NGI The Weekly Gas Market Report | Infrastructure | NGI All News Access

Timeline Unclear for Resolving Mexico’s Yucatan Gas Shortage

The timeline for resolving an acute shortage of natural gas on Mexico’s Yucatan Peninsula remained unclear Wednesday, as authorities sought to quell concerns of impending power outages because of fuel scarcity.

In a directive issued on Monday (June 17) to power sector participants, independent system operator Centro Nacional de Control de Energía (Cenace) declared a state of operative emergency throughout the peninsula because of a shortage of gas to power the area’s combined-cycle gas turbines.

Of the 2,120 MW of dispatchable generation capacity on the peninsula, at least 985 MW must be available to ensure the supply of electricity, Cenace said.

As of Monday, only 732 MW of capacity was guaranteed to be available, Cenace said, adding that as long as the peninsula’s dispatchable generation remained below 985 MW, a state of emergency would be in effect, with all participants in the electric industry instructed “to take the necessary operative measures” under the law.

Cenace said it received a warning from one of the generation subsidies of state power utility Comisión Federal de Electricidad (CFE). The generator said for the remainder of the year, the gas supply deficit would mean that only about 315 MW of the peninsula’s 1,262 MW of gas-fired combined-cycle capacity would be available.

Subsequently on Tuesday, Cenace downplayed the threat of power outages, stating that there was “sufficient electric supply for the maximum energy demand expected this summer” on the peninsula. Two prolonged blackouts have already occurred in the region this year.

Cenace said it “notified in a preventive manner all the members of the electric industry of the operational conditions expected for the Yucatán Peninsula during the summer of the present year, due to the limitations that have been registered in the supply of natural gas in the region.”

Cenace also said CFE, in coordination with the region’s independent power producers, is in the process of “increasing the availability of generation on the peninsula,” namely by increasing the supply of diesel fuel to the Merida III combined-cycle plant, which can run on natural gas or diesel. Merida III has a capacity of 484 MW when running on natural gas. Cenace and CFE said they are working to ensure 440 MW of available diesel-fired capacity at the plant.

CFE has attributed the gas shortage to “the permanent state of force majeure” declared by state oil company Petroleos Mexicanos (Pemex) “as a result of the explosion of the Abkatun Alfa marine platform” offshore Mexico’s southeastern coast. Deadly fires occurred at the platform in 2015 and 2016.

The peninsula depends entirely on gas produced by Pemex in southeastern Mexico. The gas flows from Pemex gas processing centers to the peninsula’s power plants via the 485-mile Energía Mayakan pipeline, majority-owned by French multinational Engie.

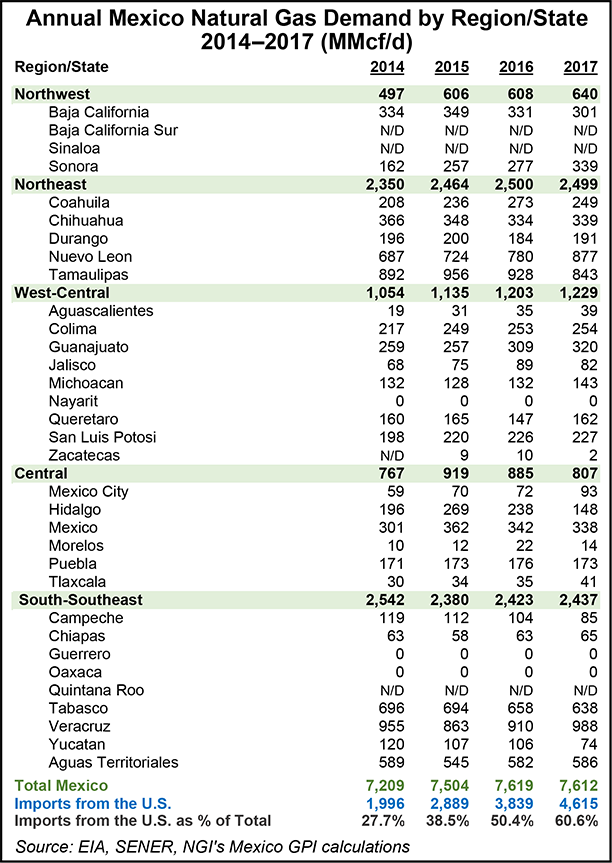

Dry gas production from the Pemex gas processing facilities in April fell 9.1% year/year to 2.225 Bcf/d, with wellhead gas production dropping 3.6% to 3.697 Bcf/d.

Since Mayakan is not yet connected to the Sistrangas national pipeline grid, and since the government canceled a tender to install a floating storage and regasification (FSRU) in Veracruz state, the peninsula is unable to receive imported gas.

The pending completion of the Cempoala compressor station reconfiguration, and the interconnection of Mayakan to the Sistrangas, would allow pipeline imports from the United States to reach the peninsula via the recently completed 2.6 Bcf/d Sur de Texas-Tuxpan marine pipeline, for which CFE is the anchor customer. However, the completion date for these milestones remains unknown.

Cenagas last month said work had concluded on the first phase of the Cempoala reconfiguration, which entailed reversing the direction of some of the station’s compressors in order to allow gas to flow south to the peninsula.

However, the installation of two turbines and a new regulation system at Cempoala are still pending. Having canceled the contract with the consortium originally slated to provide these components because of what it called unfavorable terms, Cenagas said it would launch a new tender, with the goal of completing the project “in the shortest time possible.”

While Cempoala is already able to compress a minimum of 850 MMcf/d, the new turbines would reduce the minimum volume of gas that the station can compress and send south, giving the station more flexibility.

One short-term option to partially alleviate the Yucatan gas shortage would be through swaps between Pemex and CFE, according to Talanza Energy Consulting’s David Rosales, midstream and downstream partner.

Once commercial gas begins flowing on the marine pipeline, Pemex could purchase a percentage of the pipeline’s gas volumes from CFE, Rosales told NGI’s Mexico GPI. Pemex would most likely receive the gas at Coatzacoalcos, Veracruz, which was the proposed site of the canceled FSRU. Pemex could, in theory, use this gas to meet demand from its petrochemical and industrial clients, or for pneumatic pumping in its oilfields.

“Pemex then, and only then, could send a bit less of its production from the south to Coatzacoalcos and send more gas to the peninsula,” Rosales said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 | ISSN © 1532-1266 |