NGI Mexico GPI | Markets | NGI All News Access

Plump Storage Build Sinks Natural Gas Futures; Permian Prices in Negative Again

A sixth consecutive triple-digit storage injection proved too much to bear for U.S. natural gas futures on Thursday. With weather models pushing back the timing of some expected heat, the July Nymex gas futures contract settled at $2.325, down 6.1 cents. August slipped 5.9 cents to $2.322.

Extreme losses were also seen in spot gas markets as most of the United States continues to experience rather mild weather. Led by steep declines on the West and East coasts, the NGI Spot Gas National Avg. dropped 11 cents to $1.915.

With nearly half of June already in the rearview mirror, natural gas traders have kept a careful watch on weather models to determine when sustained heat may arrive. Outlooks hinted on returning heat earlier this week, but the latest data took a bearish turn as both the American and European data trended slower with the return of ridging into the South and East, according to Bespoke Weather Services.

Although the models still show such a pattern at the end of outlooks, “for now it appears to be just a timing change in the modeling as opposed to a fundamentally different pattern,” Bespoke chief meteorologist Brian Lovern said.

Aside from some brief early-season heat at the end of May, the mild weather has been a boon for storage inventories, which had fallen more than 700 Bcf below historical levels during the winter. On Thursday, the Energy Information Administration (EIA) reported the sixth 100 Bcf-plus storage injection in a row.

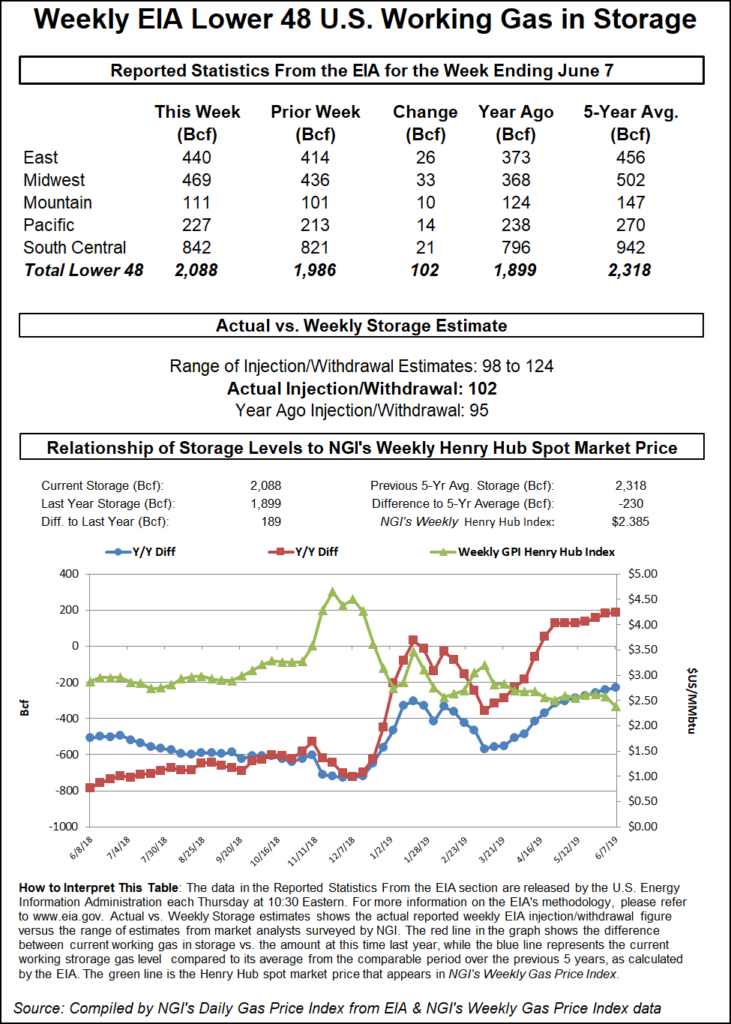

Although the reported 102 Bcf build came in on the low end of a wide range of expectations that clustered around a build near 110 Bcf, it still was above last year’s 95 Bcf injection and the 92 Bcf five-year average.

“You know the hope for bulls was that with Memorial Day behind us, we could look forward to high cooling degree days (CDD) and some injections that were possibly at least close to normal,” said Flux Paradox LLC President Gabriel Harris on Enelyst, a chat room hosted by The Desk. “Instead, exports drop after Memorial Day” and CDDs have fallen week/week.

By region, the Midwest reported a 33 Bcf injection into inventories, while the East added 26 Bcf, according to the EIA. Stocks in the Mountain region grew by a larger-than-expected 10 Bcf, and stocks in the Pacific rose by 14 Bcf.

Working gas in storage as of June 7 stood at 2,088 Bcf, which is 189 Bcf higher than a year ago but still 230 Bcf below the five-year average, according to EIA.

At the start of the injection season in April, heating degree days were down around 37% year/year, which helped to push residential/commercial demand about 6.2 Bcf/d lower year/year (and total demand about 5.4 Bcf/d lower), according to Jefferies Equity Research. The trend reversed in May, with residential/commercial demand up around 2.7 Bcf/d year/year (and total demand up about 5.5 Bcf/d).

“May injections were roughly 18% above average, which compares to April injections that came in about 140% above average. The first June injection was 11% above average,” said a Jefferies research team led by Zach Parham.

Coming into the refill season, near-record levels of injections (roughly 2.6 Tcf) were needed for storage to reach normal levels of about 3.7 Tcf by the end of summer. “The last 11 weeks have pushed about 980 Bcf into storage (versus the five-year average of around 650 Bcf), giving storage a head start in the shoulder months before we enter the summer,” Jefferies researchers said.

The five-year average storage injection is about 2.0 Tcf, though it is impacted by large injections in 2014 and 2015 (2.65 Tcf and 2.41 Tcf, respectively), according to Jefferies. Over the last three years, injections have averaged about 1.65 Tcf. The last time 2.6-plus Tcf was injected into storage was the summer of 2014, when gas prices averaged near $4.20.

With traders not yet convinced on summer heat, there is room for additional downside in prices, according to Harris. “The three-day natural gas price rally Friday through Tuesday just set up the market for a short opportunity. I don’t think we’re done exploring new price lows yet. I think new lows will come as the supply/demand balance is still loose.”

Thus far, lower prices have not made the weather-adjusted injections look any tighter, which starts to cause reasonable doubt in the market on the coal-to-gas switching mechanism, he said. “The market will need dramatic evidence that the price-switching mechanism is at full strength before a bottom occurs.”

However, Bespoke Weather Services said balance wise, the 102 Bcf injection was considerably tighter than last week’s loose 119 Bcf print, giving the firm more confidence in the data after the previous two big misses. “We feel that the tighter balances will show up in next week’s number as well, though with this week being a low demand week, we could still see another triple-digit build.”

Looking ahead, liquefied natural gas exports are set to ramp up in the coming weeks, as are exports to Mexico, which typically sees its highest demand during the summer. This would bode well for natural gas prices that continue to sit near three-year lows.

Meanwhile, it’s too early to tell if Thursday’s crude oil rally has staying power and what that could mean for long-term natural gas prices. Two oil tankers reportedly were attacked early Thursday in the Gulf of Oman amid heightened tensions between the United States and Iran.

The incident follows attacks on oil tankers near the Persian Gulf last month and raises the possibility of a disruption of crude flows. The political volatility in the region could revive struggling oil prices, which have been hit hard by swelling American inventories and the ongoing trade dispute between the United States and China.

Crude oil futures climbed as high as $53.45/bbl before going on to settle at $52.28, up $1.14 on the day.

Additional pipeline maintenance that was set to restrict gas flows did little to boost an otherwise weak spot gas market. With cooler weather forecast to begin moving into the West this weekend, prices there posted some of the steepest day/day declines.

SoCal Citygate next-day gas plunged 43.5 cents to $2.59, while Kern Delivery tumbled 27 cents to $2.13.

Given the overall sell-off across the country, the writing was on the wall for Permian Basin prices, which once again fell into negative territory. Waha traded as low as minus 24 cents before going on to average minus 3.5 cents, a drop of 48 cents on the day.

Losses, though not nearly as steep, extended across Texas. Transco Zone 1 dropped 8 cents to $2.215.

On the pipeline front, Transcontinental Gas Pipe Line (Transco) said next week (June 18-24) it would perform maintenance at its Washington Storage facility in St. Landry Parish, LA, suspending injections to the facility for the duration of the outage. Injections have averaged 276 MMcf/d and maxed at 305 MMcf/d over the last 30 days, according to Genscape.

Using the 30-day average, roughly 1.93 Bcf would not be injected over the weeklong outage. Inventory levels at Washington are at 47.2 Bcf, 62.4% of its working inventory of 75.6 Bcf.

“This is Washington’s lowest storage level at this time of year since 2014, due to last winter’s heavy withdrawals. This outage will limit shippers’ ability to balance supply surpluses and presents bearish pressure on Transco’s Gulf Coast supply markets,” Genscape analyst Josh Garcia said.

Transco Zone 3 in Louisiana saw cash prices drop a nickel to $2.245, while Southeast spot gas prices were down anywhere from a couple of pennies to as much as 13 cents.

Gas has started to flow into the Valley Crossing pipeline, which feeds into the newly completed 2.6 Bcf/d Texas-Tuxpan marine pipeline. On Thursday those flows were estimated around 60 MMcf/d. They had risen to roughly 100 MMcf/d early Friday, or less than 4% of operational capacity of the cross-border pipeline.

“We don’t expect the marine pipeline to fill right away, but these initial flows are certainly a positive step, especially ahead of increased summer demand,” said NGI’s Patrick Rau, director of strategy and research.

Meanwhile, on Thursday evening Mexico’s upstream regulator Comisión Nacional de Hidrocarburos (CNH) said it was canceling October auctions for joint ventures with state oil company Petróleos Mexicanos (Pemex) at seven onshore fields.

The cancellations add to other oil rounds nixed by Mexico’s new administration, including fields that targeted gas-rich fields. President Andrés Manuel López Obrador has said he will cancel private sector oil and gas rounds for at least three years.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 |