NGI Mexico GPI | Markets | NGI All News Access

Mexico Exports Surge; Expected Large Natural Gas Storage Build Keeps Ball in Bears’ Court

Natural gas futures continued to slide on Wednesday as weather models, while converging, failed to trend much warmer for the end of June/early July period. With another 100 Bcf-plus storage injection expected on Thursday, the July Nymex gas futures contract fell 5.2 cents to $2.276/MMBtu. August slipped 4.8 cents to $2.263.

Spot gas prices were mostly lower as thunderstorms across the country kept a lid on temperatures and demand. However, with West Texas prices moving back into positive territory, the NGI Spot Gas National Avg. slipped just 1.5 cents to $2.035.

Wednesday’s action on the futures front showed traders’ reluctance to provide any uplift to natural gas prices even as Tuesday’s roughly 6-cent decline was seen by some market observers as overdone, especially given relative support from the spot market. Cash prices held reasonably firm on Tuesday, with prices at Henry Hub averaging $2.38 — well above the final settlement price of the July contract, noted EBW Analytics Group.

The prompt month continued to lag the day-ahead price Wednesday — Henry Hub cash averaged $2.36 — as weather data struggled to convince the market that late June heat is hot enough to impress, and the weather lacks the staying power to significant boost prices to levels that are sustainable.

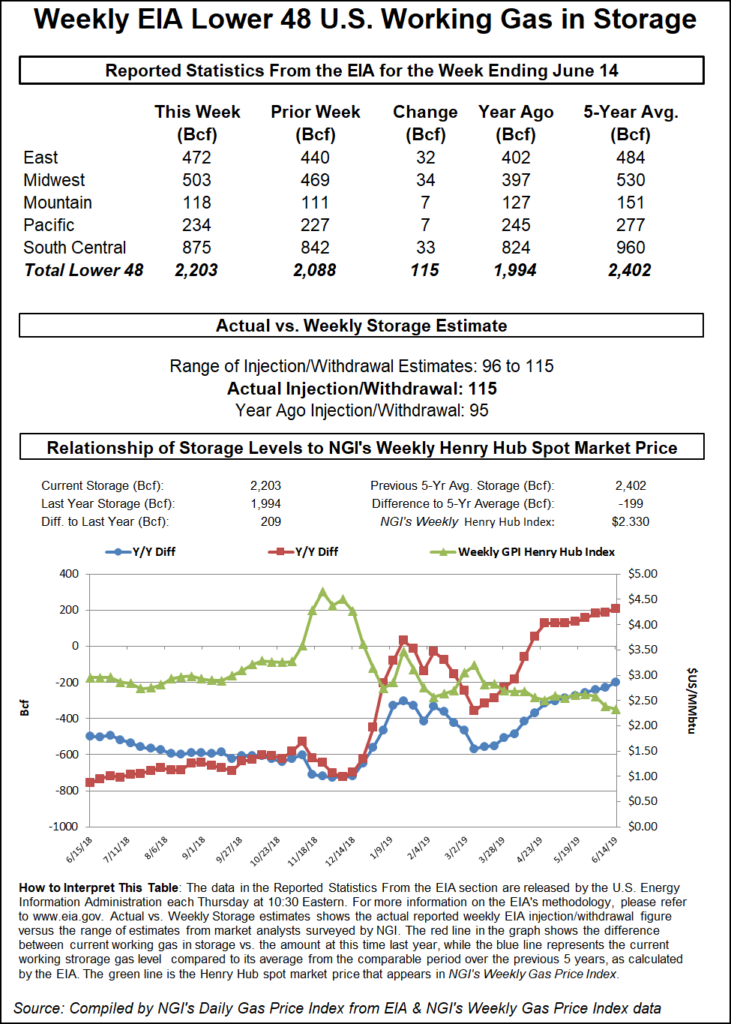

Also not helping the bulls is that the market was looking ahead to Thursday’s Energy Information Administration (EIA) storage report, which was expected to show a seventh consecutive triple-digit injection if the majority of estimates are correct. A Bloomberg survey of 14 market participants showed an injection range between 96 Bcf and 113 Bcf, and a median of 105 Bcf. A Reuters survey ranged from a 96 Bcf build to a 115 Bcf build, with a median of 105 Bcf. NGI also projected a 105 Bcf injection.

Last year, the EIA recorded a 95 Bcf injection, while the five-year average injection stands at 84 Bcf.

Despite the expected bearish storage data, liquefied natural gas (LNG) exports, pending any revisions, hit a new high around 6 Bcf on Wednesday, according to Bespoke. In addition, power burns remain healthy, though not as tight as the last couple of weeks.

“Balance data still appears supportive, with demand at sufficient levels to also be supportive, but the market clearly has concerns about another big bearish EIA surprise” on Thursday, “which we can only attribute to actual supply being at higher levels than what the data is indicating to us, if indeed we do get such a ”surprise’” in the report, Lovern said Wednesday.

Weather aside, LNG exports are seen by analysts as key to reviving gas prices, which remain near multi-year lows. Last week, Cheniere Energy Inc. indicated that production had begun from the second train at its Corpus Christi LNG export facility in South Texas.

Genscape analysts believe production at Train 2 began June 12 based on observations via the firm’s proprietary infrared monitors and verified by an uptick in scheduled delivery nominations to the facility to more than 820 MMcf/d. Genscape assumes that fuel use for an average Cheniere train represents roughly 70 MMcf/d of deliveries, and “anything more than that is presumed to be liquefied volumes,” analyst Amir Rejvani said.

The firm expects that Train 1 is currently using less than 750 MMcf/d, and “therefore any additional deliveries to the facility exceeding this are assumed to be headed to Train 2 at this time,” Rejvani said.

Meanwhile, a Sempra Energy subsidiary has requested that FERC initiate the pre-filing review for an additional two trains that would make up Phase 2 of its Port Arthur, TX, export project, which would expand the proposed terminal’s capacity to 22 million metric tons/year (mmty) from 11 mmty.

“Sempra Energy is developing one of the largest LNG export infrastructure portfolios in North America that we anticipate will play an important role in providing clean, reliable and affordable U.S. natural gas to world markets,” Sempra spokesman Brooke Holland told NGI.

The pre-filing process is the first step in the Federal Energy Regulatory Commission permitting process. Last month, state-owned Saudi Arabia Oil Co., aka Aramco, signed a heads of agreement to negotiate buying a 25% stake in the first phase of the Jefferson County, TX, terminal, which includes two liquefaction trains, up to three LNG storage tanks and associated facilities. If the Port Arthur deal is finalized, the project could achieve a positive final investment (FID) by early 2020.

“The timeline for the development of the Phase 2 opportunity will depend on a number of factors and circumstances,” Holland said. “We have received great interest for our projects from large established investment grade LNG industry players.”

The Port Arthur project, sited east of Houston, would complement Sempra’s Cameron LNG export facility in Louisiana, a 15 mmty facility scheduled for start-up this year. In addition, Energia Costa Azul is on the drawing board for Baja California, with an FID expected next year.

In addition to LNG ramping up, exports to Mexico continue to surge. Genscape estimates that U.S. pipeline exports to Mexico are now at about 5.7 Bcf/d, a record high and a gain of nearly 170 MMcf/d above the previous high on June 13.

“Flows from Texas’ Valley Crossing pipeline to Mexico’s new Sur de Texas-Tuxpan subsea system have breached 0.45 Bcf/d as the line goes through testing, linepacking, and startup operations,” according to Rick Margolin, senior natural gas analyst.

Genscape also sees a jump in exports from West Texas, with exports there cresting the 0.8 Bcf/d-mark for the first time.

“The jump in flows is partly due to hotter weather and increased power burns, but also to support development of the Wahalajara system.”

Testing on two segments of the Wahalajara system, which will connect the Waha gas trading hub to the city of Guadalajara in west-central Mexico, is taking place this month, and a portion of the increased flows out of West Texas is being directed towards these systems, according to Genscape.

Spot gas prices declined Wednesday as numerous weak weather systems continue to produce showers and thunderstorms across many areas of the country, keeping temperatures mostly comfortable across the northern and interior United States with highs of 70s and 80s.

However, abundant heat in Texas and the end of a brief pipeline maintenance event earlier this week provided some uplift to Permian Basin markets. El Paso-Permian next-day jumped more than 30 cents to average 22 cents.

With pipeline work restricting Permian outflows earlier this week and the larger issue of a lack of adequate gas takeaway in the region, West Texas cash prices once again fell into negative territory.

Kinder Morgan Inc.’s 2 Bcf/d Gulf Coast Express pipeline is expected to provide some price relief once it enters service this fall. Meanwhile, developers of the Whistler Pipeline earlier this month sanctioned the line, which would move 2 Bcf/d of natural gas from Waha, TX, to the Agua Dulce area of South Texas. However, the targeted in-service date was pushed back to 3Q2021.

“This means the next intrastate after Gulf Coast Express is likely to be Kinder Morgan’s second project, the 2 Bcf/d Permian Highway Pipeline, which targets end markets near Houston for service beginning October 2020,” Genscape analyst Colette Breshears said.

The analyst said plans for Boardwalk Pipeline Partners LP’s 2 Bcf/d Permian-2-Katy pipeline have been suspended. When asked about the status of the project after noting that Boardwalk failed to include it in its 1Q2019 earnings presentation, management said it would “continue to explore opportunities but any project that might develop would be after the 2020 time frame.”

Elsewhere in the Lone Star State, cash prices softened. Houston Ship Channel next-day gas traded at $2.285, down 7 cents on the day.

Prices were mixed in the Midcontinent, with Panhandle Eastern falling 6 cents to $1.575 and several other pricing hubs edging up a penny or so.

Cash markets across Louisiana and the Southeast slipped a little despite the heat in the region, while Appalachia prices also declined a bit as relatively mild temperatures continued there.

Northeast prices were mixed, although prices shifted just slightly on the day.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 |