NGI Mexico GPI | E&P | NGI All News Access

With Output Plunging, Pemex Pinning Hopes on Ixachi Field

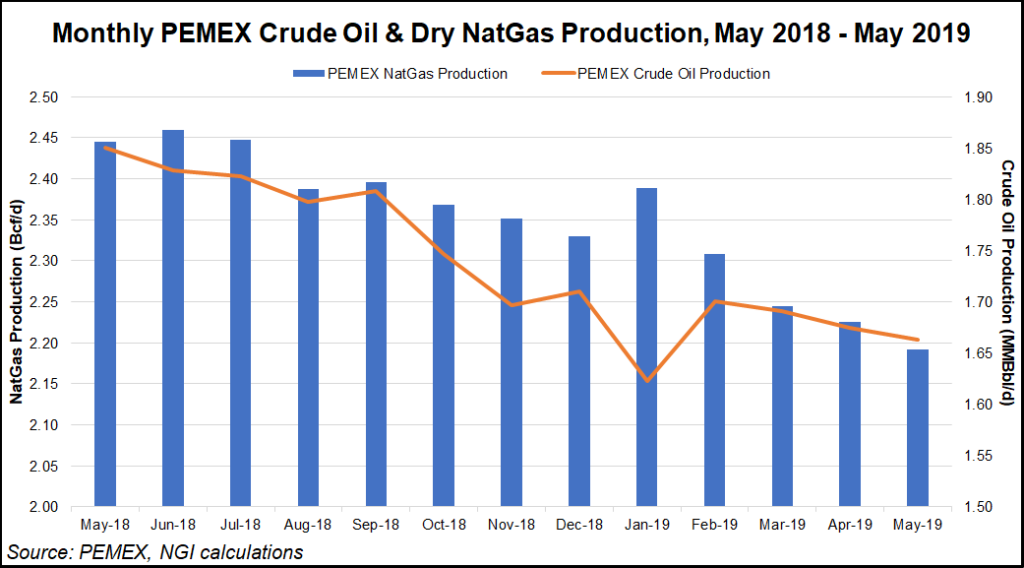

Dry natural gas production from the processing centers of Mexican national oil company Petróleos Mexicanos (Pemex) continued to fall in May, dipping 10.3% year/year to average 2.192 Bcf/d.

Wellhead gas production fell 5.2% to average 3.91 Bcf/d, while crude output dropped 10.1% to 1.66 million b/d. Associated gas production as a byproduct of crude fell 3.3% to 2.74 Bcf/d, while non-associated gas output declined 10.4% to 967 MMcf/d.

CEO Octavio Romero Oropeza said in March the 100% state-owned company’s crude production, which has been in decline since 2004, had finally “stabilized.” However, production has declined on both a sequential and year-over-year basis in each of the last three months.

The disappointing figures follow a downgrade of Pemex bonds to “junk” status by Fitch Ratings, and the lowering by Moody’s Investors Service of its outlook for the state-owned giant to “negative” from “stable.”

Declining gas output by Pemex, combined with insufficient connectivity to the national gas and power transmission networks, also led power grid operator Cenace to declare a state of operative emergency last week for the Yucatan Peninsula, which relies heavily on combined-cycle gas turbines for electricity.

However, not all the recent news has been negative on the gas supply front, with new infrastructure in place to allow for additional imports from the United States.

TC Energy Corp. and Infraestructura Energética Nova (IEnova) this month announced the completion and start of early stage commissioning of the 2.6 Bcf/d Sur de Texas-Tuxpan marine pipeline. The 480-mile pipe receives gas from the Agua Dulce hub in South Texas via Enbridge Inc.’s 2.6 Bcf/d Valley Crossing Pipeline LLC, which entered service in late 2018.

The marine pipeline’s recently activated electronic bulletin board showed that it received injections of 138 MMcf on June 18 and 351 MMcf on June 19.

Beyond imports, the administration is pinning its hopes on the Ixachi field in Veracruz to turn around domestic production.

Last week, upstream regulator Comisión Nacional de Hidrocarburos (CNH) last week approved a $6.404 billion development plan submitted by Pemex for the onshore Ixachi gas and condensate field in Veracruz state.

The plan entails drilling 47 wells, with production expected to peak in 2022 at 638.5 MMcf/d natural gas and 82,500 b/d condensate. Of these 47 wells, 24 are slated to be drilled by 2020, requiring about $800 million of investment, said CNH Commissioner Alma América Porres.

Pemex expects Ixachi to produce 387 million bbl of condensate and 3.15 Tcf of natural gas by the end of the project’s economic life in 2063.

Ixachi is one of 20 fields that Pemex is prioritizing in order to offset the natural decline of mature fields such as Cantarell and Ku-Maloob-Zaap. By accelerating development of the 20 fields, CEO Octavio Romero Oropeza has pledged that Pemex will begin to reverse its declining oil production by year-end.

However, with the year nearly half-over, Ixachi is only the sixth of these fields with an approved development plan. The other five comprise Cahua, Cheek, Esah, Chocolm and Xikin. Combined peak oil production from the six fields is expected to reach 190,000 b/d, according to CNH.

Ixachi is an abnormally high-pressure reservoir at for its depth, according to CNH’s Julio César Trejo Martinez, general director of extraction rulings.

Welligence Energy Analytics’ Pablo Medina, vice president of research, tweeted that he views the Pemex plan to drill 24 wells at Ixachi by 2020 as “impossible,” citing the complexity of such high-pressure, high-temperature wells at a depth of 23,000 feet.

Of Pemex’s 20 high-priority fields, Ixachi is the only gas-rich one, adding to the project’s importance.

President Andrés Manuel López Obrador also has suspended bid rounds for new blocks, a farmout tender for operating stakes in Pemex-controlled blocks, and the migration of several oilfield services contracts at Pemex-operated fields to exploration and extraction contracts.

The bid rounds, farmouts, and migrations all were tools of the previous government’s 2013-2014 energy reform designed to incentivize private-sector investment in exploration and production.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 |