NGI All News Access | E&P | Infrastructure

Four Natural Gas Rigs Exit U.S. Patch; Oil Gains

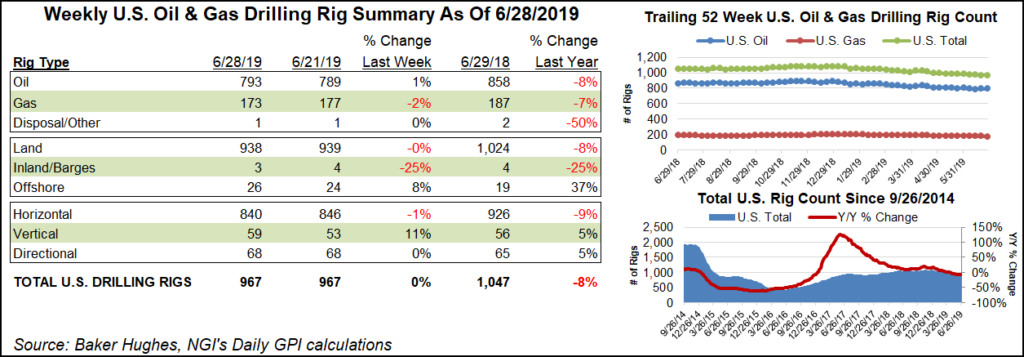

The U.S. natural gas rig count dropped four units to 173 during the week ended June 28, while gains in the oil patch helped keep overall domestic drilling activity steady, according to data released Friday by Baker Hughes, a GE Company (BHGE).

In the United States, an increase of four oil-directed rigs saw the combined domestic drilling count end the week at 967, down 80 units from the 1,047 active rigs a year ago.

One net rig departed on land, along with one in inland waters, while the Gulf of Mexico added two rigs to end the week at 26 — up from 18 a year ago. Total directional rigs were unchanged week/week, while six horizontal units departed and six vertical units joined the patch, according to BHGE.

Canada’s rig count climbed by five units to reach 124 for the week, down from 172 a year ago. Total Canadian oil rigs increased by four, while one gas rig was added. The combined North American rig count finished at 1,091, down from 1,219 in the year-ago period.

Among plays, the Cana Woodford saw the largest week/week gain, picking up four units to end at 49 rigs (74 a year ago). The Permian Basin added two rigs to its tally to finish the week at 441 (474 a year ago).

The Denver Julesburg-Niobrara, Eagle Ford Shale and Granite Wash each dropped two rigs, while the Mississippian Lime and Williston Basin each dropped one.

Among states, Louisiana and Oklahoma each gained two rigs week/week, while Texas and Wyoming each picked up one. Alaska and Colorado each saw two rigs pack up shop, while one each departed from New Mexico and North Dakota.

Following three years of growth, energy sector activity across Texas, parts of New Mexico and Louisiana was flat during the second quarter, and business activity overall has contracted, according to the latest survey by the Federal Reserve Bank of Dallas.

The quarterly survey by the Dallas Fed, as it is known, tabulated results and comments from oil and gas executives headquartered in the Eleventh District, which includes Texas, southern New Mexico and northern Louisiana. The survey, conducted from June 12-20, had 161 respondents, including 101 exploration and production executives and 60 from oilfield services operators.

“Results from this quarter’s survey indicate a further slowdown in the oil and gas sector, with employment and business activity essentially unchanged from last quarter,” said Dallas Fed’s Michael Plante, senior research economist. “Increasing pessimism and a surge of uncertainty suggest a potentially challenging near-term outlook, especially for oilfield service firms.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |