NGI The Weekly Gas Market Report | E&P | LNG | NGI All News Access

Latest Malaysia Offshore Natural Gas Discovery May Hold 2 Tcf

Thailand’s state-owned oil and gas exploration unit has discovered an estimated 2 Tcf offshore Malaysia, adding to the bounty discovered in the nation in recent years.

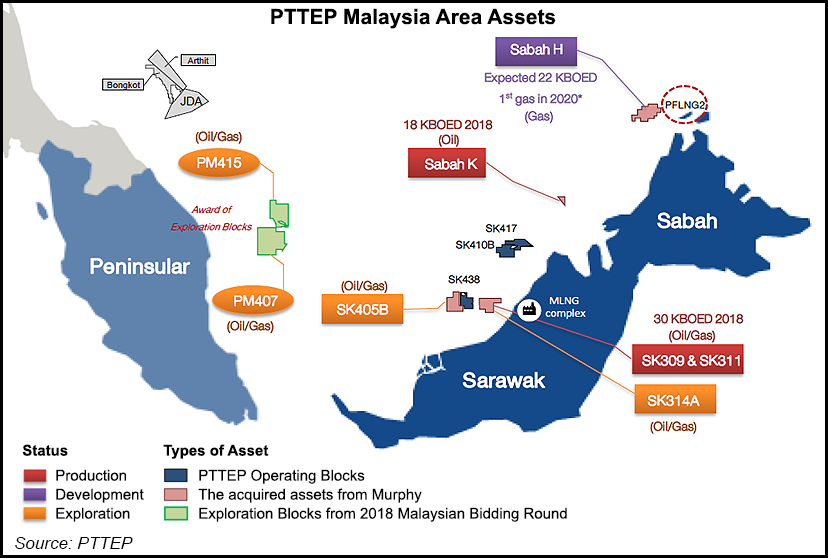

PTT Exploration and Production Public Co., aka PTTEP, a subsidiary of Thailand’s state-owned PTT, said the find was made by PTTEP HK Offshore Ltd. at Lang Lebah-1RDR2. It was the first exploration well in the Sarawak SK410B Project offshore Sarawak state on Borneo Island.

PTTEP operates the project, with a 42.5% share, in partnership with Kuwait Foreign Petroleum Exploration Co. (KUFPEC) (42.5%), and Carigali Sdn (15%), a subsidiary of Malaysia’s state-owned Petroliam Nasional Berhad, aka Petronas.

“The well encountered 252 meters of net gas pay, indicating multi-trillion cubic feet gas discovery,” PTTEP said, adding that the well flowed at a rate of 41.3 MMcf/d and 246 b/d of condensate.

Wood Mackenzie senior analyst Huong Tra Ho said the discovery is indicative of a 2 Tcf find, which would make it the seventh largest global gas discovery so far this year. “The discovery is located in the gas-rich Sarawak-Luconia-East Natuna Basin, which has enjoyed an exploration success rate of 55% over the past 10 years, above the 37% global average.”

The Lang Lebah discovery has a high chance of commercialization for feeding the Malaysian liquified natural gas (LNG) sector that is in urgent need of new supply as existing sources met only 85% of its requirements in 2018, Wood Mackenzie noted.

PTTEP also is part of the Anadarko Petroleum Corp.-led consortium that recently sanctioned a massive Mozambique LNG project in Offshore Area 1.

Malaysia, currently the world’s third largest LNG exporter behind Australia and Qatar, started importing gas in 2015 from the Santos-led Gladstone LNG (GLNG) project in eastern Australia. GLNG has sales and purchase agreements with Petronas and Korea Gas Corp. for 7.2 million metric tons/year (mmty) in aggregate.

PTTEP CEO Phongsthorn Thavisin said the new find affirmed the company’s “strategy organically growing reserves from exploration activities.” The company plans to revise its five-year investment plan for 2019-2023, budgeting $16.11 billion, excluding two new gas fields, Erawan and Bongkot. In February, PTTEP said it planned to invest about $32.6 billion in the Bongkot and Erawan fields to safeguard production volumes of at least 700 MMcf/d and 800 MMcf/d, respectively. The investment includes the drilling campaign and constructing additional wellhead platforms.

PTTEP recently acquired petroleum blocks in Malaysia from Murphy Oil Corp. for $2.13 billion and agreed to pay up to a $100 million bonus payment contingent on future exploratory drilling results delivered before October 2020. PTTEP also acquired Portugal-based Partex Holding BV for $622 million in June. The two deals together were said to make PTTEP the third largest upstream acquirer in 2019.

PTTEP’s growing global footprint also comes amid depleting natural gas reserves in the Gulf of Thailand, which also prompted the country to develop its LNG sector. Thailand has one operational LNG facility, the Map Ta Phut LNG terminal, Southeast Asia’s first import terminal. PTT has another LNG facility planned, while state-owned EGAT is planning to build a 5 mmty floating storage and regasification unit in the Gulf of Thailand.

Thailand is also balancing its gas use with more renewables. PTT CEO Chansin Treenuchagron said in late June the state-run firm is in no hurry to lock in new LNG supply deals, as it monitors domestic gas output and increases renewables over the next two to three years. He said he expects gas demand growth in Thailand to hold steady at about 1%/year over the next five years.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |