NGI The Weekly Gas Market Report

NGI The Weekly Gas Market Report | Forward Look | Markets | NGI All News Access

Some NatGas Forward Markets Heat Up as Temperatures, Exports Set to Rise

Driven by increasingly warmer weather outlooks, natural gas forward prices posted nearly 10-cent gains across the front of the curve for the June 20-26 period, according to NGI’s Forward Look.

The gains largely mirrored those seen in the Nymex futures market, where the July contract shot up nearly 12 cents early in the week as weather models began to converge on the intensity and duration of a heat wave that has started to build in recent days. Prices shifted only slightly in both directions the next couple of days as rising production negated any further warmer trends in long-range outlooks.

Thursday morning’s weather data continued to trend slightly hotter, focused around the Fourth of July and into the long holiday weekend as all models further weakened the upper level trough sitting just off the East Coast, according to Bespoke Weather Services. The weakening would allow hotter weather to move into the East during that time frame.

“This increases the odds of more 90s into parts of the East late next week, similar to the next two to three days,” Bespoke chief meteorologist Brian Lovern said. “By July 10, models do strengthen ridging around Alaska into western Canada, typically a cooler signal, but the downstream trough is modeled to stay mostly up in eastern Canada, limiting U.S. cooling impacts.”

Bespoke does not trust models with that level of detail, so the firm still expects heat to back down to normal levels after the early part of July. However, confidence is lower in the medium range, as Madden Julian Oscillation-related forcing, which has been a good signal over the last several weeks, is weaker.

The warmer shifts in the weather models have been a welcome development for market bulls who took one to the gut last week, when prompt-month prices fell to lows not seen in the last three years. Another sign of optimism occurred on Thursday when the Energy Information Administration (EIA) reported the tightest stat of the summer so far.

The EIA reported a 98 Bcf injection into storage inventories for the week ending June 21, snapping a string of 100 Bcf-plus builds that expanded the year/year surplus that reflected much more supply in the market than available data had shown. The reported injection was within the range of expectations, although consensus was a couple of Bcf higher.

The 98 Bcf build compared with last year’s 71 Bcf injection and the five-year 70 Bcf injection average, according to EIA. Nymex futures responded swiftly to the EIA report, gaining a few cents immediately as the print hit the screen.

The 98 Bcf injection was dead on with Bespoke’s projection. Balance wise, the build was the tightest the firm has seen “in a long time” and close to the five-year average balance.

“We will have to see if we can sustain this level of tightness, as we must remember a part of this number was the temporary decline of Canadian imports,” Lovern said. “In-week balances this week do not appear as tight as the ones for the report issued today.”

There were no major surprises in the EIA data. A 35 Bcf injection was reported in the Midwest, and 27 Bcf was added in the East. The Pacific injected 11 Bcf, while stocks in the Mountain region rose by 9 Bcf. The South Central region reported an 18 Bcf injection, including a 1 Bcf withdrawal in salt facilities and an 18 Bcf build into nonsalts.

Working gas in storage as of June 21 was 2,301 Bcf, 236 Bcf above last year and 171 Bcf below the five-year average, according to EIA.

Some market observers on Enelyst, an energy chat room hosted by The Desk, said 100 Bcf-plus storage injections may be in the rearview mirror. However, larger-than-normal builds were likely to continue at a slower pace, especially with warmer weather ahead.

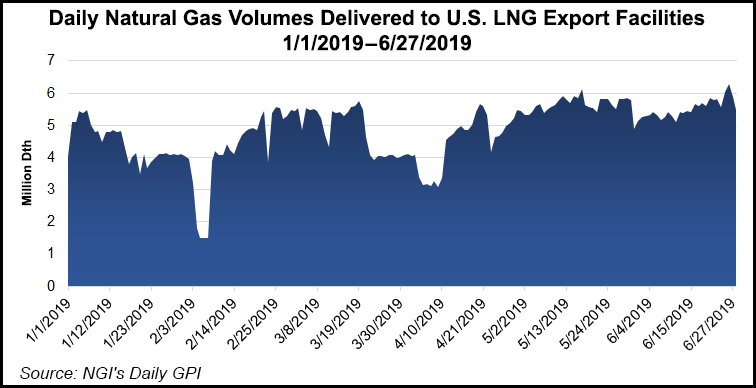

Genscape Inc. senior natural gas analyst Eric Fell said gas prices also pointed to an expected increase in liquefied natural gas (LNG) exports, which should provide some uplift to prices.

