NGI The Weekly Gas Market Report | Infrastructure | NGI All News Access

North Dakota, Backed by PE Funds, Looking to Boost Natural Gas Use

A vision to kick-start fledgling petrochemicals and other natural gas-related businesses in North Dakota to absorb burgeoning natural gas production from the Bakken Shale is attracting capital commitments from public and private sources for a year-old startup, backed by investors with energy project experience.

The new player in the Bakken could lead to an infusion of billions in new investments in the nation’s second biggest oil producing state.

In an announcement that raised as many questions as it answered, Bakken Midstream Natural Gas LLC CEO Mike Hopkins said the privately held operator plans to develop gas infrastructure by financing, building and operating pipeline, processing and storage infrastructure.

Most of the gas and natural gas liquids (NGL) now produced in North Dakota are shipped to out-of-state and export markets.

“It is more than a lack of gas infrastructure in North Dakota, it’s a lack of any significant use of natural gas and NGLs in the state,” said Hopkins, an Alberta native and former energy lawyer. “That is what we want to change.”

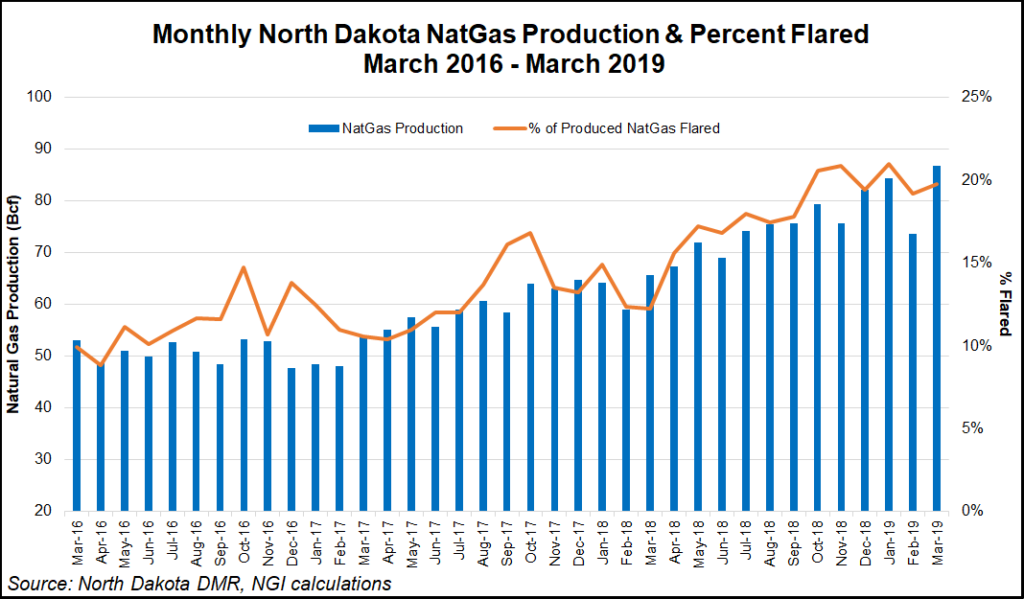

If Bakken Midstream is successful in fulfilling its vision, North Dakota could have a robust midstream gas sector that “normalizes” gas flaring and establishes new gas demand in the state.

Hopkins wants to do in North Dakota what was done in the late 1970s and early 1980s in Alberta, which had plenty of gas but little use for it within the province. He said it would be akin to what other states, including Louisiana, Pennsylvania and Texas, have done in the Lower 48 to make use of surfeit gas by attracting export and petrochemical projects.

“It is sort of routine these days,” Hopkins told NGI on Thursday, “that Alberta announces some new, multi-billion dollar facility that is being built there” that is energy intensive. “With a lot of gas infrastructure built over time, Alberta is an attractive place for these industries, and we think we can create a version of that in North Dakota.”

Hopkins shied away from providing specific dollar amounts in fund-raising, except for $200,000 from the North Dakota Commerce Department’s economic development funds. However, he said processing, storage, NGL pipeline and large-scale fractionation projects envisioned would begin at $100 million, with some projects topping $1 billion.

“The state is pleased to invest in a company that is willing to develop the infrastructure projects needed to attract a value-added industry that will benefit all of North Dakota,” said state Commerce Commissioner Michelle Kommer. He said the funds from development grants are designed to encourage more gas-related industries in part to reduce associated gas flaring.

Earlier this month, Bakken Midstream completed the first round of private equity (PE) funding that turned out to be over-subscribed, including the two $100,000 state grants, which Hopkins characterized as an indication of the potential economic potential seen in the new gas development company.

“This is money just to operate our company and to fund the development work that is ongoing over the course of the next year or so,” said Hopkins.

Initial funding is led by private investor Steve Lebow, a primary financier for Costco Wholesale, PetSmart, Dick’s Sporting Goods, and ULTA Beauty. “Now we have switched our sights to the actual projects we’ll be developing. Our investors, including Lebow, have been involved and invested in energy projects,” Hopkins said.

“When these projects get to the point where we have the site and the commercial agreements in place, we’ll then be doing project financing” using PE funds and debt “where we and our partners put in the equity required and work closely with the debt investors.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |