NGI The Weekly Gas Market Report | Infrastructure | Markets | NGI All News Access

Demand Growth, Lack of NatGas Pipes Signals Trouble for Summer Reliability in Texas, California

A tepid start to the summer cooling season has accompanied sagging natural gas spot prices as of late, but tighter margins in Texas and California could lead to reliability problems as the mercury rises in the weeks ahead, according to the North American Electric Reliability Corp. (NERC).

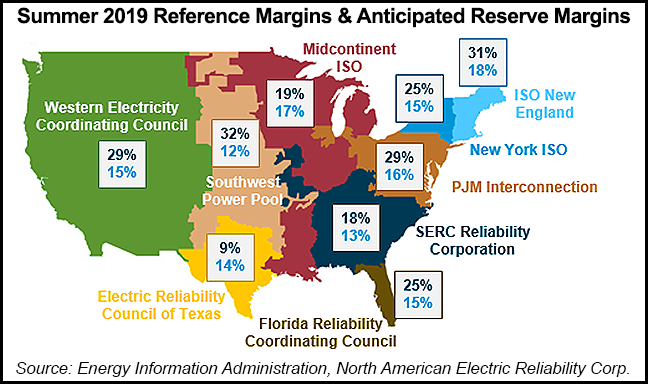

While most regions have adequate resources to meet peak demand this summer, NERC found in its 2019 Summer Reliability Assessment released earlier this month that low and declining reserve margins in the Electric Reliability Council of Texas (ERCOT) region could require emergency measures to address resource shortfalls during high demand periods.

ERCOT’s summer reserve margin has dropped to 8.5% in 2019 from 10.9% last year, with the decline attributable to higher load growth, a planned generator retirement and delays in adding new generation, according to NERC.

Earlier this year, ERCOT predicted record power consumption in its territory this summer, and drilling activity in the Permian Basin has been cited as a driver of higher demand in the Lone Star State.

ERCOT remains the only region in the Lower 48 to have an anticipated reserve margin that is lower than its reference margin, according to the NERC report. An anticipated reserve margin that matches or exceeds the reference margin level is an indication of adequate resources to “manage loss of load risk under normal conditions.”

Meanwhile, a dearth of interstate natural gas pipeline capacity continues to leave Southern California electric generators inadequately supplied for peak summer days, NERC found.

“As a result, withdrawals from the Aliso Canyon natural gas storage facility would be necessary to ensure adequate fuel for area generators,” NERC said. “In the California Independent System Operator (CAISO) area, shortages in resources with upward ramping capability create the potential for operation risks during peak load periods.

“Electric supply transfers from neighboring areas may be needed to maintain reliability during late afternoon as solar generation output decreases while system demand is high.”

In addition to straining electric markets, the pipeline capacity shortage in Southern California has caused significant volatility for spot prices in the region in recent years, particularly at SoCal Citygate. Last year, the late summer heat sent average day-ahead prices there surging above $20/MMBtu on several occasions, including a peak average daily price of $39.240 recorded in late July 2018, Daily GPI historical data show.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |