NGI Data | Markets | NGI All News Access

Natural Gas Bears Win Battle as July Natural Gas Expires Lower; Cash Mixed

Natural gas bulls and bears remained at a stalemate for most of Wednesday, but a hint of cooler weather ahead in the latest weather data was enough to spur some aggressive selling in the last half hour of trading. The July Nymex gas futures contract went on to expire 1.7 cents lower at $2.291, while August contract fell 1.8 cents lower at $2.268.

However, with increasingly warmer weather all but certain for the rest of this week, spot gas prices mostly continued to rise Wednesday outside of the West. Still, day/day changes were small, and the NGI Spot Gas National Avg. rose just one penny to $1.960.

Indeed, as weather outlooks clearly show increasingly warmer weather through at least the middle of next week, forecast signals for July are still mixed, according to EBW Analytics. “While early July weather is coming in reasonably hot, most forecasts still call for temperatures closer to seasonal norms during the remainder of the month.”

Weather data overnight Tuesday had additional hotter changes, this time more strongly in the American ensemble data than in the European ensemble models, according to Bespoke Weather Services. “The changes put the two models closer together in terms of their projection of total demand over the next 15 days.”

The overnight hotter change was seen in both the six- to 10-day and 11- to 15-day period in the eastern half of the United States, including down into parts of the South, according to Bespoke. This places total demand within a few gas-weighted degree days of last year’s levels for the same dates.

“That is still a pace we don’t expect to continue, but the trend toward cooling things back toward normal is slower today,” Bespoke chief meteorologist Brian Lovern said. “We are not seeing extreme heat in any one region, but just broad coverage of above-normal temperatures combined with lack of any notable cool anomalies outside of near the West Coast over the next week or so.”

Indeed, the latest models reflected a strengthening in a ridge near Alaska, which brought cool changes in the Midwest. Warm changes, however, were in the South, where hotter-than-normal conditions were associated with Arctic blocking, according to Radiant Solutions. The period averages above normal with temperatures in the Northwest and parts of the East, while near-normal readings encompass the Mid-Continent.

Radiant continued to favor the European weather data given its higher skill in recent weeks. “While the Global Forecast System solution is cooler in the Mid-Atlantic and warmer in the Plains, it has been biased in this regard.”

On the technical front, the next level of support for prices would be $2.10/2.08, and then $2.00/1.95, if the downtrend continues, according to Societe Generale. The $2.50 level remains a critical level of resistance if prices were to meaningfully rally.

From a market positioning perspective, the Commodities Futures Trading Commission’s most recent data indicated the market is twice as short as it was in mid-April and as short as it has been since July 2018, according to Mobius Risk Group.

“Recall that last summer, the speculative community was net short as a result of year/year looseness, which was undeniable but in complete disregard for the impact weather was having on overall balances,” Mobius said. “This worked until low inventory and bullish weather caused a mass exodus from short positions in 4Q2018.”

This year, however, Energy Information Administration (EIA) storage data continues to paint an increasingly bearish picture on the supply front, as inventories have shifted to a more than 200 Bcf year/year surplus and closed the gap on a more than 700 Bcf deficit to the five-year average. The supply outlook is even more bearish considering that the heat wave expected next week is currently forecast to ease considerably after the first week of July.

