NGI Weekly Gas Price Index | Markets | NGI All News Access | NGI Data

Rain Drenches Weekly Natural Gas Prices; Futures Crumble as Storage Swells

Another week without widespread heat left natural gas prices mixed for the June 17-21 period, with modest gains in much of the country taking a back seat to extreme weakness in California and Rockies. The NGI Spot Gas Weekly Avg.dropped 6 cents to $1.93.

Interestingly, prices on the West came crashing down from recent highs despite ongoing heat in parts of the region. Among the sharpest declines were those at SoCal Citygate, where prices plunged more than 80 cents for the week to average $2.09.

Even as temperatures hovered above average for the better part of the week, a vastly improving storage situation has unfolded in the state. Southern California Gas (SoCalGas) announced that its Aliso Canyon facility had reached the California Public Utilities Commission-directed maximum working capacity of 34 Bcf.

The steep sell-off in California also occurred as SoCalGas announced that the return of L235-2 was being postponed for a sixth time. The line is now expected to return to partial service July 30 rather than July 6.

Over in the Rockies, losses ranged from 20-30 cents at the majority of pricing hubs, while Transwestern San Juandropped 32 cents on the week to average $1.53 as the pipeline continued maintenance that restricted outflows from New Mexico. The work is scheduled to last through the end of the month.

With little demand in downstream markets, Permian Basin prices also posted noteworthy decreases. Wahadropped 34 cents to average just 9 cents for the week.

On the positive side of the ledger, though just barely, Chicago Citygatenudged a half-cent higher on the week to $2.115.

Prices in the Midcontinent were as much as 33 cents higher at NGPL Midcontinent, although most other market hubs in the region rose less than a dime.

Smaller increases of just a few pennies were seen across most of the rest of the country.

Without a firm grasp on U.S. natural gas supply — and a lack of widespread heat so far this summer — natural gas futures plunged to a four-year low after the latest storage data sent shockwaves through the market.

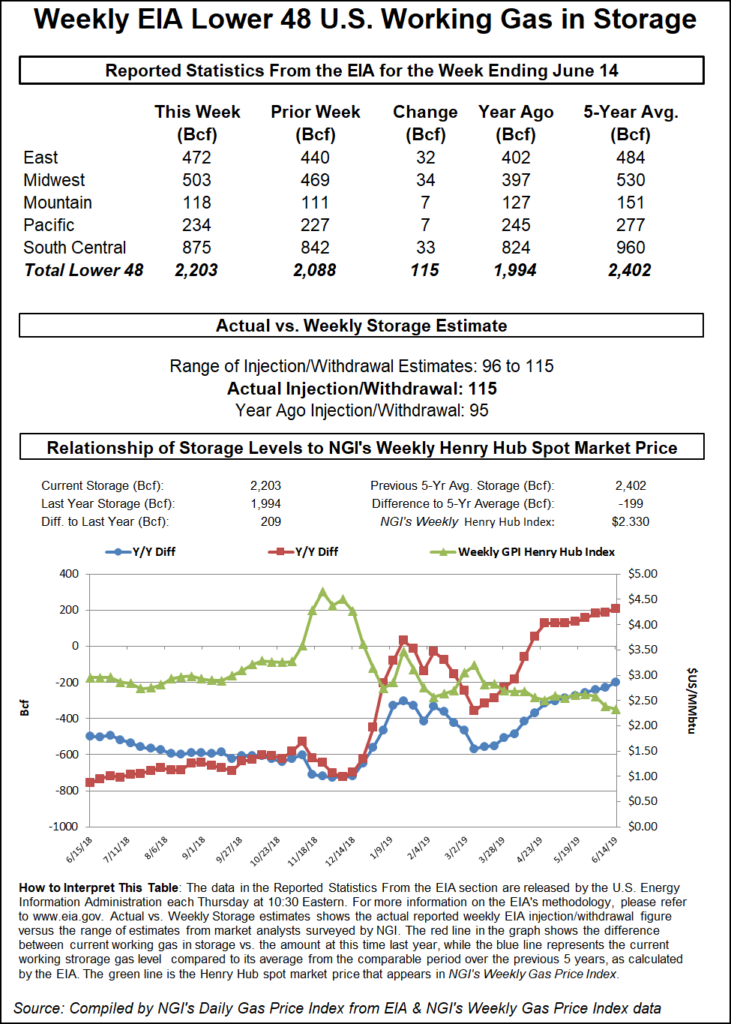

The week’s declines came quickly, as the July Nymex gas contract dropped more than a nickel on both Tuesday and Wednesday. But then the floor collapsed Thursday after the Energy Information Administration (EIA) dropped a bombshell when it reported a 115 Bcf injection into storage inventories for the week ending June 14. The build was roughly 10 Bcf above what the majority of analysts had projected and was far above last year’s 95 Bcf injection and the 84 Bcf five-year average.

At 2,203 Bcf, inventories rose to some 209 Bcf above last year’s levels and fell to 199 Bcf below the five-year average, according to EIA.

The Nymex prompt-month contract went on to settle Thursday at $2.185, down 9.1 cents on the day. On Friday, July futures recovered only one-tenth of a cent to reach $2.186.

The last several storage injections have been far higher than what analysts expected ahead of the EIA’s weekly storage reports, with several analysts quickly pointing to supply data as the culprit for a string of bearish injections. “There appears to be, quite simply, much more supply out there than is indicated by the data, giving us very low confidence in what to expect going forward in terms of the supply/demand balance,” Bespoke Weather Services said Thursday.

