Utica Shale | E&P | Marcellus | NGI All News Access | NGI The Weekly Gas Market Report

Pennsylvania Impact Fee Collections Surpass $242M

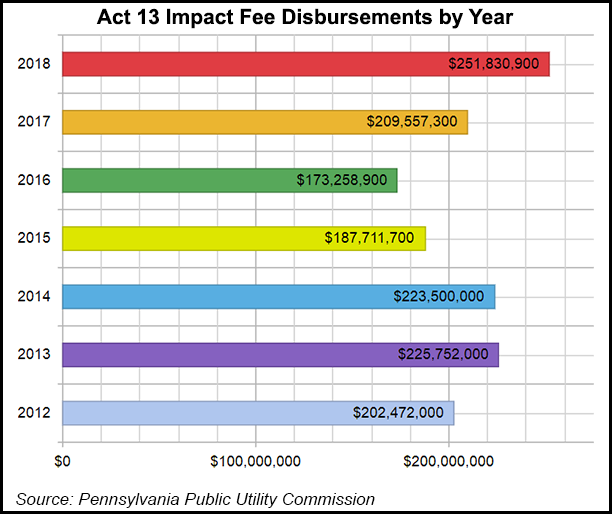

A growing number of wells paying impact fees in Pennsylvania increased the fund to $242.9 million for the 2018 reporting year, about $33.4 million more than in 2017, the state Public Utility Commission (PUC) said on Thursday.

The fee is levied annually on all unconventional wells in the state during their first 15 years of operation, as long as they produce more than 90 Mcf. The fee is not volumetric, but rather one calculated using a multi-year schedule based on the average annual price of natural gas.

The fee schedule, and the amount companies must pay for each well, depend on the number of years the wells have produced. Fees are highest for wells in their first operating year.

Companies are required to self-report annually and pay the fees by April 1 for the prior year.

“Pennsylvania’s natural gas impact tax is working as designed, as revenues — nearing $1.7 billion since 2012 — from this single tax on our industry are boosting investments in local communities across all sixty-seven counties,” said Marcellus Shale Coalition President David Spigelmyer.

“…Local governments rely on impact tax revenues to fund a host of priorities, including enhancing road and bridge infrastructure, flood mitigation and prevention, emergency response planning and equipment, and local parks, playgrounds and trails.

“Additionally, more than $450 million has been invested in statewide environmental infrastructure grants, including water and wastewater treatment systems, brownfield site remediation, flood mitigation and prevention, abandoned well plugging and other capital improvement projects.

The increase is about $4 million less than had been projected by the state’s Independent Fiscal Office (IFO) earlier this year. IFO said the increase would be mostly from the revenue collected from the 779 wells spud last year.

The new wells, IFO said, would help boost collections by $15 million and offset collections from older wells with declining fees. A total of 9,560 wells paid impact fees in 2018, compared with 8,518, according to the PUC.

Another $8.87 million is to be distributed to municipalities and counties where producer payments had been withheld during a long-running court case concerning the definition of stripper well that was resolved by the Pennsylvania Supreme Court six months ago.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |