Shale Daily | E&P | NGI All News Access | Permian Basin

BP Agrees to Supply and Buy Natural Gas from Canada’s Woodfibre LNG

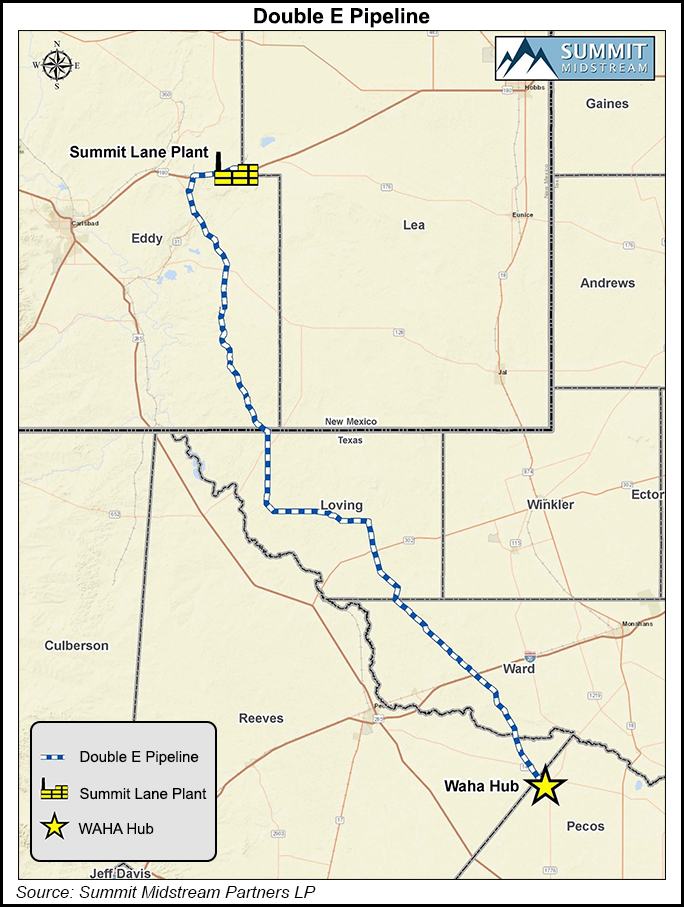

Summit Midstream Partners LP on Thursday sanctioned the Double E Pipeline Project, a 1.35 Bcf/d system designed to move natural gas from the Permian Basin’s Delaware to the Waha hub and beyond.

Summit, headquartered in The Woodlands north of Houston, said the final investment decision (FID) was issued after securing “sufficient” binding commitments for long-term, firm transportation service. Joint venture (JV) agreements also were secured with an affiliate of Double E’s undisclosed foundation shipper.

“We are excited to announce our FID on the Double E Pipeline Project, which will provide critical energy infrastructure for rapidly growing residue natural gas volumes in the northern Delaware Basin,” said CEO Leonard Mallett.

“The Double E Project will serve an infrastructure-constrained area, alleviate natural gas flaring, and provide access to growing markets along the U.S. Gulf Coast.”

Double E “is a marquee project” for the partnership, “and when combined with our existing gathering and processing operations in the Permian Basin, promotes our strategy of achieving scale, diversifying our operations downstream of wellhead gathering and becoming more integrated in our core focus areas.”

Double E joins a list of big gas transport projects that would move supply from an increasingly constrained area, as producers are practically giving gas away. Apache Corp., which works the Alpine High in the Delaware, in late March began deferring about 250 MMcf/d gross volumes because of low prices at Waha; it got some relief earlier this month with the start-up of the first of three cryogenic processing plants at Altus Midstream Co.’s Diamond Cryo Complex.

Waha spot prices on Wednesday, the day before Summit sanctioned Double E, fell 28 cents to average only 21.5 cents, although deals were seen as low as minus 15 cents.

The already sanctioned Gulf Coast Express is set for completion this fall, while Permian Highway Pipeline (PHP), also sanctioned and underway, would provide some relief into 2020, but analysts expect gas take-away capacity from the Permian could become constrained again by 2022.

Last year Summit Permian Transmission LLC held an open season for Double E to test support for service to various receipt points in New Mexico’s Eddy and Lea counties and the West Texas counties of Loving, Ward, Reeves and Pecos. From the Waha in West Texas the system plans to connect with “multiple current and planned takeaway pipelines” to demand centers south, Summit noted. The target in-service date was set at 2Q2021, pending regulatory approvals.

“Commercial discussions with additional potential shippers are ongoing,” Summit officials said, with plans to “look for opportunities to subscribe the limited remaining capacity prior to commissioning.”

The partnership would continue to own a majority of Double E and lead development, permitting and construction. Summit also would operate the system when it ramps up. Its share of capital expenditures (capex) required to develop the project is estimated at around $350 million, with more than 90% of spend incurred in 2020 and 2021.

Although the JV partner for Double E was not disclosed, ExxonMobil Corp.’s XTO Energy Inc. and Summit in 2017 teamed up to develop and operate an associated gas gathering and processing system to serve Permian operators in New Mexico.

XTO has been active in securing oil and gas capacity to move supply from its No. 1 U.S. onshore target. Last year it signed a letter of intent to take up to 450,000 Dth/d of capacity on the Permian Highway Pipeline, which would carry up to 2 Bcf/d to the Texas coast and beyond.

Summit said its share of Double E capex is to be generated by internal cash flow and proceeds from potential asset sales. In addition, given the take-or-pay volume commitments underpinning the project, Summit and its lenders amended the revolving credit facility to provide additional financial flexibility.

Double E expects to file its application with the Federal Energy Regulatory Commission in 3Q2019. An in-service date is estimated for 3Q2021 pending approvals.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |