NGI Mexico GPI | Markets | NGI All News Access

Natural Gas Futures Get Boost from EIA Data; Cash Slips Despite Heat

After several weeks of exceptionally bearish data, the latest natural gas storage report renewed optimism for bulls, sending futures prices higher Thursday. The August Nymex contract, in its first day in the prompt-month position, settled 5.6 cents higher at $2.324/MMBtu. September rose 5.4 cents to $2.298.

Spot gas prices, which traded Thursday for delivery through Sunday, were mostly lower but losses were small at the majority of market hubs. Interestingly, prices were lower in the Northeast, where temperatures continued to rise on their way to the upper 80s to lower 90s, if forecasts verify. The NGI Spot Gas National Avg. dropped 4.5 cents to $1.915.

While cash market action remained largely ho-hum, natural gas futures rejuvenated as most weather data continued to trend slightly hotter. The exception was the European data, which had been the hottest but eased off the coming heat to better match the American and Canadian models.

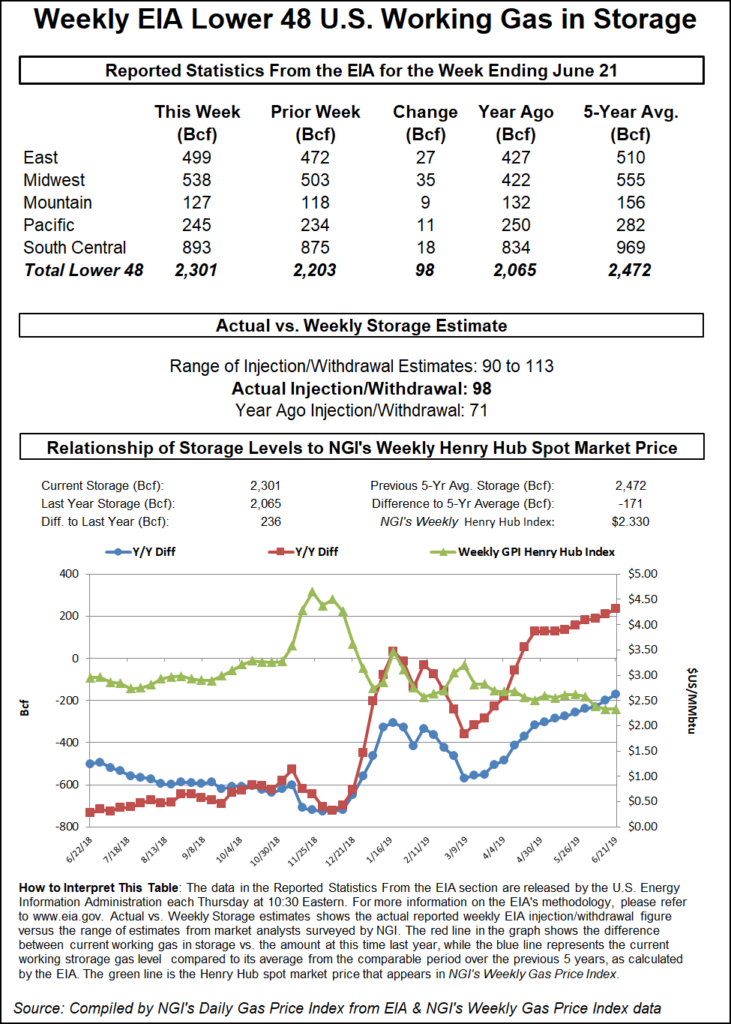

While futures were already a few cents higher early Thursday, price action kicked into high gear after the Energy Information Administration (EIA) delivered the tightest stat of the summer so far. The EIA reported a 98 Bcf injection into storage inventories for the week ending June 21. The build was well within the range of expectations but fell a couple Bcf shy of consensus. However, it was far above both last year’s 71 Bcf injection and the five-year 70 Bcf average.

Nevertheless, traders drove up prices immediately once the report was released. The August Nymex contract was trading about 3 cents higher near $2.30 before the report. As the print hit the screen, the prompt month shot up to $2.327, up about 6 cents from Wednesday’s settle.

“The market does appear to be tightening as June gas production was down slightly, power burn has the potential to come in well above expectations given spot prices, and Mexico and liquefied natural gas (LNG) exports continue to ramp as new projects enter service, all of which could help push injections to more normalized levels as we progress through the summer,” Jefferies Equity Research said.

There were no major surprises in the EIA data. A 35 Bcf injection was reported in the Midwest, and 27 Bcf was added in the East. The Pacific injected 11 Bcf, while stocks in the Mountain region rose by 9 Bcf. The South Central region reported an 18 Bcf injection, including a 1 Bcf withdrawal in salt facilities and an 18 Bcf build into nonsalts.

Working gas in storage as of June 21 was 2,301 Bcf, 236 Bcf above last year and 171 Bcf below the five-year average, according to EIA.

Coming into the refill season, near-record levels of injections (roughly 2.6 Tcf) were needed for storage to reach normal levels of about 3.7 Tcf by the end of summer, according to Jefferies.