However, Mobius Risk Group said that understanding how mild June has been relative to last year, and in comparison to all previous shale-era Junes (2010-2018), from a population weighted cooling degree day (CDD) perspective, is a critical piece of information. The first 20 days of the month have been 1.5% cooler than normal when compared to the last 30 years and 20.5% cooler than the same 20 days last year, the Houston-based firm said. Furthermore, six out of the eight prior years have ranked in the top 10 warmest Junes over the past 69 years, while June 2019 is on track to rank a lowly 34th warmest.

“Weather is, and will remain, the most dominant force affecting near-term prices,” Mobius said.

It is also important to put ”market expectations’ in context when considering the implications of a given EIA inventory report, according to Mobius. Expectations are most commonly arrived at through modeling efforts centered around the collection of daily and weekly storage data posted on pipeline electronic bulletin boards.

“This type of analysis is very useful over time but fraught with episodically significant errors,” the firm said. Market observers also need to consider CDDs as well as other sources of power generation that could impact natural gas demand.

“The location of significant weather deviations versus normal, and behavior of non-fossil fueled power generation, should be used as a clarifying point for disaggregating market noise. By market noise, we mean the all-too-often scenario where ”oversupply’ is the culprit for all negative price changes,” Mobius said.

Looking ahead, upstream operators are still hopeful for a pricing recovery to maintain activity levels into 2020, according to Tudor, Pickering, Holt & Associates (TPH). However, pressure on the liquids market and a continued compression of the natural gas forward curve should pressure budgets and growth, the firm said.

“The pricing pain has still largely been confined to 2H19, however, strip 2020 has fallen to $2.51 from $2.70 a month ago. Ultimately, the forward curve may need to average between $2.25 and $2.50 before operators go ex-growth,” TPH said.

The sooner companies move in this direction, the more likely the equities may find support, as fundamentals will continue to deteriorate under status-quo growth plans, according to TPH. “We estimate a move to maintenance capital expenditures in gassy basins (Appalachia and Haynesville) would require activity levels to be reduced by roughly 30%, or around 35-40 horizontal rigs and around 20-25 frac spreads.”

Already, low prices have prompted ARC Resources Ltd., one of Canada’s major natural gas producers, to dial back capital spending for this year and next. Capital spending will be C$700 million ($530 million) this year, down from an initial projection of C$775 million, as the company defers a gas-processing and liquids-handling facility, ARC said Thursday. Spending in 2020 will be even lower, between C$500 million and C$625 million.

After another day of steep declines on Friday, there was a large swath of the United States sporting $1 handles for spot gas.

Even as Texas continued to bake under near 100-degree temperatures, weather systems were barreling across the northern United States, keeping temperatures rather mild, according to NatGasWeather. Cooling was forecast to sweep across the West and Plains as well, although heat was expected to begin building.

Where demand becomes strongest is later in the coming week “as the upper ridge expands across much of the southern two-thirds of the United States with widespread highs of upper 80s to 100s,” the forecaster said. The hot ridge is still expected to extend across the Midwest late in the week into early July with highs of 90 near Chicago.

Midwest cash markets were unimpressed by weather outlooks, however.Chicago Citygate tumbled 18 cents to $1.91.

Houston Ship Channel dropped 10.5 cents to $2.145 even as the entire Houston area remained under a heat advisory again Friday, with heat indices predicted to reach more than 110 degrees, according to the National Weather Service (NWS).

This advisory is the second of its kind in as many days as brutal heat coming off the Gulf of Mexico brings “dangerous” conditions to Southeast Texas, forecasters said. Friday’s actual high was forecast to top out around 94 in Houston, although heat indices were expected to range anywhere between 106 and 111, the NWS said.

Over in West Texas, Permian Basin pricing got hammered after enjoying a few days of renewed strength.Wahaaveraged only 2 cents after plunging 30.5 cents on the day.

Cash markets across Louisiana and the Southeast slid between 10 and 15 cents, while Appalachia losses were capped at around a dime.

On the pipeline front, ANR Pipeline was expected to continue planned maintenance along its Tie-Line in northwest Ohio, limiting up to 196 MMcf/d of westbound flow from Monday through Friday (June 24-28). Located in ANR’s Northern Area (Zone 7), flows were to be limited through the Defiance Westbound throughput meter by 250 MMcf/d (leaving 434 MMcf/d available).

In the week ending Friday (June 24), flows through Defiance Westbound had averaged 384 MMcf/d and maxed at 630 MMcf/d, according to Genscape Inc.

Spot gas in the Rockies posted sharp declines of as much as 80 cents Friday, driving several pricing hubs below $1.Kingsgate averaged only 85 cents after falling 55.5 cents on the day.

In California,SoCal Citygate tumbled 70 cents to $1.135 while other markets in the region posted similar declines.

Pricing across the border in Canada remained extremely weak, even though cash ended the day in positive territory for some hubs.Westcoast Station 2 jumped 11.5 cents to average 11 cents on Friday.

As expected, continued maintenance and outages on the Nova Gas Transmission Ltd. system prevented volumes from reaching storage, with last week’s build coming in at 3 Bcf, compared to a five-year average 6 Bcf build, according to TPH. Inventories now sit at a 20% deficit to norms.

Meanwhile, the Alliance pipeline work and other gas flow restrictions in the region that have cut off around 1 Bcf/d of Canadian exports have driven NOVA/AECO C spot pricing further into shut-in territory, especially as prices have moved into negative territory at times, TPH said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |