identified a prospect to drill, since it still needs to reprocess seismic data and create a seismic map. However, the exploration plan includes the drilling of a “conceptual” well to a depth of at least 3,500 meters (11,483 feet). According to the plan, the well would be spudded in the fourth quarter of 2022.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 |