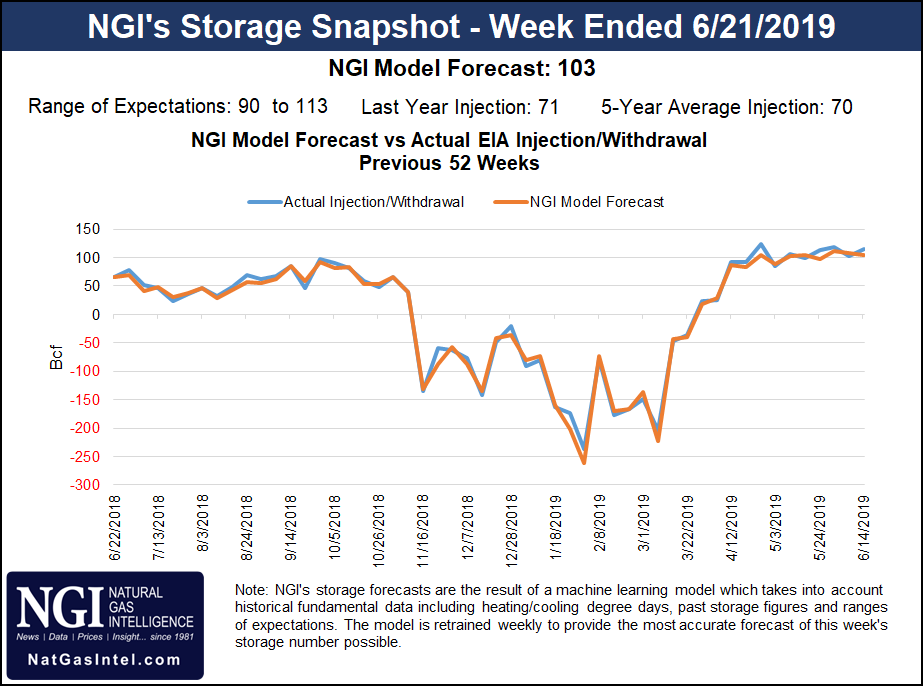

The EIA is set to report its weekly storage inventory report at 10:30 a.m. ET on Thursday. Estimates for the report ranged from a 90 Bcf injection to a 113 Bcf build, according to major surveys. A Bloomberg survey of 12 market participants had a median injection of 100 Bcf, as did a Reuters poll, which had 19 respondents. NGI projected a 103 Bcf build.

Last year, the EIA reported a 71 Bcf injection for the similar week, while the five-year average stands at 70 Bcf.

If the EIA were to report a 100 Bcf-plus injection, it would be the seventh in a row. A sub-100 Bcf build would finally reflect tight supply/demand balances in the market.

Although natural gas prices in the spot gas and futures markets were rather dormant midweek, the crude oil market has experienced quite a bit of volatility in recent days. West Texas Intermediate (WTI) crude rose to a new four-week high on Tuesday after the EIA reported a larger-than-expected withdrawal from stocks, the second draw in as many weeks.

The meaty draw occurred as U.S. demand edged higher, with the four-week average the highest since 2007, according to Kyle Cooper of ION Advisors. “Gasoline and distillate exports both surged, and this contributed to the gasoline and distillate draws. This was a very bullish report overall.”

While the EIA data undoubtedly played a major role in the recent rally, other developments that have occurred over the past week or so could mean the recent surge has some staying power. Prior to last week, the market largely discounted the potential impact of supply disruptions in the Persian Gulf, focusing instead on a long list of bearish market drivers, according to EBW. “Last week’s developments fundamentally changed the picture.”

Two developments were particularly significant, according to EBW. First, the attack on two oil tankers in the Gulf of Oman and President Trump’s threats to launch a retaliatory attack on Iran shattered the market’s complacence regarding the potential for major supply disruptions in the Gulf. Then, immediately on the heels of the assault on the oil tankers, the string of massive crude builds was finally broken.

Other developments were also constructive, and concerns regarding major supply disruptions are likely to persist, according to EBW. This has become evident as Nymex crude held its ground even after President Trump called off potential air strikes against Iran and took a more conciliatory tone, suggesting that the supply disruption premium built into the market last week is not likely to evaporate quickly, and instead is likely to bolster prices on an ongoing basis.

“This is likely to be particularly true over the next 30-60 days, when refinery crude utilization is likely to be at its peak for the year, and a major supply disruption could quickly drive up prices in the physical delivery market to new highs for the year,” EBW said.

Spot gas prices shifted less than a dime in either direction at most pricing hubs across the United States, with most markets increasing a bit as temperatures were set to continue rising, boosting demand.

The only areas of the country that were forecast for below-average temperatures were in the West, where the steep sell-off in cash prices continued. Next-day gas at Malin dropped nearly a dime to average $1.795, while El Paso Bondad slid 14 cents to $1.62.

With such hefty losses in the West, prices in the Permian Basin supply region also took a hit. Waha fell 28 cents to average just 21.5 cents, although deals were seen as low as minus 15 cents.

The negative Permian prices have been a constant reminder of the lack of adequate gas takeaway capacity in the oil-driven basin. And while projects like Kinder Morgan Inc.’s Gulf Coast Express and Permian Highway pipelines will likely provide some relief beginning this year and into 2020, analysts have projected that natural gas take-away capacity from the Permian could become constrained again by 2022.

Elsewhere across the country, Consumers Energy in the Midwest rose 4 cents to $2.14, while ANR SW in the Midcontinent was up 3.5 cents to $1.82.

Henry Hub also climbed 4 cents to $2.315, with similarly small gains seen across Louisiana and the Southeast.

On the pipeline front, Enterprise Products Partners LP’s Pascagoula gas processing plant advised Destin Pipeline that its force majeure was lifted and the processing plant would be able to process offshore gas as of Wednesday morning.

Per Destin’s notice, deliveries to several receipt points have increased. Production at Delta House has been ramping up since June 20, but this recent increase in deliveries has mostly been fueled by increased receipts from Midcontinent Express and Petal Gas Storage, according to Genscape.

“Initial processing capacity will be 650 MMcf/d, rising to 1000 MMcf/d around July 1 after additional work is completed, but nominations at the time of writing don’t yet reflect this,” Genscape analyst Josh Garcia said early Wednesday.

Cash prices across Appalachia and the Northeast ended the day mostly in the black, although like the rest of the country, gains were capped at less than a dime.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |