Shale Daily | Markets | NGI All News Access | NGI The Weekly Gas Market Report

Oil Prices Surge as U.S.-Iran Tensions Escalate

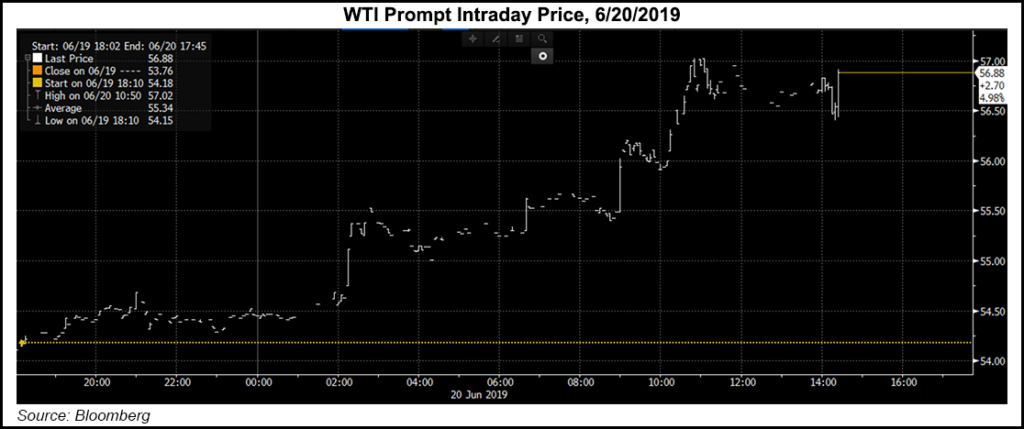

Crude oil prices surged Thursday following reports that Iran had shot down a U.S. drone near the Strait of Hormuz, stoking fears that tensions between the two nations could escalate and disrupt energy transit in the process.

At around 2:30 a.m. ET Thursday, West Texas Intermediate futures on the New York Mercantile Exchange (Nymex) were up more than $3 day/day, with the August contract trading above $57/bbl after opening the week in the low $50s.

Price Futures Group analyst Phil Flynn said the reported news of the drone incident raises “fears Iran and the U.S. are headed toward a military confrontation that would have serious price consequences for energy. There is too much dangerous activity going on in the Strait of Hormuz.”

Calling it “the world’s most important oil chokepoint,” the Energy Information Administration (EIA) estimated that last year 21 million b/d flowed through the Strait of Hormuz, which is between Oman and Iran and which connects the Persian Gulf to the Gulf of Oman and the Arabian Sea. That amounts to about 21% of global petroleum liquids consumption, according to the agency.

“Volumes of crude oil, condensate, and petroleum products transiting the Strait of Hormuz have been fairly stable since 2016, when international sanctions on Iran were lifted and Iran’s oil production and exports returned to pre-sanctions levels,” EIA said in a research note published Thursday. “Flows through the Strait of Hormuz in 2018 made up about one-third of total global seaborne traded oil. More than one-quarter of global liquefied natural gas trade also transited the Strait of Hormuz in 2018.

“There are limited options to bypass the Strait of Hormuz. Only Saudi Arabia and the United Arab Emirates have pipelines that can ship crude oil outside the Persian Gulf and have the additional pipeline capacity to circumvent the Strait of Hormuz.”

Recently equity markets have seemed “much more focused” on Federal Reserve Bank policy “and U.S./China trade tensions than Middle East geopolitical tensions,” said Tudor, Pickering, Holt & Co. (TPH) analysts in a note to clients early Thursday. However, geopolitical tensions “seem to be surfacing with increased cadence and gravitas of late.” This had TPH analysts “increasingly confident” of a supply-side risk premium creeping back “into the market mindset, effectively placing a floor under global oil prices…and energy equities.”

News of the drone attack came after Washington, DC, had identified Iran as the prime suspect in earlier attacks on tankers in the region, and after Iran provocatively announced that it planned to violate limits on uranium enrichment set out in the Joint Comprehensive Plan of Action (JCPOA), the 2015 multi-nation pact aimed at reigning in Iran’s nuclear program.

In a note analyzing the implications of Iran’s plan to violate the JCPOA, and issued prior to Thursday’s developments, ClearView Energy Partners LLC analysts cautioned that “the market may be undercounting risks that have become increasingly visible during the last two months of rising U.S.-Iran tensions.”

Recent data indicate a growing supply cushion for the Organisation for Economic Co-operation and Development countries, and trade conflicts pose downside risks for demand.

“That said, a disruption of petroleum transit through the Strait of Hormuz remains the granddaddy of supply risks, because it has the potential to take around 18 million b/d offline,” the ClearView analysts said. “Iran knows it, and the world knows it, too.”

The rising sense of risk in the Middle East wasn’t the only factor leaving analysts bullish on oil Thursday, with the latest U.S. inventory data and the prospect of interest rate cuts from the Federal Reserve also pointing to stronger prices.

“After a few painful weeks of bearish data, U.S. inventories saw the draw we’ve been waiting for,” with petroleum inventories including crude, gasoline and distillates “down 5.3 million bbl and much better than the predicted minus 0.6,” Raymond James & Associates Inc. analysts led by J. Marshall Adkins said. “…Wednesday, the U.S. bolstered its case for Iran’s involvement in the latest tanker attacks, presenting mine fragments of Iranian origin reportedly recovered from the damaged tankers.

“Back home, the Federal Reserve is keeping rates right where they are, but a rate cut by the year end now seems more likely than not.”

Meanwhile, if it can be said that the bulls were out in full force in the oil markets Thursday, then it was the bears on the prowl for natural gas after another sizeable miss to the high side in the latest weekly EIA Lower 48 storage report.

The EIA reported a 115 Bcf injection into natural gas storage inventories for the week ending June 14 that came in roughly 10 Bcf above consensus estimates.

Nymex futures responded immediately to the bearish EIA data, falling 5 cents at the front of the curve. The July contract was trading about 2 cents higher day/day near $2.30/MMBtu a few minutes before the report was released at 10:30 a.m. ET. The July contract was down to around $2.18 as of early Thursday afternoon, off nearly 10.0 cents from the previous day’s settle.

“Balance wise, it is back looser, and rather difficult to justify based on the best data we have available to us,” Bespoke Weather Services said. “There appears to be, quite simply, much more supply out there than is indicated by the data, giving us very low confidence in what to expect going forward in terms of the supply/demand balance.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |