NGI Mexico GPI | Markets | NGI All News Access

Expected Large Storage Build Cuts Natural Gas Futures Rally Short; West Texas Cash Drops

After a brief swing into positive territory, U.S. natural gas futures prices on Wednesday ultimately gave back a bit of the previous three days’ worth of gains as traders focused on an expected triple-digit storage build rather than on increasing heat in weather models. The July Nymex gas futures contract settled 1.3 cents lower at $2.386, with similarly small losses seen through the rest of the curve.

Spot gas prices were mixed, but most markets shifted only a few pennies in either direction. The exceptions were in California and West Texas, where a steep sell-off occurred despite continued scorching temperatures in the region. The NGI Spot Gas National Avg. ultimately slipped 5 cents to $2.025.

To be sure, natural gas traders — both in West Coast cash markets and in the futures market — appeared to brush off significant heat that has steadily been building in weather outlooks. Although Tuesday’s midday data was enough to send the prompt-month Nymex contract up about 4 cents, traders quickly reversed course on Wednesday despite an even warmer shift in outlooks.

The hotter-trending forecast was the risk Bespoke Weather Services had been expecting “based on shifts in tropical forcing patterns and what should be another temporary backing off of the intensity of the El Niño state.”

The outlook showed heat levels building, especially across the southern half of the United States, which, pattern wise, is similar to what occurred in the second half of May. The shift was evident in the American and European ensembles, “both of which are quicker to erode this week’s cooler pattern, and allow for near to slightly above-normal gas-weighted degree days thereafter,” Bespoke chief meteorologist Brian Lovern said.

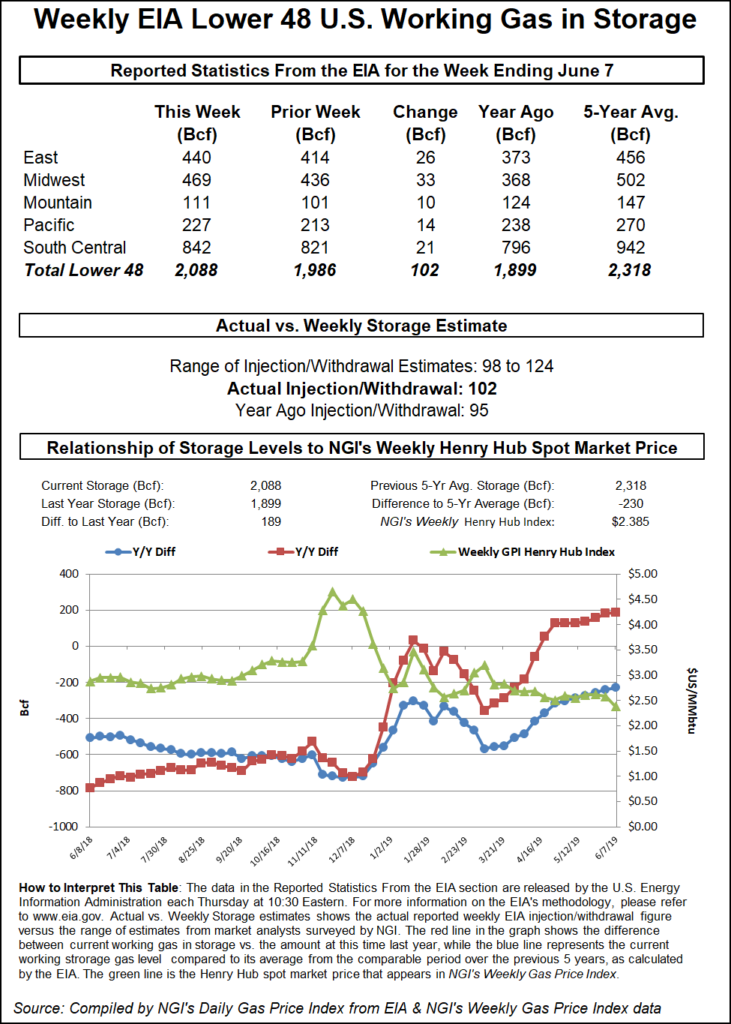

As for storage, a Bloomberg survey of 12 analysts had an injection range of 98 Bcf to 124 Bcf, with a median of 110 Bcf. A Wall Street Journal poll had a range of 102 Bcf to 118 Bcf, with an average of 108 Bcf. A Reuters survey had an injection range of 100 Bcf to 124 Bcf, and a median of 109 Bcf. NGI projected a 108 Bcf injection.

