NGI The Weekly Gas Market Report

NGI The Weekly Gas Market Report | Forward Look | Markets | NGI All News Access

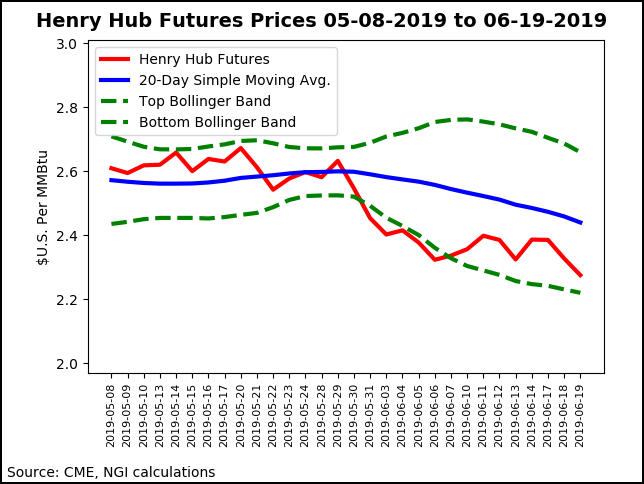

Little Hope for Natural Gas Bulls as Weather, Storage Send Forward Prices Lower

A series of thunderstorms that continue to barrel across the United States drenched any hopes that natural gas bulls could continue to ride last week’s forward price momentum. A lack of confidence in long-term weather data and eyes on another 100 Bcf-plus storage injection put additional pressure on the forward markets, sending July prices down an average 5 cents from July 13-19, according to NGI’s Forward Look.

Weather models have remained at odds over several aspects of an expected heat wave later this month, including its duration and intensity. And while there has been some convergence in the amount of projected demand, neither model has trended any hotter.

Only minor changes were seen in the weather data overnight Wednesday, with the American Global Forecast System (GFS) model losing a couple cooling degree days (CDD) since Wednesday, according to NatGasWeather. The European model yet again failed to trend hotter and continues to lag the GFS model by more than 15 CDDs over the 15-day forecast.

“To our view, the GFS still looks hot enough to satisfy, but the European model needs to be hotter,” NatGasWeather said. “It doesn’t help most of the data isn’t quite sure if the hot upper ridge will cover enough of the eastern half of the United States July 3-7, and where the data needs to be hotter, including the GFS.”

Radiant Solutions said that the latest model runs were cooler across the south-central United States, where temperatures now look to reside on the negative side of normal through most of the period. Cooler changes were also noted in the Northeast as the negative North Atlantic Oscillation looks to persist, maintaining troughing overhead.

In addition, ridging looks to shift from the central United States at the onset to the West through the period, resulting in widespread above-normal temperatures in the West and more normal conditions in the center of the country. “Models show decent pattern agreement but differ within some of the details, with the Euro cooler in the East and the GFS cooler in Texas,” Radiant said.

Meanwhile, Wednesday’s power burns were revised stronger and now closely match the tightest single-day burns since early March, according to Bespoke Weather Services. On the supply side, production continues to bounce around but remains at least 1 Bcf off late-March highs. Feed gas deliveries to liquefied natural gas (LNG) export terminals have also fallen as Sempra Energy’s Cameron LNG facility is back to taking in very little gas, the firm said.

Ahead of Thursday’s storage report, Bespoke chief meteorologist Brian Lovern said the firm continues to see the data as “supportive” but said the market was clearly trading on other concerns, be it fears of a bearish miss on storage, or simply added pressure due to the gas glut over in Europe and expectations of the oversupply “ultimately leading to LNG shut-ins here in the United States.”

On the storage front, the market indeed got another shock when the Energy Information Administration (EIA) reported a 115 Bcf into storage inventories for the week ending June 14. The reported build compares with last year’s 95 Bcf injection and the 84 Bcf five-year average build.

The 115 Bcf build was considered a hugely bearish miss, as most estimates had clustered around a build roughly 10 Bcf below the actual print. NGI had projected a 105 Bcf injection.

“That was a big crusher,” said Huntsville Utilities’ Donnie Sharp, senior natural gas supply coordinator, on energy chat room Enelyst. “Lots of volumes reversing course very quickly.”

The July Nymex futures contract was trading about 2 cents higher day/day near $2.30 a few minutes before the report was released at 10:30 a.m. ET. Prices dropped down to $2.246 after the print hit the screen, and went on to settle Thursday at $2.185, down 9.1 cents.

“Summer’s over. We’ll see you next winter,” said independent weather forecaster Corey Lefkov.

Indeed, the natural gas market has remained unconvinced over the timing and intensity of heat expected later this month, and the mild weather so far this summer has led to a string of triple-digit storage injections. Thursday’s report was the sixth such 100 Bcf-plus build in a row.

“Balance wise, it is back looser, and rather difficult to justify based on the best data we have available to us,” Bespoke’s Lovern said. “There appears to be, quite simply, much more supply out there than is indicated by the data, giving us very low confidence in what to expect going forward in terms of the supply/demand balance.”

Broken down by region, 34 Bcf was injected in the Midwest, 32 Bcf was added in the East and 33 was stocked in the South Central, including 26 Bcf into nonsalt facilities and 8 Bcf into salts, according to EIA. At 2,203 Bcf, inventories are 209 Bcf above last year’s levels and 199 Bcf below the five-year average.

Meanwhile, the LNG demand case that bulls have pinned their hopes to could be viewed as being on thin ice due to the current oversupply situation in the global market. Already, an ongoing trade dispute between the United States and China has pushed out domestic LNG supplies from the largest buyer of the super-chilled fuel.

And now, greater exports to Europe have swelled inventories there, threatening potential U.S. LNG shut-ins. However, an unexpected rally at the Dutch Title Transfer Facility earlier this month due to weaker pipeline supply, combined with lower Henry Hub prices, reopened the August contract arbitrage windows between Henry Hub and the other global hubs, according to Energy Aspects.

“With the arbitrage windows open again” and only a few days for lifters to decide whether to cancel a U.S. cargo in August, “the global market appears to have enough space to accept the U.S. cargoes,” Energy Aspects said.

Natural gas forward prices were lower across the vast majority of market hubs during the June 13-19 period, with steep sell-offs seen in California despite ongoing heat on the West Coast.

SoCal Citygate July prices plunged 62 cents to $4.537, while August tumbled 28 cents to $5.121 and the balance of summer (July-October) dropped 29 cents to $4.29, according to Forward Look. Much smaller declines were seen in the winter strip (November-March), which slipped just 6 cents to $4.17.

Southern California Gas Co. (SoCalGas) has indicated that the Aliso Canyon storage facility has filled up to its California Public Utilities Commission-directed maximum working capacity of 34 Bcf, likely leading to the drop-off in forward prices. However, there could be room for some upside ahead for prices.

SoCalGas announced Wednesday another postponement to the return of critical import lines. The return of L235-2 at limited pressure has been postponed to July 30 from July 6.

“This is the sixth postponement to this schedule in the last three months; flows were at one time expected to resume as early as April 2,” Genscape analyst Joseph Bernardi said.

Other postponements have corresponded with upward movements in SoCal Citygate forward prices due to their implications for continued uncertainty in SoCalGas’ supply for its summer demand season and for refilling storage before winter, according to Genscape.

The dramatic decreases in California spilled over into the Permian Basin, where cash prices returned to negative territory earlier in the week due to brief pipeline maintenance. Waha forward prices were hanging by a thread as well after the July contract tumbled 21 cents to 7.6 cents, Forward Look data show. August fell 11 cents to 58.3 cents, the balance of summer slipped 12 cents to 81 cents. The winter strip was down 8 cents to $1.80.

Like California, Permian prices could see some price relief on the horizon as exports to Mexico continue to grow. Genscape estimates that U.S. pipeline exports to Mexico surged to 5.7 Bcf/d on Thursday.

“Exports have been continually setting new record highs, but today’s number represents a gain of nearly 170 MMcf/d above the previous record from June 13,” Genscape senior natural gas analyst Rick Margolin said.

Flows from Texas’ Valley Crossing pipeline to Mexico’s new Sur de Texas-Tuxpan subsea system have breached 0.45 Bcf/d as the line goes through testing, linepacking and startup operations. Meanwhile, there are no clear signs that displacement of Mexican LNG imports have begun.

However, Genscape is forecasting displacement to start in the middle of next month, at which time Sur de Texas will significantly displace LNG sendout from the Altamira terminal. “Later in the year, we expect the Wahalajara pipeline system’s startup will displace Mexican LNG sendout at the Manzanillo terminal,” Margolin said.

Genscape is also seeing a jump in exports from West Texas, with exports there cresting the 0.8 Bcf/d mark for the first time. The jump in flows is partly due to hotter weather and increased power burns, but also to support the development of the Wahalajara system.

“Testing on two segments of the Wahalajara system is taking place this month; a portion of the increased flows out of West Texas is being directed towards these systems,” Margolin said.

The majority of other pricing hubs across the country followed the Nymex lead, although NGPL Midcontinent posted substantial gains for the June 13-19 period as some pipeline maintenance on Natural Gas Pipeline Co. of America that had been due to end by the weekend was extended, according to Forward Look. The work was limiting eastbound flows through the Amarillo pooling point.

NGPL Midcontinent July prices shot up 11 cents to $1.525, while August slipped a penny to $1.58 and the balance of summer held steady at $1.58. The winter strip was down 6 cents to $2.22.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9915 | ISSN © 2577-9877 | ISSN © 1532-1266 |