“If LNG doesn’t in fact back down soon (the biggest risk to our outlook), gas prices won’t stay sub-$2.30 for too long,” Fell said.

The August Nymex contract, in its first day in the prompt-month position, went on to settle Thursday at $2.324, up 5.6 cents on the day. September rose 5.4 cents to $2.298.

Looking ahead, EBW Analytics said the discrepancies in the long-range weather models may prove supportive for prices as cooler weather could possibly be delayed until late July. “Although emerging warmth for the first half of July is supportive for Nymex futures, a relapse toward bearish 30-year normal temperatures in the latter half of the month sounds a cautionary note for bulls.”

There were few standouts during the June 20-26 period, with the majority of pricing hubs closely following the lead of Nymex futures. July prices averaged 8 cents higher during that time, the balance of summer (July-October) rose 9 cents and the winter (November-March) climbed 8 cents, according to Forward Look.

California pricing hubs, however, moved against the pack as much cooler weather moved into the region, softening demand and dramatically lowering cash prices.

At SoCal Citygate, July prices plunged 54 cents to $3.905, August dropped 28 cents to $4.771 and the balance of summer slid 29 cents to $3.92, Forward Look data show. The winter strip, however, rose 8 cents to $4.18.

Rockies markets typically move in line with California, but this week was different as prices looked to the Nymex for direction. Northwest Sumas July prices rose a nickel from June 20-26 to reach $2.158, August tacked on a penny to hit $2.248, and the balance of summer climbed 5 cents to $2.03. The winter strip was up 7 cents to $3.09.

Some of the gains seen in the summer across the Rockies could also be due to below-average hydro output projected for the remainder of the season. Earlier this month, the National Oceanic and Atmospheric Administration’s Northwest River Forecast Center (NWRFC) released its final Pacific Northwest water supply projection of 2019. The forecast through September, the end of the current water year, showed above-average water supply in the southern half of the Columbia River Basin and below-average supply in the northern half.

The southern half of the Columbia River Basin developed an above-normal snowpack earlier this year following above-normal snowfall in February 2019, according to EIA. Conversely, snowpack in the northern half was near or below normal.

“These differences in regional snowpack are reflected in the regional differences in the water supply forecast for April through September,” EIA said.

As of June 13, the NWRFC projected the Dalles Dam water supply forecast for April through September to be 85.2 million acre-feet, approximately 8% lower than the 30-year normal.

Across the border in Western Canada, prices were strong across the forward curve, but gains were less pronounced for the prompt month, according to Forward Look. NOVA/AECO C July rose a nickel from June 20-26 to reach 52.6 cents, while August jumped 9 cents to 88 cents and the balance of summer climbed 9 cents to 82 cents. The winter strip was up 11 cents to $1.54.

AECO cash basis has been showing some relative strength in recent days and when comparing this month versus last year. The province’s need to refill storage continues in an environment where record production volumes are being matched by record demand, according to Genscape.

Alberta storage inventory sits at about 131.5 Bcf, still more than 57 Bcf below last year’s same-date level and 86 Bcf below the five-year average.

“There has been minimal tightening of the year/year or year/five-year deficits so far this summer,” Genscape senior natural gas analyst Rick Margolin said. “Despite production hitting record highs, strong demand continues to keep pace.”

Production this month to date averaged a record-high for the month of June at 11.3 Bcf/d, according to Genscape. However, demand this month to date is also setting June records, averaging 4.8 Bcf/d.

“The demand growth is primarily driven by structural changes from the province’s oil sands sector and gradual changes of fuel in the power stack,” Margolin said. “As a result, when there have been a few days of above-normal temperatures, some daily prints have come in above the 5 Bcf/d mark, something that has never happened in the month of June in provincial history.”

Meanwhile, exports have come in at about 6.4 Bcf/d so far this month, which is only about 160 MMcf/d off last June’s pace as well as the prior three-years’ average, Genscape data show.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9915 | ISSN © 2577-9877 | ISSN © 1532-1266 |