Shale Daily | E&P | NGI All News Access | NGI The Weekly Gas Market Report

Oklahoma Production Still Said Solid Bet, Despite Recent Grumblings

Recent corporate developments among Oklahoma oil and gas producers have called into question the solidity of returns on investment in the state, but producers and some analysts see value persisting in the prolific Anadarko Basin.

“We’ve got good rock here,” said Petroleum Alliance of Oklahoma spokesman Cody Bannister, referring primarily to the SCOOP, aka the South Central Oklahoma Oil Province, and the STACK, or the Sooner Trend of the Anadarko Basin, mostly in Canadian and Kingfisher counties.

Some production and midstream companies reported shifts in their output and shipping guidance for the year in first quarter earnings calls, initiating a buzz over whether the SCOOP and STACK formations had lost their shine.

Oklahoma City-based Devon Energy Corp., one of the largest Lower 48 independents, during the first quarter conference call reported that it would remove one drilling crew in the second half of the year and reduce overall investment in the STACK to stay within its capital expenditure forecast, if necessary.

EnLink Midstream LLC lowered its guidance for 2019 gas gathering and processing volume growth in its first quarter report, which further stoked concerns over production declines. Oneok Inc., on the other hand, reaffirmed its year/year volume growth expectations in the SCOOP and STACK at 2%.

The largest STACK upset this year has come from Alta Mesa Resources Inc., which has consistently missed targets and most recently admitted the U.S. Securities and Exchange Commission (SEC) was investigating the company.

The Oklahoma-focused exploration and production (E&P) company, which also owns midstream assets concentrated in the STACK, had been struggling, announcing across-the-board layoffs and recently disclosing it would write down $3.1 billion of assets because of undisclosed issues in its financial accounting.

Alta Mesa’s issues may be more indicative of managerial problems than broader challenges in Oklahoma’s shale and tight oil and gas plays, according to market intelligence group Alerian.

Alta Mesa’s “missed targets and lowered guidance are largely the result of numerous missteps by management and high spending rather than a significant geological issue in Oklahoma,” Alerian energy research analyst Michael Laitkep said in a recent note to clients. “Fortunately, AMR’s problems do not have much direct read-through for E&Ps and midstream companies in the region.”

To that point, some companies have over-drilled in the SCOOP and STACK, adding too many wells per unit, which could impede returns over the long run, said Continental Resources Inc.’s Rory Sabino, director of investor relations.

“We’ve been consistent in STACK, two zones per unit and three to four wells per zone to get to that six to eight sweet spot well-count per unit,” said Sabino, noting that some companies had drilled up to 15-20 wells per unit.

Drilling that many wells may damage a company’s PV-10, or present value of estimated future oil and gas revenues for proven reserves. In addition, some companies likely overpaid to position themselves in the SCOOP and STACK in 2015 and 2016, Sabino added.

There are also geological variances within the STACK resulting in higher-pressure wells in certain areas and normal- or lower-pressured wells in others. Over-pressured areas are ripe for higher initial output with less intervention, or less cost, and where those areas reside is key to optimal returns, Sabino said.

In an April investor presentation, Continental carved out the high-pressured areas of the STACK, essentially drawing a line near the western borders of Kingfisher and Canadian counties. The over-pressured area lies to the west, and normal-pressured areas lie to the east of that line, according to the company.

Normal-pressure areas still perform well for some, however. Oklahoma pure-play Chaparral Energy Inc. garnered equal if not better returns in the normal-pressured areas, stemming in part from the higher proportion of oil that comes out of those wells.

“We have assets in both [areas], and we’ve been able to produce really strong returns in both areas,” said Chaparral CEO Earl Reynolds.

Other market dynamics have added to the noise around Oklahoma’s future.

The call of the Permian Basin in West Texas and southeastern New Mexico has spurred some producers to reallocate their spending, at times in favor of a more Permian-heavy asset portfolio, Bannister noted, despite solid output potential in Oklahoma.

In addition, a change to Oklahoma’s state oil and gas production tax legislation last year has squeezed profit margins, particularly for smaller independent companies.

A new gross production tax rate on oil and gas production went into effect last July, which raised the rate to 5% from 2% for the first three years of production. After three years, the rate increases to 7% for the remainder of the well’s life, which is unchanged from the previous tax rate.

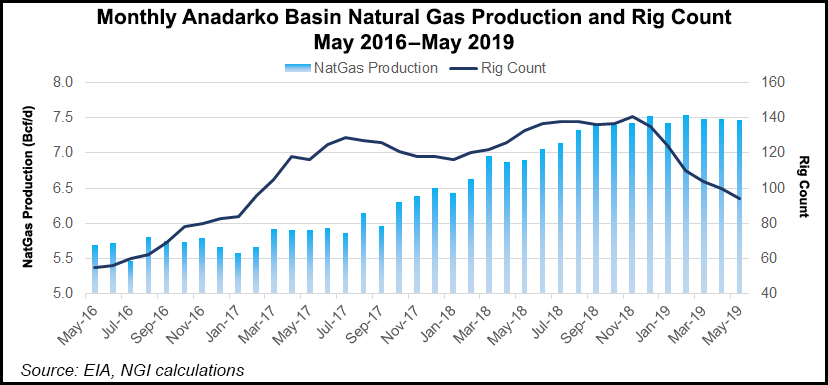

The U.S. Energy Information Administration (EIA) in its most recent Drilling Productivity Report reported Anadarko Basin gas production volumes at 7.5 Bcf/d in May, and the agency is estimating the output will slip in June to 7.44 Bcf/d and in July to 7.39 Bcf/d. May’s production was still well above the year-earlier total of 6.9 Bcf/d.

Some of the production decline coincided with abnormally high rain in April, May and early June, said Reynolds, which could be a factor in those monthly decreases.

Larger producers like Midcontinent-focused Continental and Marathon Oil Corp. reported stronger output results for the first quarter of the year in both the SCOOP and STACK, respectively, which could offset some of the concern over slips in the EIA production figures.

While the rig count is also down year/year, much of that decline can be attributed to gains in drilling efficiencies and technological advances, allowing producers to extract more with fewer rigs, Laitkep noted.

The Oklahoma rig count has dropped to 100 for the week ended Friday (June 21), down by one from the previous week and down from 138 a year ago, according to data from Baker Hughes, a GE Company.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |