Shale Daily | E&P | NGI All News Access | NGI The Weekly Gas Market Report | Permian Basin

Coal Producer Alliance Resource Grows Oil, Gas Exposure in $145M Permian Deal

Looking to grow its oil and gas assets, coal producer Alliance Resource Partners LP has agreed to a $145 million cash deal to purchase interests in the Permian Basin, management announced Monday.

The transaction would see the Tulsa-based master limited partnership acquire around 9,000 net royalty acres in the Midland sub-basin, with exposure to more than 400,000 gross acres, from Wing Resources LLC and Wing Resources II LLC.

The acreage includes 783 gross horizontal wells currently producing an estimated 460 boe/d, 70% weighted to oil and 14% natural gas liquids net to Wing’s interests. Also included are 441 drilled but uncompleted wells and 279 permits, according to Alliance.

The assets included in the transaction “are under active development by well capitalized operators bringing visible and near-term growth to current production,” Alliance management said.

Oil and gas acquisitions in the economically attractive Permian play have been common in recent years. The Alliance deal suggests that the allure of the West Texas and southeastern New Mexico play extends beyond only oil and gas operators.

Alliance describes itself as the second largest coal producer in the eastern United States, operating as a diversified producer and marketer of steam coal to utilities and industrial users. The partnership produces coal from eight mining complexes operated across Illinois, Indiana, Kentucky, Maryland and West Virginia.

Alliance CEO Joseph W. Craft III said the deal shows the partnership’s “commitment to build its oil and gas minerals segment as a growth platform for the future. The Wing acquisition enhances our already significant ownership position in the prolific, liquids-rich Permian Basin and, upon completion, these assets are expected to complement our existing coal and oil and gas businesses.”

Alliance plans to fund the transaction with cash on hand and by borrowing under its credit facility. The deal, expected to close in early August, would grow Alliance’s oil and gas exposure to roughly 51,000 net royalty acres, mostly concentrated in the Permian and Midcontinent, with additional assets in the Bakken Shale and in the Appalachian Basin.

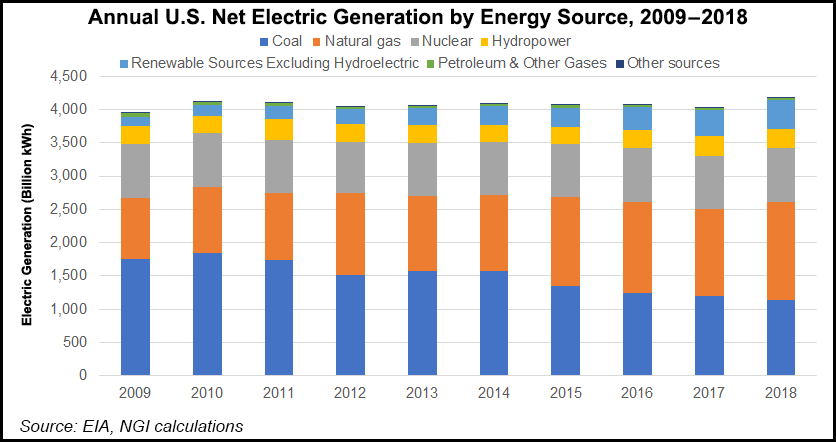

Abundant and cheap natural gas supply thanks to innovations in horizontal drilling and hydraulic fracturing has seen gas cut into coal’s share of U.S. electric generation in recent years.

The Trump administration, sympathetic to the challenges the coal industry has faced, recently adopted its Affordable Clean Energy rule, part of an effort to roll back Obama-era regulations that would have phased out coal generators through stricter limits on carbon dioxide emissions from U.S. power plants.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |