Shale Daily | Bakken Shale | E&P | NGI All News Access | NGI The Weekly Gas Market Report | Permian Basin

Natural Gas Flaring Bug Hits Oil Hotspots in Bakken, Permian

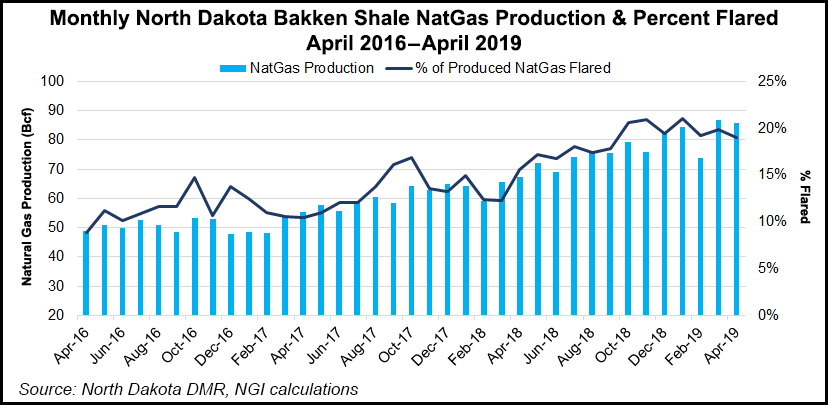

As volumes of flared natural gas continue to grow, collectively topping more than 1 Bcf/d in North Dakota’s Bakken Shale and the New Mexico-Texas Permian Basin, industry leaders are expressing concerns about the need to reverse the tide of wasted gas, and even debating what constitutes “waste.”

Officials at the Permian Basin Petroleum Association (PBPA) confirmed that a more rapid buildout of processing and pipeline infrastructure ultimately will help ease the problem, but operators have been worried about flaring getting out-of-hand. Similar sentiments have long permeated the Bakken play, where North Dakota has set goals for reducing the waste.

“Gas production in our area is something that folks have been concerned about for a good while,” said PBPA Executive Vice President Stephen Robertson, who thinks infrastructure for oil, gas and natural gas liquids (NGL) is “coming along,” but not fast enough.

Flaring and venting volumes in Permian producing areas of West Texas and southeastern New Mexico set an all-time record during 1Q2019, averaging as much as 661 MMcf/d, according to estimates published recently by Rystad Energy. The analysts expect volumes to stay above 650 MMcf/d until the 2 Bcf/d Gulf Coast Express pipeline comes online, which is expected this fall.

The contraction in capacity has led to tough choices for operators that want to continue robust oil production without increasing flaring volumes.

Excess crude oil production can always be trucked to market if pipelines and rail cars are full, but gas requires sufficient pipeline capacity, Robertson said.

“Some of the infrastructure that needs to be put in place involves gathering systems, but the larger problem is the large capacity pipelines that will take the Permian production to Cushing, OK, or the Gulf Coast,” he told NGI’s Shale Daily.

“Much of what needs to get done is dirt moving and actually putting pipes in place, which is something that can only go so quickly.”

Last week, the three-member Railroad Commission of Texas (RRC), whose members have been skeptical of studies that estimate Permian flaring as rising rapidly, held an open meeting for Exco Operating Co. LP, which is in Chapter 11 bankruptcy with parent company, Exco Resources, Inc. The operating arm wanted a permit to flare gas as it attempted to resolve an ongoing dispute over gas transportation rates with a unit of Williams.

As part of the discussion, one of the RRC commissioners asked Exco attorneys whether flaring needed to be regulated. A decision on the flaring permit was postponed. Commissioner Ryan Sitton said it was a case of deciding what to curtail — oil or gas production — and the relative economics of the two.

Noting the regulators have to be more concerned about flaring, Sitton said that whether the gas is burned at the wellhead or in an end-use application like a power plant, the emissions are the same.

“I think there is a lot of confusion about whether flaring has any differential impact on the capturing of a given gas molecule,” Sitton said during the session.

Exco attorney David Nelson, said the operating company needs to be able to flare to avoid shutting in the wells and risking potential damage to the reserves that would constitute waste of some oil.

“There is potential damage to the reservoir that could result in a reduction in the total amount of oil produced from that reservoir, and that is what we consider physical waste,” he said. “More than anything, we are concerned about that happening in this situation.”

Nelson said the risk is widespread whenever wells are shut in.

“It is clear that it can happen in a lot of instances and it constitutes physical waste of reserves.

Everyone agrees that reservoirs can be damaged when wells are shut in for an extended period of time, which presents the conundrum we’re discussing.”

In North Dakota, some of the same debates are ongoing as operators attempt to curtail flaring volumes and still maintain the Bakken’s robust oil production.

North Dakota Pipeline Authority director Justin Kringstad recently said that midstream processing/pipeline capacity should match production in the early 2020s as several projects are under development, but for now the shortfall continues.

“Significant improvements in gas capture are expected as additional gas plants are brought online in the second half of this year and into 2020,” Kringstad said.

In the meantime, Bakken producers and midstream operations are “evaluating their operations daily” seeking any additional efficiencies that would maximize gas capture. “When available, a number of producers are using wellhead gas capture units as a means of increasing capture rates,” Kringstad said.

North Dakota Department of Mineral Resources (DMR) also weighed in. Katie Haarsager, spokesperson for DMR chief Lynn Helms, said “there are currently no additional changes to the state’s gas capture policies being planned [by the state Industrial Commission,” which is headed by the governor. The goals remain the same as we look toward processing capacity to come online” later this year.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |