NGI The Weekly Gas Market Report | Infrastructure | NGI All News Access

Mexico’s President Said Able to ‘Part Seas’ on Stalled Energy Projects

Mexico President Andrés Manuel López Obrador has the popular support to push forward stalled energy projects in Mexico in a way his predecessors couldn’t, according to energy sector professionals.

“I think he could have a tremendous impact on moving projects along,” Kiewit Mexico’s Michael Ross said at the Mexico Energy Forum in Mexico City earlier this month. “I think if he could get behind projects, with his approval rating, he could probably part the seas like no one else to make these projects happen.”

Seven months after taking office, López Obrador enjoys approval ratings rarely seen in Latin America. A recent poll conducted by El Universal saw 72% of respondents say they approved of the job he was doing. By comparison, Brazil’s populist president Jair Bolsonaro, who also convincingly won an election last year, is polling at less than half of that.

At the same time, key energy projects in Mexico remain stalled, with little clarity as to when they might go ahead. These include the Tuxpan-Tula, Tula-Villa de Reyes, Samalayuca-Sasabe, Guaymas-El Oro, La Laguna-Aguascalientes, and Villa de Reyes-Guadalajara pipelines.

TC Energy Corp., formerly TransCanada, is developing the first two projects, while billionaire Carlos Slim’s Grupo Carso is behind Samalayuca-Sasabe. Infraestructura Energética Nova (IEnova) built and is the operator of Guaymas-El Oro, while La Laguna-Aguascalientes and Villa de Reyes-Guadalajara are under development by Mexico-based Fermaca.

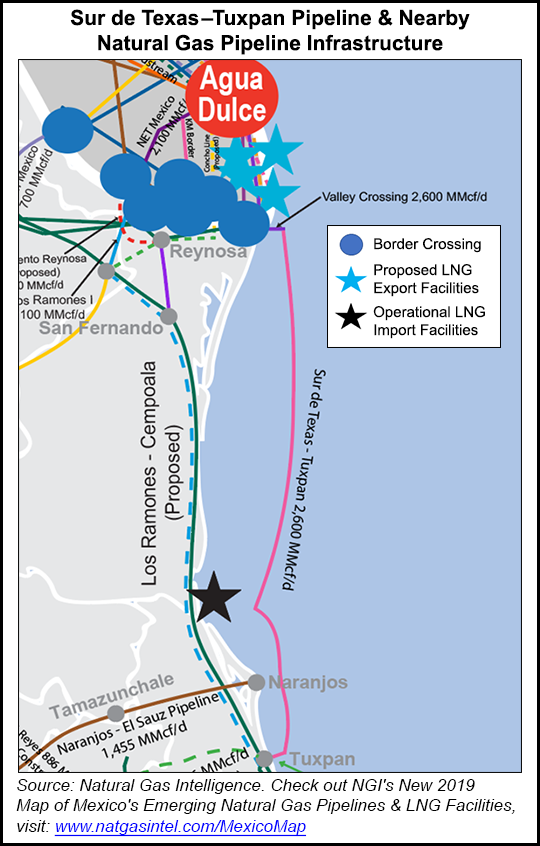

After months of delays, Mexico’s Sur de Texas-Tuxpan pipeline completed construction this month, with some initial gas now flowing on the pipeline.

“It’s frustrating,” Ross said. “Mexico needs everything we like to build. Power plants, roads, bridges, water treatment plants, oil and gas facilities. We were patient in 2017 and 2018, and the projects were slow. Then we got a new president, and we heard there would be some moving forward though we haven’t seen it yet.”

However, “there is huge potential” and López Obrador “could bring it all together,” he said.

IEnova CEO Tania Ortiz said at the Gulf Coast Power Association’s Mexico Electric Power Market Conference in Mexico City in early June that the consultation process with indigenous groups needs to be revamped.

“Consultations with indigenous groups are very important. But there is work to be done, and regulation needed there,” Ortiz said. “We recognize their rights, but we need regulation, because these consultations seem to have no end.

“There is also a big responsibility on the part of companies to meet communities and speak to them. I remember with our wind farm in Baja California, I went to speak to the people on the land and I thought it would be very hard, but once we talked to them and we talked about our project we found they were very supportive of it. They liked the infrastructure and the shared income. So we need to line up the needs of communities with developers.”

López Obrador has taken the idea of public consultations to a national level, holding votes on whether projects such as the international airport in the capital city and a refinery in his home state should be built.

He also held a vote on whether the 642 MW Huexca combined-cycle thermal power plant in Morelos should go ahead. At the end of February, the plant obtained the approval of voters in the referendum, allowing it to enter operation.

While there has been criticism of this approach, it is indicative of a leadership style that can be harnessed to benefit stakeholders in projects, according to energy expert Rosanety Barrios.

“If there is something clear about this change in government, it’s the great opportunity for civil society to get involved directly and voice their opinions,” Barrios said at the Mexico Energy Forum.

Despite considerable buildout in the last 10 years, new energy infrastructure is sorely needed in Mexico. This week, persistent natural gas shortages led Mexico’s electric power independent system operator Centro Nacional de Control de Energía (Cenace) to declare an “operational crisis” in the Yucatan peninsula through October.

Cenace said given current gas supply conditions, the Yucatan can expect regular power supply of 732 MW during the summer months. But peak demand is expected to hit 2,170 MW, while a minimum supply to ensure a functioning grid on the peninsula’s is 985 MW.

The area, which depends completely on Petroleos Mexicanos (Pemex) production for its natural gas needs, has already seen two widespread blackouts so far this year, and it’s likely that these will continue through the summer months.

“Energy is needed for the economic growth of the county,” Iberdrola CEO Enrique Alba said at the Mexico Energy Forum. “The most expensive energy is the one you don’t have.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 | ISSN © 1532-1266 |