Last year, the Energy Information Administration (EIA) reported a 95 Bcf increase to inventories for the similar week, and the five-year average stands at 92 Bcf.

Meanwhile, TC Energy Corp.’s long-awaited 2.6 Bcf/d Sur de Texas-Tuxpan pipeline is now complete, the company said late Tuesday. The nearly 500-mile, offshore project had experienced multiple delays, with TC management late last year projecting an in-service date of early 2Q2019. The pipeline is considered critical for alleviating gas supply constraints for power generators and industrial consumers in southeastern Mexico amid declining gas output by national oil company Petróleos Mexicanos, aka Pemex.

“While fully operational capacity is still an unknown, and downstream takeaway constraints are a potential issue, the fact that a route to deliver U.S.-sourced natural gas to the thirsty central and southeastern Mexican markets is a plus for both Mexican consumers and U.S. producers,” Mobius Risk Group said.

Market observers so far have yet to see any flows on Sur de Texas-Tuxpan’s feeder pipe Valley Crossing, and only expect the pipeline to run at about 25% capacity in the first few months of service. Still, 650,000 MMcf/d of gas capacity would provide a significant chunk of demand and likely some price relief to the market.

On the supply front, Genscape Inc. estimated that U.S. Lower 48 production on Wednesday was down to 86.82 Bcf/d. While likely to be revised, the figure represented a 0.69 Bcf/d day/day drop and sinks production to a 23-day low.

“This continues to drag on the month-to-date average underperforming our forecast by more than 1.1 Bcf/d,” Genscape senior natural gas analyst Rick Margolin said. “We once again reiterate that this underperformance is maintenance-related and not indicative of any structural shifts by producers.”

The Permian Basin has been the largest source of underperformance as month-to-date volumes have come in 0.64 Bcf/d below forecast. Takeaway constraints have been exacerbated by planned and unplanned maintenance events on Natural Gas Pipeline Co. of America and El Paso Natural Gas.

“The situation may have been worse except that the region has marginally increased exports to Mexico by about 130 MMcf/d in the past 30 days,” Margolin said.

Gulf Coast area volumes are coming in low by more than 0.44 Bcf/d versus forecast. Nearly all of these declines are from northern Louisiana, where planned and unplanned maintenance has impacted volumes, according to Genscape. The firm is also seeing notable daily swings in offshore receipts.

Gulf of Mexico sample volumes were down nearly 0.14 Bcf/d day/day primarily led by volumes on Destin Pipeline throttling down with the startup of the 14-day Pascagoula plant maintenance.

Rockies production is underperforming by 0.3 Bcf/d versus forecast. Roughly two-thirds of the miss is from the Opal area, where production takeaway has been impacted by maintenance on Kern River, Overthrust and Rockies Express pipelines.

Last month, daily production estimates at one point trailed forecasts by nearly 1.4 Bcf/d, but when most of the maintenance events concluded, the end-of-month average came in 0.4 Bcf/d below forecast, according to Genscape. The firm expects this month’s volumes to show a similar rebound and closing of the delta to its forecast.

Spot gas trading action was relatively quiet on Wednesday as little change in weather patterns was expected in the next several days. The same was true for the West Coast, where a heatwave blanketing the region was expected to stick around the rest of this week, lifting demand from the Pacific Northwest to Southern California.

Despite the scorching outlook, fixed prices softened throughout the region Wednesday, with SoCal Citygate plunging 57 cents to $3.025 and basis contracting to less than 70 cents. At PG&E Citygate, spot gas dropped 10 cents to $2.88, sliding to a 52.5-cent premium over Henry Hub.

Meanwhile, a large weather system over the central and northern United States was keeping a lid on temperatures even as far away as Texas, the South and the greater Southeast. Given the lack of strong demand in those regions, as well as the steep price declines in California, West Texas cash markets suffered a blow Wednesday.

After surging as high as $1.45 on Monday, Waha spot gas dropped as low as 3 cents on Wednesday before going on to average 44.5 cents, a loss of 27 cents on the day.

In the Midwest, next-day gas shifted a few cents in either direction, with Chicago Citygate climbing 2 cents to $2.175.

Henry Hub rose 1.5 cents to $2.355, while Columbia Gas in Appalachia picked up a penny as gas flows resumed following maintenance earlier this week. Northeast prices were mostly lower, with Transco Zone 6 NY sliding 5.5 cents to $2.105.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 |