“The last 13 weeks have pushed about 1.2 Tcf into storage (versus the five-year average of around 805 Bcf), giving storage a head start in the shoulder months before we enter the summer,” Jefferies analysts said.

The five-year average storage injection is about 2.0 Bcf, though it is impacted by large injections in 2014 and 2015 of 2.65 Bcf and 2.41 Bcf, respectively, according to Jefferies. Over the last three years, injections have averaged just about 1.65 Tcf.

“The last time 2.6 Bcf-plus was injected into storage was the summer of 2014, when gas prices averaged near $4.20/MMBtu,” Jefferies analysts said.

Ahead of the EIA report, Genscape Inc.’s composite composite storage model estimated a 100 Bcf injection. The firm’s estimate is a seasonally-weighted hybrid of its storage model and daily supply/demand model.

On the supply side, Genscape’s supply/demand model showed production for the storage week averaged 88.4 Bcf/d, about 0.2 Bcf/d greater than the prior week. Imports from Canada averaged 4.3 Bcf/d, having dropped about 0.5 Bcf/d week/week with the start of the Alliance Pipeline shutdown.

On the demand side, total demand (including net exports) averaged 79 Bcf/d, about 1 Bcf/d greater than the prior week. The bulk of the increases were from power burns and exports to Mexico and LNG, according to Genscape.

Power burns averaged 32.6 Bcf/d, a 1 Bcf/d week/week increase. Exports to Mexico increased 0.2 Bcf/d to average 5.4 Bcf/d with the startup of linepack deliveries to Mexico’s new Sur de Texas system and testing on systems connecting to West Texas. LNG feed gas increased 0.2 Bcf/d to average 5.5 Bcf/d as Cameron LNG operations throttled up.

Looking ahead, Genscape expects demand to continue growing, with its outlooks indicating that forward supply growth is much slower compared to what the market has seen in the last 12-18 months.

“Big picture, assuming normal weather and current prices (including LNG arbitrage, which is way in money for winter), we have demand up quite a bit more than supply winter on winter,” Genscape senior natural gas analyst Eric Fell said.

Raymond James & Associates Inc. also acknowledged the demand drivers for the long-term gas market, but analysts said the upcoming gas supply surge, particularly from associated gas production, should more than offset robust demand growth.

“Given the high degree of associated gas production generated by some of the largest shale oil plays, U.S. natural gas prices now relate inversely to oil prices, thereby driving gas lower.”

Spot gas prices across the country were mostly lower, although actual declines were fairly small given the heat blanketing much of the country. Daytime temperatures were forecast to reach close to 90 degrees from Chicago to New York City, according to NatGasWeather. It also remained hot over most of Texas, the South and Southeast, as well as the Southwest, where highs were expected to surge into the low 100s.

“It will be of interest where power burns come in over the next week as anything close to 40 Bcf/d will likely suggest tightening in the balance and would be welcomed after three straight months of larger-than-normal builds,” NatGasWeather said.

The firm still expects a weather system to sweep across the Northeast Sunday and Monday, although it has looked less impressive in recent data with only a quick 24-hour shot of minor cooling before warming returns. “Where the data has been hotter is mid- and late next week as upper high pressure has trended stronger across the Southeast and Mid-Atlantic regions, while already hot across the Southwest into Texas and the Plains.”

Despite the current sweltering outlook for the Midwest and Northeast, spot gas prices in those regions ended the day in the red. Chicago Citygate next-day gas fell a penny to $2.085, while other pricing hubs in the Midwest slipped no more than a couple of cents.

At Transco Zone 6 NY, cash fell a more substantial 7.5 cents to $2.105. Spot gas in New England fell a little more day/day.

Also on the negative side of the ledger, Questar in the Rockies dropped 8.5 cents to $1.60, although several market hubs in the region posted gains on Thursday.

In California, PG&E Citygate fell 16.5 cents to $2.305, while Oregon prices rose a few cents on the day.

West Texas prices also continued to decline, although El Paso Permian remained in positive territory even after tumbling 28 cents. Next-day gas averaged 3.5 cents.

Markets across the rest of Texas were among the only to post day/day gains. Houston Ship Channel picked up 4 cents to $2.245, while Texas Eastern S. TX climbed 4 cents to $2.235.

The 2.6 Bcf/d Sur de Texas-Tuxpan marine pipeline, which stretches from South Texas to Veracruz in Mexico, remains idle following anchor customer Comisión Federal de Electricidad’s (CFE) refusal to give the green light to the project.

Tudor, Pickering, Holt & Co. (TPH) said this could mean an immediate loss of 0.7 Bcf/d of natural gas flows into Mexico. “The pipe was in the commissioning phase,” flowing as high as 0.4 Bcf/d this week, “and was expected to be a much needed outlet for an oversupplied U.S. market.”

TPH analysts suggested the dispute could “open up a can or worms” for other projects currently under force majeure in Mexico.

“We are currently modeling 0.7 Bcf/d of incremental Mexican exports by the end of the month, meaning every week this drags on, another 5 Bcf is added to storage vs. our base case assumptions.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 |