NGI The Weekly Gas Market Report | Markets | NGI All News Access

Mexico Natural Gas Prices Stabilize as U.S. Imports Swell

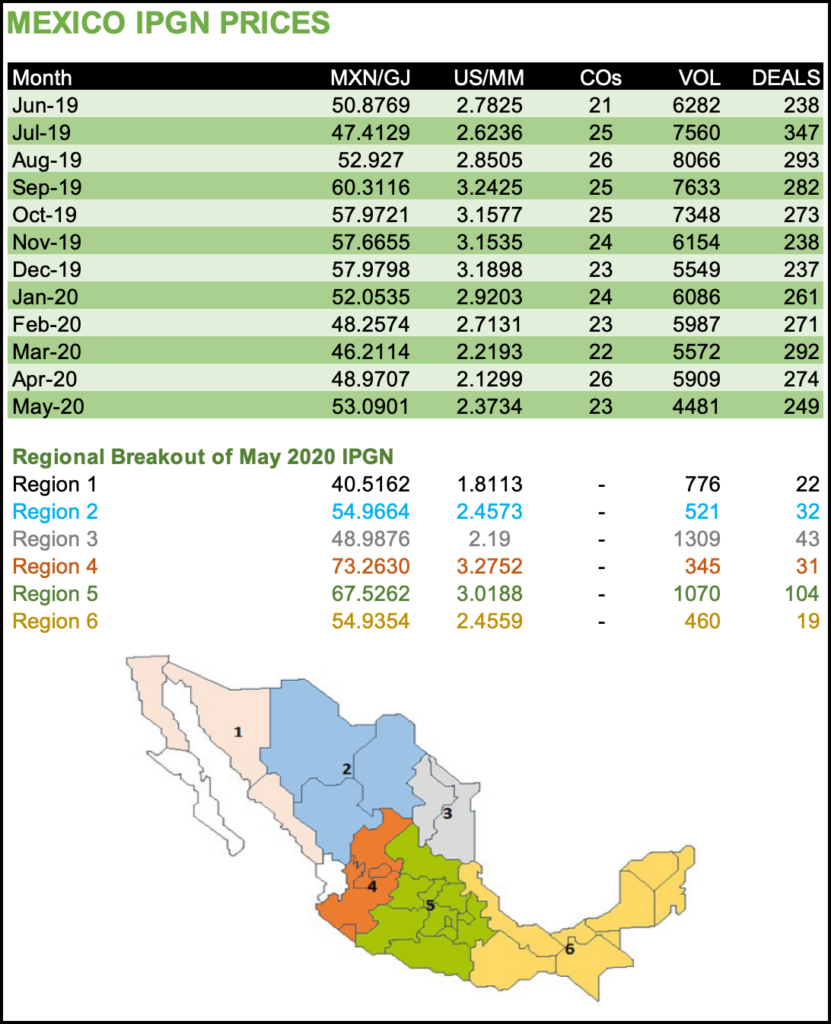

After falling for four straight months, Mexico’s IPGN monthly natural gas price index stabilized in May, rising to $3.00/MMBtu from $2.88/MMBtu in April.

The IPGN is a compilation of post-transaction prices reported by marketers to the Comisión Reguladora de Energía (CRE). A majority of prices are linked to indexes in the United States, which is the leading source of gas consumed in Mexico.

Twenty-three marketers in Mexico reported 296 deals for a total volume of 5.728 Bcf/d in May, compared to 18 companies transacting 243 deals for 5.683 Bcf/d in April.

The price jump “was likely the result of a slight increase in key U.S. prices in May, as we believe that more than half of all gas transacted in Mexico is priced directly from U.S. indexes,” said NGI’s Patrick Rau, director of strategy and research.

“Plus, cooling demand usually picks up a bit in May, so that likely factors into it as well.”

Rau said the simple average of the daily Henry Hub, Houston Ship Channel and El Paso Permian prices on a per-MMBtu basis was $2.77 in January, $2.29 in February, $2.24 in March, $1.66 in April and $1.72 in May.

The corresponding monthly IPGN prices were $4.37, $3.82, $3.15, $2.88 and $3.00, reflecting the U.S. benchmarks, plus the cost of transporting the molecule. Mexico’s Sistrangas national pipeline grid is divided into nine transport pricing zones.

Despite the modest price recovery in May, abnormally cool summer temperatures have kept a lid on both spot and future U.S. natural gas prices this month.

In the nonbinding Consulta Pública survey conducted earlier this year by Sistrangas operator Centro de Control del Gas Natural (Cenagas), respondents from the marketing segment said their gas demand could more than double between 2019 and 2024, assuming they have access to sufficient transport capacity.

Natural gas imports into Mexico, meanwhile, have continued to surge, accounting for 72% of natural gas supply in March, up from 64.3% in the same month a year ago, according to data from energy ministry Sener.

Excluding gas demand from national oil company Petróleos Mexicanos (Pemex), gas import share of supply totaled 93% in March versus 86% in March 2018. Gas imports averaged 6.698 Bcf/d for the month, with liquefied natural gas (LNG) accounting for 580 MMcf/d, or 8.7% of the total, according to Sener.

Gas imports are up from 5.192 Bcf/d in March 2018, a month in which LNG supplied 838 MMcf/d, or 16% of the total.

Genscape Inc. analysts recently attributed the spike in gas imports to testing and line packing on the recently completed Sur de Texas-Tuxpan marine pipeline, and on Fermaca’s partially completed Wahalajara pipeline system.

Genscape expects that Sur de Texas-Tuxpan, a joint venture between TC Energy Corp. and Infraestructura Energética Nova (IEnova), will begin displacing LNG imports to the Altamira terminal by the middle of July.

“Later in the year, we expect the Wahalajara pipeline system’s startup will displace Mexican LNG sendout at the Manzanillo terminal,” Genscape analysts said.

The remaining sections of Wahalajara comprise the 1.189 Bcf/d La Laguna-Aguascalientes and 886 MMcf/d Villa de Reyes-Aguascalientes-Guadalajara pipelines. These two sections are due to enter commercial operation in July and November of this year, respectively, according to an update earlier this month by Sener.

Meanwhile, Sener also said commissioning of TC Energy’s Tuxpan-Tula and Tula-Villa de Reyes pipelines depend on the completion of two milestones outside of the company’s control.

Once Sener completes an indigenous consultation for Tuxpan-Tula, the time to commercial startup would be 12 months. For Tula-Villa de Reyes, the timeline would be 11 months starting from the completion of an “archeological rescue” of artifacts discovered along the pipe’s route.

Commissioning Tuxpan-Tula and Tula-Villa de Reyes is considered essential for the marine pipeline to operate at its full 2.6 Bcf/d capacity.

Gas production by Pemex has been in steady decline since 2009, leading to the increased reliance on imports. Dry natural gas production from Pemex processing centers averaged 2.225 Bcf/d in April, down 9.1% from the same month a year ago.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 | ISSN © 1532-1266 |