Shale Daily | NGI All News Access | NGI Archives

Mexico Cancels Pemex Farmout Tender to Dismay of Reform Advocates — Bonus Coverage

Editor’s Note: Please enjoy this bonus coverage from NGI’s Mexico Gas Price Index, which includes daily prices, analysis and coverage of the emerging natural gas market in Mexico.

Request a Trial | Subscribe

Mexican upstream hydrocarbons regulator Comisión Nacional de Hidrocarburos (CNH) last week formally cancelled a tender for operating stakes in seven onshore areas currently held by national oil company Petróleos Mexicanos (Pemex) in the states of Veracruz, Tabasco and Chiapas.

The farmout tender would have been the sixth conducted under the framework of Mexico’s 2013 constitutional energy reform, which has sought to attract private capital to the energy sector to ease the investment burden on Pemex and state power utility Comisión Federal de Electricidad (CFE).

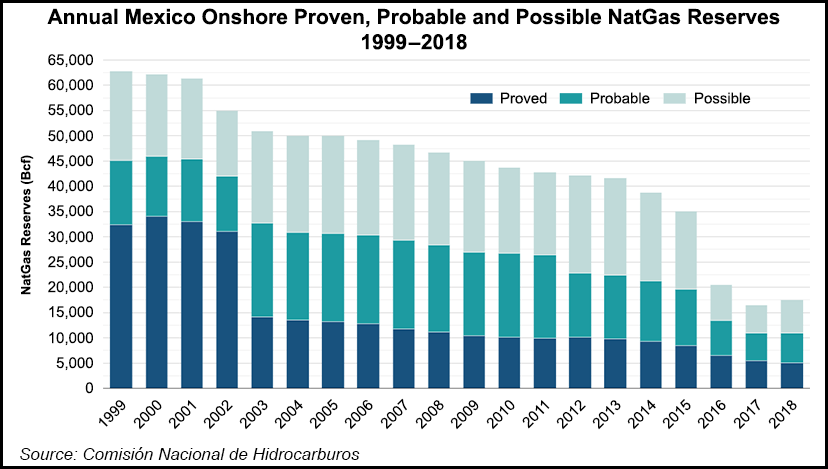

The areas on offer for the planned tender contained a combined 392 million boe of proved, probable and possible, or 3P, hydrocarbon reserves and 683 million boe of unrisked prospective resources as of June 2018, and were producing 43,000 b/d of crude oil and 228 MMcf/d of natural gas, according to Pemex.

Although CNH technically canceled the tender, it did so at the behest of energy ministry Sener, which withdrew the seven areas from consideration for bidding, CNH commissioner Sergio Pimentel said during a session earlier this month.

President Andrés Manuel López Obrador has long opposed the energy reform and its mechanisms for attracting private sector investment, which include the farmout tenders for acreage already assigned to Pemex, as well as bid rounds for new blocks.

To read the full article and gain access to more in-depth coverage including natural gas price and flow data surrounding the rapidly evolving Mexico energy markets, check out NGI’s Mexico Gas Price Index.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |